Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

Unless you’re an investment uber-nerd, the thought of purchasing Treasury bills and bonds probably conjures up images of your grandmother buying dusty old savings bonds when you were a child. The days of sleepy Treasury investments are gone, though, at least for the time being. “Right now, interest rates are at highs not seen for decades,” says Mary Ann Sullivan, lead financial planner with South Bay Financial Partners. This means it may be a good time to take advantage of the current rates and diversify your portfolio with Treasury investments.

We’ll walk you through how treasury bills and bonds work, and how to buy them if you think they’re a good addition to your financial plan.

What Are Treasury Bills and Bonds?

Treasury bills, notes, and bonds (also known as T-bills, T-notes, and T-bonds) are essentially loans between you and the government, where you are the lender. You can buy new T-bills through regularly scheduled auctions, which ultimately determine the price you pay and how much you earn. It’s a bit wonkier if you’re not used to investing, but it’s not too hard to learn.

The government sets specific auction dates for T-bills, notes, and bonds. You (or anyone else) can submit an order to buy a certain amount on that date (a “non-competitive bid” since you’re not trying to edge anyone else out). After the government tallies up everyone’s bids at closing on auction day, it sets the final discount price. This discount price is key to your yields.

| Treasury bills | Treasury notes | Treasury bonds | |

|---|---|---|---|

|

Maturities |

4, 8, 13, 17, 26 or 52 weeks |

2, 3, 5, 7 or 10 years |

20 or 30 years |

|

Interest payments |

When T-bill matures |

Every 6 months |

Every 6 months |

|

Auction frequency |

Every week except for 52-week T-bills, offered every four weeks. |

Monthly except for 10-year T-notes, offered quarterly |

Quarterly |

As an example, if you submit an order for a $100 T-bill (known as the “face value” or “par value”), the final discount price might come back around $90, meaning the government will take $90 from you today in exchange for paying you back $100 later. That leaves you with a gain of $10, and depending on the maturity timeline, that’s how the “interest rate” is calculated.

How to Buy Treasury Bills and Bonds

If you're interested in purchasing Treasuries, you have two options:

- TreasuryDirect.Gov

- A brokerage account

Navigating the websites of both options can be clunky due to their outdated interfaces, but here are some general steps to help you through the process.

Treasury Direct

Buying directly from the government through the Treasury Direct website has a few advantages. You can get started with as little as $100, and you don’t have to worry about any trade fees or commissions.

The downside is it’s yet another account you have to manage. You can’t hold the T-bills or bonds in an IRA or other tax-advantaged account, and if you want to sell your T-bills before they mature, you’ll need to transfer them out to a brokerage account anyway.

