Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

Paying off credit card debt can feel like an impossible goal. At least, it felt that way when my total credit card balance was more than $10,000 in 2015. If I continued only making minimum payments, it would’ve taken a decade to pay it off. Plus, I’d have to pay thousands of dollars in interest.

Throughout the process, I learned some tricks to paying off credit cards that helped me repay my debt in only three years. Here’s how I did it, plus a few additional credit card repayment strategies to try.

Tips to pay off credit card debt faster:

- Set a budget

- Pay more than the minimum

- Use a debt payoff strategy

- Consolidate debt

- Switch to cash

- Use a debt management plan

- Ask for a lower APR

- Boost your income

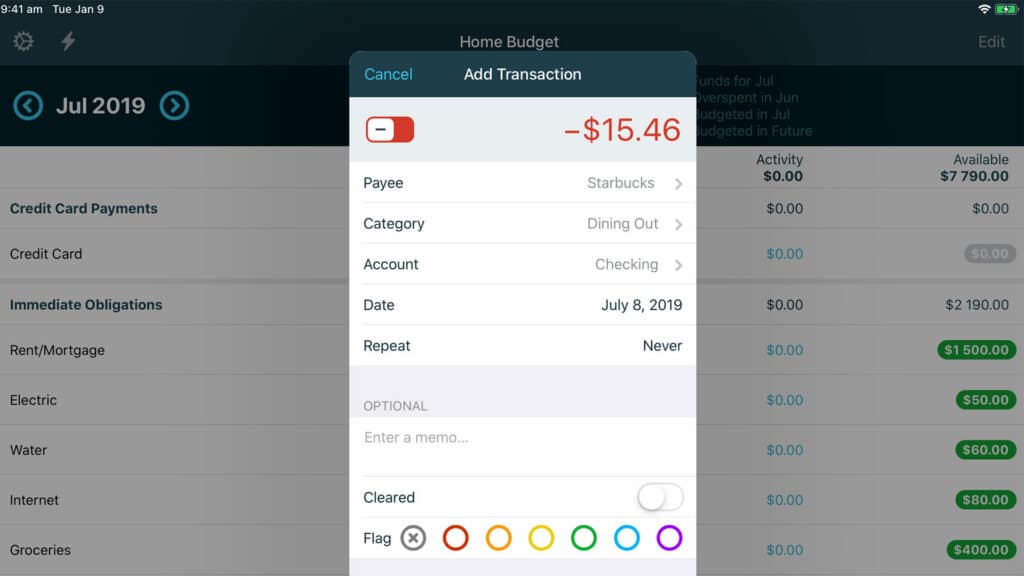

1. Create a Budget and Stick to It

Setting up a realistic budget makes it easier to avoid overspending and find funds to put toward credit card debt. The trick is to make your budget something you can stick to, which means honestly evaluating your spending and income. Also be sure to give yourself a little wiggle room for the things you enjoy. If you deprive yourself of all your favorite activities, it will be nearly impossible to stick to your budget.

Here are some tips to create a budget:

- Determine your monthly expenses. It may help to divide expenses between necessary and miscellaneous to help you see which areas you can cut back on.

- Record your monthly income sources. Include your stable income as well as the average income received from any side gigs.

- Compile all your income and spending information. Putting the information into a spreadsheet can help organize the data, or you can use a budgeting app.

- Review the itemized and total expenses. See where your cash flow is going to help identify what you can reduce or eliminate. You can then put the money saved toward your credit card debt.

- Revisit your monthly budget. Check back regularly on your expenses to adjust your plan as needed, especially if your income or expenses have changed.

Quick Tip

To save money on bills, consider using a bill negotiation app. These apps do the legwork by either negotiating existing rates, finding a lower price or canceling unused subscriptions.

2. Pay More Than the Minimum Each Month

One of the quickest ways to get ahead of credit card debt is to pay more than the minimum due each month. Your minimum payment might be $25, but if you pay only that amount each month and you owe much more, you’ll rack up a lot in interest charges each month, making it harder and harder to pay down what you owe.

You can also set up autopay if you know you can put a set amount toward your bill each month. Say the minimum is $25 but you know you can pay $300. If you set up autopay on your credit card account, it will be a little less to manage and will help you pay down the debt faster. Just be sure you’re checking your balance and interest charges along the way—and ensure there is enough money in your checking account to fulfill the autopay payments. Unless you have overdraft protection, you may need to pay overdraft fees to your bank.

3. Explore Debt Payoff Strategies

Creating a repayment plan to pay off credit card debt can be helpful. Pick a strategy that works for you based on your needs and financial situation. Here are a couple of repayment strategies and how they work.

Debt Avalanche Method: Pay Off High-Interest Debt First

The debt avalanche method involves putting any extra money you have toward your highest-interest credit card first while making the minimum payment on your other cards. Once the highest-interest card account is paid off, the freed-up cash flow is redirected toward the card with the next-highest interest rate.

Since the card with the highest interest rate is targeted first, this strategy is most effective at saving money on interest charges.

Debt Snowball Method: Pay Off the Smallest Balance First

The debt snowball method is similar to the debt avalanche method. But the key difference is you focus on paying off the card with the smallest balance first. In the meantime, you make minimum payments on your other credit card accounts.

