Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

What Is a Good Credit Score?

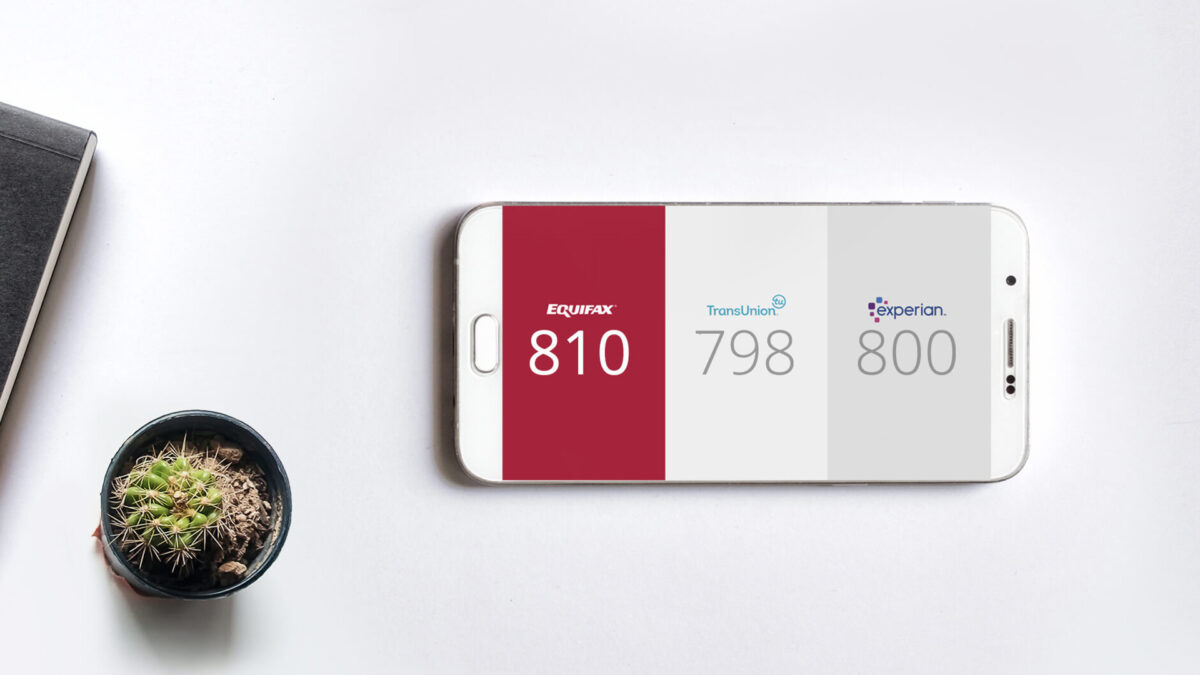

According to the credit bureau Experian, 67% of American adults have a good

1. Lower Interest Rates

A good credit score not only makes it easier to qualify for credit cards and loans, but it could help you qualify for more attractive financing offers as well. In general, lenders and credit card companies reserve their

You typically don’t need a perfect credit score to qualify for the best deals that credit card issuer and lenders have to offer. But with good or excellent credit, you’re more likely to be eligible for a wider variety of financing options—including 0% APR credit card offers and premium credit cards if you’re interested in such pro

2. Higher Credit Limits

When you qualify for a new credit card, the card issuer may also review your credit score to determine how much money it’s comfortable allowing you to borrow at a given time (aka your credit limit). A good credit score could give you access to

On a positive note, if you start out with credit cards with lower limits you can work to

3. Better Credit Card Offers and Loans

Credit card companies and lenders commonly set criteria that applicants must meet to borrow money. Satisfying a minimum credit score is typically part of the pro

