Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

Getting a credit card is a big step toward adulthood for many teenagers. While some parents may worry about the potential for costly financial consequences, credit cards can also serve as a learning tool. Having a credit card also provides convenience and security, but more importantly, it can help students and teens build a good credit history.

5 Reasons Teenagers Should Have a Credit Card

Here are five reasons why you may want to help your teen get a credit card and factors to consider when choosing the best credit card for an 18-year-old:

- Build credit early

- Get more fraud protection

- Learn financial management

- Have peace of mind

- Earn rewards

1. Build Credit Early

Getting a credit card for a teen might seem like asking for trouble at first. However, using a credit card and paying its bills on time helps teens boost their credit score and establish a credit history. As long as they know the repercussions of not paying their bills on time, like facing high interest charges or tanking their credit score, teens can benefit in many ways from getting started early with credit cards.

Having access to credit early on can also help them later in life, especially if they decide to apply for a loan for a home or car. That lengthy credit history can really pay off down the road, especially if they maintain a good credit score.

Recommended Low-Interest Credit Cards

| Credit Card | Intro APR | APR | Learn More |

|---|---|---|---|

|

|

0% intro APR for 15 months

0% intro APR for 15 months from account opening on purchases and qualifying balance transfers. 20.24%, 25.24%, or 29.99% Variable APR thereafter; balance transfers made within 120 days qualify for the intro rate and fee of 3% then a BT fee of up to 5%, min: $5. |

20.24%, 25.24%, or 29.99% (Variable) |

Apply Now Rates & Fees |

|

|

0% Intro APR for 15 months

This card allows new cardholders to save money with an introductory 0% interest rate on new purchases and balance transfers for the first 15 months of account opening. After the introductory period, a 20.49% - 29.24% variable rate will apply. Balance transfers made within the first 60 days of account membership will be charged a balance transfer fee of either $5 or 3% of the amount of each transfer. After 60 days, that balance transfer fees increases to either $5 or 5% of the amount of each transfer, whichever is greater |

20.49% - 29.24% (Variable) | Apply Now |

|

|

0% intro APR for 21 months

0% intro APR for 21 months from account opening on purchases and qualifying balance transfers. 18.24%, 24.74%, or 29.99% variable APR thereafter; balance transfers made within 120 days qualify for the intro rate, BT fee of 5%, min $5. |

18.24%, 24.74%, 29.99% (Variable) |

Apply Now Rates & Fees |

|

|

0% for 18 months on Balance Transfers

New cardholders enjoy 0% introductory APR on all balance transfers for the first 18 months of account opening. After that, the variable APR will be 19.24% - 29.24%, based on your creditworthiness. Balance transfers do not earn cash-back rewards and are charged an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first four months of account opening. After that, the fee will be 5% of each transfer (minimum $5). |

19.24% - 29.24% (Variable) |

Apply Now Rates & Fees |

2. Get More Fraud Protection

No one wants to deal with fraudulent charges or not receiving services they've already paid for. The good news is that most credit cards come with zero liability protection, which means you're not responsible for unauthorized charges on your card. You're protected if your credit card is lost, stolen or used fraudulently.

Debit cards offer some protections, but they are typically less stringent than what you'll find with credit cards, plus it can take longer to get your money back when something untoward has occurred. The extra protections offered by credit cards might be just the peace of mind you and your teen need as they begin to make more purchases.

How to Dispute a Charge on a Debit Card

3. Learn Financial Management

As mentioned above, a credit card is an excellent tool for establishing healthy financial habits like paying your bills on time and in full and not spending more than you can afford. Learning these skills early can help many teenagers establish healthy financial habits that can benefit them through young adulthood and beyond.