The snowball method is advantageous for those who need quick wins to stay motivated with their debt-free plan. However, the downside is you might incur more interest over time.

4. Consolidate Debt

Consolidating debt involves combining multiple loans into a single loan. This is done by taking out a new loan or credit account to pay off existing debt. A major benefit of debt consolidation is that if a person qualifies for a lower interest rate, they can save thousands of dollars on interest.

Here are some strategies to consolidate credit card debt, including a couple I have used:

- Transfer a balance: A balance transfer credit card allows consumers to transfer a balance from one credit card issuer to another, often with a 6-18 month interest-free introductory period. You typically need good to excellent credit to qualify and may be charged a fee of around 3% of the amount transferred.

- Debt consolidation loan: I also used a debt consolidation loan because my credit card APRs were over 20%. I qualified for two $5,000 loans with an average 6% APR. I used the funds to pay off my debt and then paid off the loans over three years, saving me thousands in interest. This option is useful for someone with good credit as those with bad credit are often charged high interest rates.

- Home equity loans: Homeowners can often consolidate debt with a home equity loan or home equity line of credit. Both typically have lower rates than credit cards since they are secured by the equity in your home, but both have potential risks. If a borrower defaults, the lender can foreclose on their home.

- Cash-out refinance. A homeowner takes out a new, larger mortgage to pay off their existing mortgage and then pockets the difference in cash, minus any closing costs. Mortgage rates tend to be lower than credit card rates, so this could save on interest, but a lender can foreclose on the home if the borrower defaults. Consult a financial advisor to determine whether refinancing a mortgage makes sense in your situation.

5. Switch to Cash

If you’re struggling to pay down your debt, it could help to make most or all of your purchases with cash for a while. The main benefit of this strategy is that it can prevent you from adding to your debt because you won’t be using credit cards.

One method is to withdraw the cash you need and use it throughout the week or month to pay for anything you’ve budgeted for. Another method is to swap out your credit cards for your debit card, but you’ll want to keep a close eye on your bank balance to ensure you don't overdraft or incur other bank account fees.

Paying with cash can be a useful strategy to help you get back on track, adjust to a new budget or save money to put toward credit card debt. It has its downsides though, as you’ll be stuck carrying around cash or visiting ATMs more often. And you won’t be able to take advantage of credit card rewards and perks this way. But it’s worth considering if you think it could help you pay down debt.

6. Consider a Debt Management Plan

If you need help creating a plan to get rid of credit card debt, you can also contact a credit counseling agency. An agency can help you create a debt management plan in exchange for a fee. Plus, the counseling agency might be able to negotiate lower interest rates and fees with existing creditors.

A debt management plan requires a debtor to make a monthly lump-sum payment to the agency. The agency then uses those funds to pay each creditor. A major benefit of this plan is that a person’s credit card debt is paid in full—usually within three to five years. As a result, it could help people improve their credit scores over time.

Related Article

Related Article

Should You Use Savings to Pay Off Debt?

7. Ask Your Credit Card Company for a Lower Rate

Another method is to ask your credit card issuer to lower your APR. Call the number on the back of your card and politely ask the representative if they can lower your rate. If you have a good credit score or a history of on-time payments, you can share this information with them to boost your chances.

There’s no guarantee this approach will work, but it sometimes does, so it’s worth a shot. If you do get a lower rate, you’ll have fewer interest charges piling up each month as you work on chipping away at your debt, which will save you money in the long run.

8. Boost Your Income

To pay off debt faster, I also focused on growing my income. I picked up several side hustles—freelance writing, driving for Uber, beta-testing and taking surveys. I put some of the extra money I earned toward paying down my credit cards.

Here are some side hustle ideas to consider:

- Dog walker

- Rideshare driver

- Online instructor

- Food delivery driver

- Renting out a spare bedroom

The trick with any side gig is to find something you can easily work into your existing schedule and that fits your skills.

Outside of picking up a side hustle, getting a promotion at an existing job or landing a new role that offers a higher salary can also boost income that can be used toward paying down your credit card debt faster.

Bottom Line

Paying off credit card debt can be difficult, especially if you’re juggling multiple bills or have a high balance. But the best time to start tackling it is right now. Think through your budget and financial habits to develop a plan that works for your unique situation, whether that’s employing a debt payoff strategy, getting a balance transfer card, seeking out other resources or a combination of these strategies.

The sooner you get started, the less interest you’ll be charged and the sooner you can develop a plan to become debt free.

FAQs

-

Yes, it might be possible to negotiate outstanding credit card balances with card issuers. Sometimes an issuer might agree to accept an upfront lump-sum payment that is less than the total amount owed. However, settling credit card debt can negatively impact a person’s credit score.

-

Using emergency savings to pay off the debt in full might be a good option if you have enough funds to cover unexpected expenses. Otherwise, doing so might result in having to take on additional debt if an unexpected expense arises.

-

Choosing which bills to pay off first depends on the goal. First, focus on necessary costs, like housing, utilities, food and transportation. When it comes to credit card debt, consider whether the goal is saving on interest charges, or keeping up the debt repayment momentum by paying down smaller balances first.