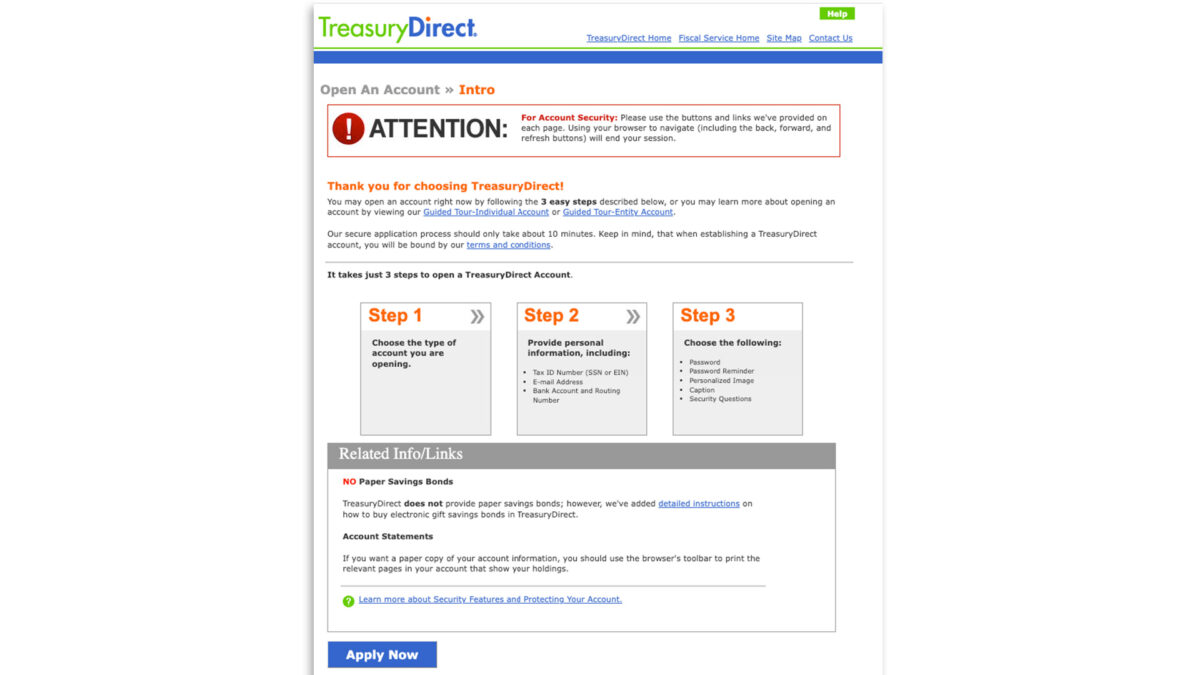

1. Create an account: It typically takes about 10 minutes to create an account. You must provide your Social Security number, contact information, and banking details.

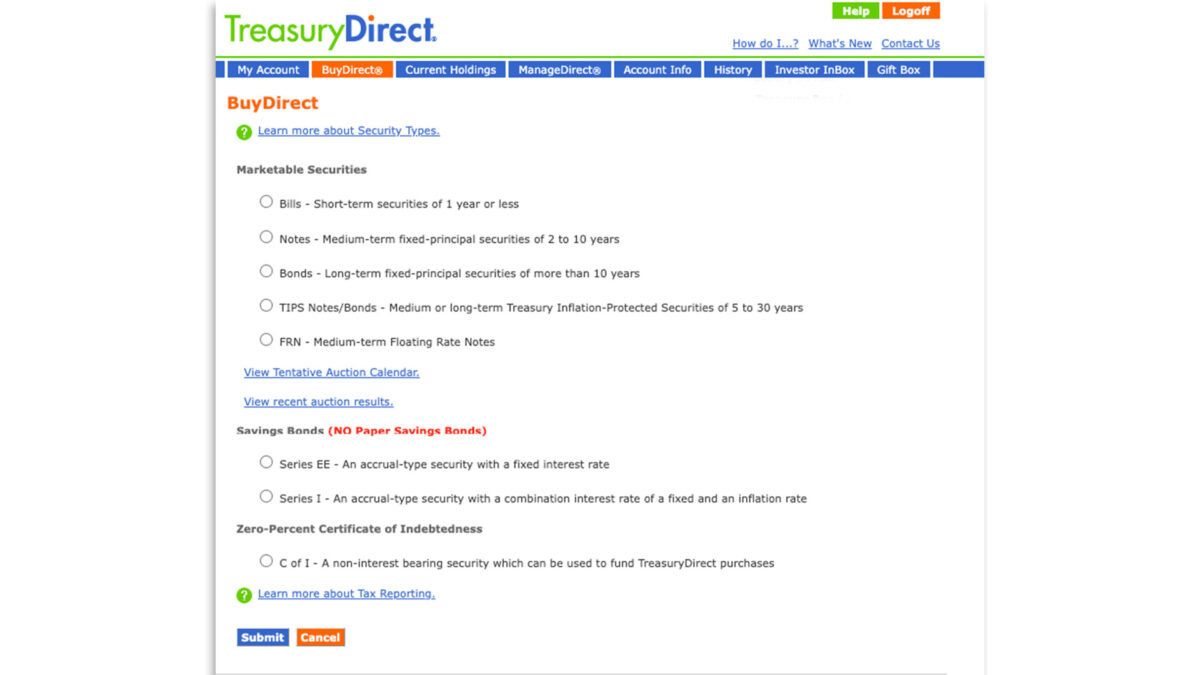

2. Decide on your purchases: You’ll be submitting orders for individual T-bills and T-bonds, so you’ll need to know what you want to buy in advance. You won’t know what rates you’ll be earning until auction day ends, but you can see recent rates here.

3. Place an auction order: Click on the Buy Direct tab to set up your auction order. You can do this anytime in advance of the next couple of auction dates for each T-bill and T-bond type you want to buy.

4. Check the auction results: While not necessarily required, you can check your discount rate when the dust settles on auction day at 5 p.m. EST by clicking on the Current Holdings tab, then the Pending Purchases and Reinvestments tab.

5. Pay for the order: The government will automatically withdraw the money to pay for your new T-bill on the settlement date, usually a few days after the auction. Remember, the amount you end up paying for the T-bill will be less than the face value you specified in your order.

Banks and Brokers

You can also buy T-bonds through many banks and brokers. This can be a simpler way to go if you already have an investment account elsewhere, especially if you’re hoping to store your T-bills and bonds in an IRA or other tax-advantaged account. You can also sell your T-bills and bonds if you need to access those funds before they mature.

Banks and brokers allow you more ways to purchase T-bills and bonds.

- You can buy new ones through the primary market, just like through the Treasury Direct website.