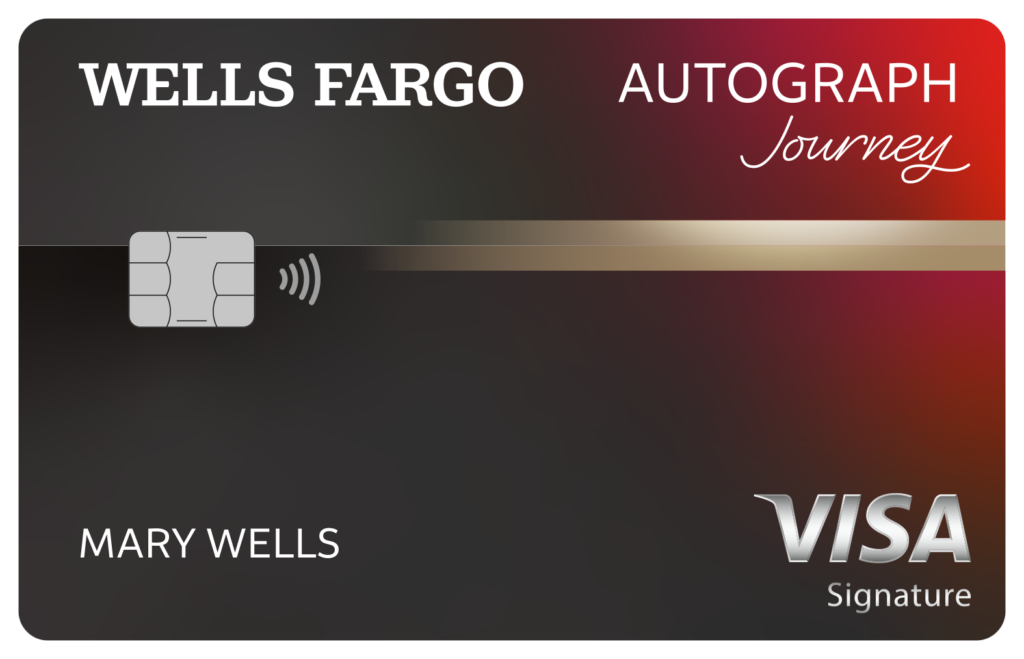

For example, the

Recommended Travel Credit Cards

| Credit Card | Intro Bonus | Annual Fee | Rewards Rate | Learn More |

|---|---|---|---|---|

|

|

100,000Chase Ultimate Rewards Points

Earn 100,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. Dollar Equivalent: $2,100 (100,000 Chase Ultimate Rewards Points * 0.021 base) |

$95 |

1x- 5xPoints

Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more. |

Apply Now Rates and Fees |

|

|

60,000

Earn 60,000 bonus points when you spend $4,000 in purchases in the first 3 months – that’s $600 toward your next trip. |

$95 |

1x - 5xPoints

Earn unlimited 5X points on hotels, 4X points on airlines, 3X points on other travel and restaurants, and 1X points on other purchases. |

Apply Now Rates & Fees |

|

|

50,000Southwest Rapid Rewards Points

Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening. Dollar Equivalent: $600 (50,000 Southwest Rapid Rewards Points * 0.012 base) |

$69 |

1x - 2xPoints

Receive 3,000 anniversary points each year. Enjoy benefits including 2X points on local transit and commuting, including rideshare, 2X points on internet, cable, and phone services; select streaming, 2 EarlyBird Check-In® each year, 10,000 Companion Pass® qualifying points boost each year, and more. |

Apply Now Rates and Fees |

|

|

60,000Citi ThankYou® Points

Earn 60,000 bonus ThankYou® Points after spending $4,000 in the first 3 months of account opening, redeemable for $600 in gift cards or travel rewards at thankyou.com. Dollar Equivalent: $1,080 (60,000 Citi ThankYou® Points * 0.018 base) |

$95 |

1X-10XPoints

10x on Hotels, Car Rentals, and Attractions booked through CitiTravel.com 3x -- Earn 3 Points per $1 spent on Air Travel and Other Hotel Purchases 3x -- Earn 3 Points per $1 spent on Restaurants 3x -- Earn 3 Points per $1 spent on Supermarkets 3x -- Earn 3 Points per $1 spent on Gas and EV Charging Stations 1x -- Earn 1 Point per $1 spent on All Other Purchases |

Apply Now Rates & Fees |

Other lenders may also use credit score minimums to screen loan applicants. The

4. Lower Insurance Premiums

Another perk of good credit that many people overlook is the potential to save money on your insurance rates. In many states, the price of your car insurance and homeowners insurance may go up or

Many insurance companies use credit-based insurance scores to assess risk when providing quotes to potential customers. Your credit information can help an insurer determine the likelihood that you’ll file a claim in the future—a claim that could cost the

Insurance companies place a lot of trust in the predictive power of credit scores. You might have a completely clean driving record. However, if you have a bad credit score, you could still pay a higher insurance rate than you would otherwise. One

5. More Housing Choices

Whether you decide to rent an apartment, lease a home, or apply for a mortgage, your credit score is likely to come into play in each scenario. Landlords and property managers typically review the credit history and credit score of

Good credit can make securing housing easier and more affordable whether you decide to rent or buy. Down payment and security deposit requirements are often lower for applicants with higher credit scores. Plus, you’ll need to satisfy minimum credit score requirements to qualify for a mortgage or to lease an apartment in the

Next Steps

Good credit can save you money and make your financial life easier to navigate in many ways. So, if your credit score isn’t as strong as you would like it to be, it’s in your best interest to take action.

If you want to

Another possible way to boost your credit scores is to

Depending on your situation, the changes above (and others) may not help you