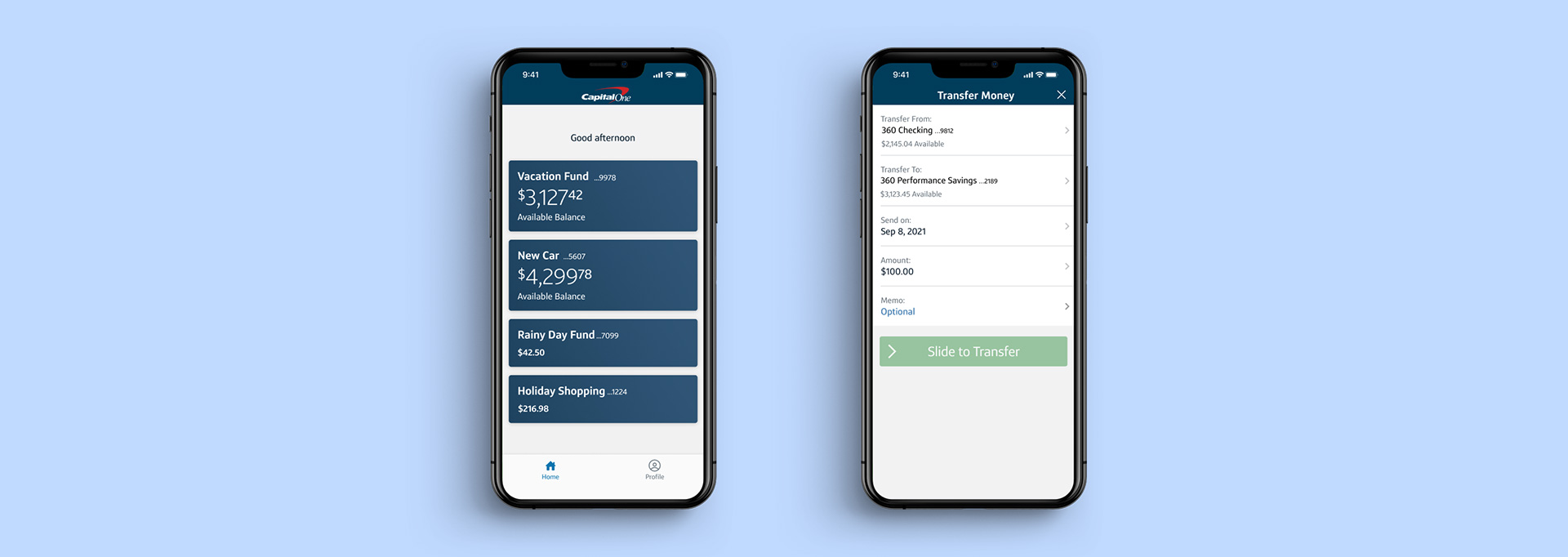

Paired with a bank account made for teens, these can be powerful tools with long-lasting benefits as your kids begin to learn how to manage and spend money.

Best Student & College Checking Accounts: Earn Up to $300 in Bonuses

4. Have Peace of Mind

In addition to the credit-building and convenience perks of credit cards, they can offer a lot of peace of mind for parents as their kids venture out further into the world. And it's worth keeping in mind that just because your teen has a credit card, it doesn't mean they have to use it. However, having a credit card comes in handy when an emergency requires a quick payment method.

5. Earn Rewards

Some credit cards offer ways to earn rewards like cash back on everyday purchases or specific cash-back categories like gas and restaurants. Your teen shouldn't focus on getting a credit card just to earn rewards, but it's a nice perk to have if included. If they're buying gas or lunch more often, or helping out at home by running errands or buying groceries, they could start to take advantage of the wider benefits credit cards offer all consumers.

What to Look for in a Beginner Credit Card

Not all credit cards for beginners are created equal. Some may offer better benefits than others. Here are some features to consider when looking for a credit card for a teenager:

- Zero annual fees: Credit card issuers sometimes charge cardholders an annual fee. These fees can vary, with the highest fees reserved for luxury credit cards. Many student credit cards and beginner cards have no annual fee. Inquire about an annual fee before applying for a card.

- Security: You want a card that offers identity theft protection in the event the card is stolen or lost.

- Credit limit: A high credit limit can be dangerous for a teen who may be new to money management. Find a card with low credit limits to start slowly and build the proper financial habits.

- Credit score requirements: Card issuers perform a credit check to determine a person's qualifications when applying for a card. Look for cards with lower credit score requirements so your teen is more likely to qualify.

- Interest rates: Without established credit, you could end up with higher interest rates, but some beginner cards may offer more favorable rates than others.

- Other fees: Pay attention to additional fees charged by card issuers. Late payments are not only costly but they can decrease one's credit score.

Recommended No-Annual-Fee Credit Cards

| Credit Card | Intro Bonus | Rewards Rate | Learn More |

|---|---|---|---|

|

|

$200Cash Bonus

Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back. |

2%Cashback

Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. To earn cash back, pay at least the minimum due on time. Plus, for a limited time, earn 5% total cash back on hotel, car rentals and attractions booked on the Citi Travel℠ portal through 12/31/24. |

Apply Now Rates & Fees |

|

|

1.5%Extra Cash Back

Earn an extra 1.5% on everything you buy (on up to $20,000 spent in the first year) — worth up to $300 cash back. That's 6.5% on travel purchased through Chase Travel, 4.5% on dining and drugstores, and 3% on all other purchases. |

1.5% - 5%Cashback

Enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases. |

Apply Now |

|

|

$200Cash Bonus

Earn a $200 cash rewards bonus after spending $500 in purchases in the first 3 months. |

2%Cashback

Earn unlimited 2% cash rewards on purchases. |

Apply Now Rates & Fees |

|

|

20,000Points

Earn 20,000 bonus points when you spend $1,000 in purchases in the first 3 months - that's a $200 cash redemption value. Dollar Equivalent: $200 (20,000 Points * 0.01 base) |

1x - 3xPoints

Earn unlimited 3X points on the things that really add up - like restaurants, travel, gas stations, transit, popular streaming services, and phone plans. Plus, earn 1X points on other purchases. |

Apply Now Rates & Fees |

Review a credit card's benefits before your teen applies for a credit card to ensure they are eligible for the card and it offers features important to them.

FAQs

-

Yes, you can sign a credit card agreement at 18. However, it might be difficult to secure a credit card before turning 21 because of underwriting requirements. You'll need to show proof of a steady income source or use a cosigner to qualify for most credit cards.

-

Start your credit card journey by establishing healthy financial habits like spending within your means, paying your card on time and not carrying a balance over month to month.

-

Debit cards and credit cards both offer opportunities to build solid financial habits. Debit cards draw on funds in the bank, while you borrow against a credit limit with credit cards. Credit cards typically offer better consumer protections against fraud than debit cards, although debit cards have started offering more protection recently. Determine your needs to choose the most suitable card option for your teenager.

-

You must be at least 18 to get your own credit card. Typically, you'll need to show you have a steady source of independent income or use a cosigner to qualify for a card if you're under 21.