- You can also buy and sell them on the secondary market.

- You’ll also have access to pooled funds such as ETFs and money market funds that allow you to buy a slice of many T-bills and bonds rather than individually.

The downside is you’ll need more cash (usually $1,000 minimum), and there may be trading fees with some platforms. Since each broker works differently, you’ll have to investigate how a specific platform allows you to buy T-bills and bonds (hint: try searching something online like “step-by-step how to buy T-bills through Vanguard” or whatever your broker’s name is).

Want to earn some extra cash?Explore the Best Bank Bonuses Currently Available

Visit the Marketplace

Benefits and Risks

T-bills and T-bonds get a bad rap as being antiquated, but there are many reasons why you might consider adding them to your investment mix as well as good reasons why you don’t see everyone investing in T-bills and T-bonds.

Benefits

- Diversifies your portfolio

- Fewer taxes

- Safe and low risk

- Low volatility

- Relatively liquid

Risks

- Purchasing process can be clunky and confusing

- May lose out on interest if rates rise

- Rates don't always keep up with inflation

- Liquidity risk

- May not grow enough for retirement alone

Benefits

- Diversification: "Historically, bond values have moved inversely to stocks which made them an especially good way to diversify a stock portfolio,” says Sullivan.

- Fewer taxes: You’ll pay federal taxes on any gains you make, but you’ll get a free pass on state and local taxes.

- Safe and low risk: T-bills and bonds are backed by the U.S. government. It’s not the same thing as FDIC insurance from a bank, but it’s as close as you can get for an investment.

- Low volatility: T-bills and bonds don’t ride the see-saw highs and lows of the stock market, making them a more predictable way to invest.

- Relatively liquid: You can generally sell T-bills and bonds if you want the money back sooner than the maturity date. Depending on how rates have changed since you took out the T-bill or bond, you may have to sell at a loss — or you could earn a profit.

Risks

- Purchasing process can be clunky and confusing: The Treasury Direct website looks straight out of 1995. The auction system where you buy T-bills at a discount to the face value in order to be repaid with “interest” later is confusing when compared to easy-to-understand savings accounts.

- May lose out on interest if rates rise: Tying up your cash in a T-bill now means you can’t easily take advantage if rates rise in the future. Additionally, if you need to sell your T-bills and bonds after rates have risen, you may be forced to sell your investments at a loss.

- Rates don't always keep up with inflation: Anyone with a savings account knows the interest rate offered doesn’t generally keep up with inflation, and that’s especially true if you’re looking at a 30-year T-bond horizon. Your money may actually be worth less later.

- Liquidity risk: You’re generally able to sell your T-bonds and bills if you need an early out, but that’s not guaranteed. You may be stuck with them longer than you’d hoped.

- May not grow enough for retirement alone: T-bills currently have high yields for a “safe” investment, but the yields aren’t high enough for your retirement portfolio to grow much on them alone, especially if you’re still in your younger years.

Related Article

Related Article

8 Reasons You Should Have Multiple Bank Accounts

Are Treasury Bills and Bonds a Good Investment?

“If you’re saving for a goal in the next one to seven years, such as buying a house, sending a child to college or going to grad school, Treasuries could be a perfect investment,” says Sullivan. Depending on when you need the money, you can purchase a Treasury bill, note or bond that’ll mature around the exact time you need the money.

They’re not necessarily a great idea for your emergency fund, however. The whole idea of an emergency fund is having liquid assets you can withdraw at any time without having to wait around to sell your investments. “Buying bills and bonds requires monitoring.” Unless you buy into a Treasuries fund, “these are not set-it-and-forget-it purchases,” says Sullivan.

Finally, T-bills and bonds can be a good choice for your retirement portfolio. As you get closer to retiring, you can adjust the percentage you hold in Treasuries up higher. That way, you’ll protect your money against any major stock market drops while still earning a good, stable income.

Frequently Asked Questions

-

The Treasury Direct website offers a standardized, one-size-fits-all approach for buying T-bills and bonds. Your investment brokerage may offer a user interface you’re more familiar with, however.

-

Maybe. Some banks offer brokerage accounts that let you buy T-bills and bonds, while others do not.

-

It depends on your investing timeline and how much you’re looking to earn. Treasury bills are better for short-term savings goals and generally (not always) offer lower rates compared to Treasury bonds which frequently offer higher rates, which are better for long-term savings goals.

-

Not necessarily. You could still lose your money if the U.S. government defaults — a scenario we’ve gotten uncomfortably close to lately. Certificates of Deposit, on the other hand, are protected against any losses by FDIC insurance.

-

You’ll pay federal taxes on your Treasury bond returns, but not state or local taxes.