Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

Identity theft and fraud have become increasingly common in the United States since the turn of the century. According to data from the Federal Trade Commission, more than 5 million people filed theft or fraud complaints in 2022. But while fraud and identity theft complaints were down slightly from 2021, the number of reports has risen steadily since 2001 when there were more than 300,000.

If you’ve been a victim of identity theft or fraudulent activity, or you’re simply concerned about becoming one, chances are you’ve heard about freezing your credit. Here’s how credit freezes work, when it can make sense to freeze your credit, how to unfreeze it, and what to be aware of before you start freezing your credit.

What Does Freezing Your Credit Do?

When you freeze your credit accounts, you essentially limit access to your credit reports with the three major bureaus, Equifax, Experian, and TransUnion.

Here's what you can expect when there is a freeze on your credit:

- You limit access to your credit reports: Prospective lenders or credit card issuers can’t view your reports, but neither can scammers.

- You'll have trouble opening new credit accounts: Because most financial institutions require a credit check as part of their approval processes for credit cards and loans, freezing your credit can help prevent someone from opening new lines of credit in your name or taking out a fraudulent loan. But that means you won’t be able to get financing either when there is a credit freeze.

- Your credit score is not affected: Placing a freeze on your credit does not affect your credit score.

But you can still rent an apartment, get a new insurance policy, and apply for a job with a credit freeze in place. Your credit file won’t be restricted in these cases.

Credit freezes are free, and they last as long as you leave them in place.

When Freezing Your Credit Makes Sense

While you’ll often hear of people freezing their credit after falling victim to identity theft or fraud, anyone can freeze their credit at any time. Here are some scenarios of when it may make sense to freeze your credit.

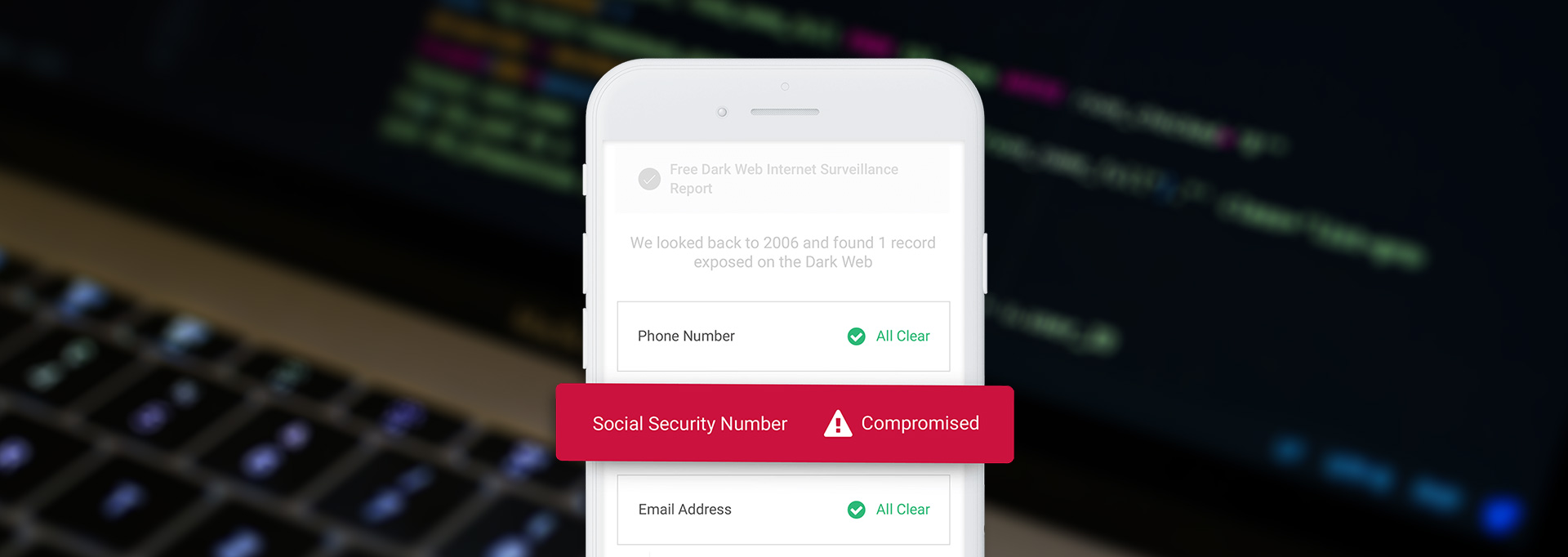

- You're worried that your personal information has been compromised: If you’re worried your personal information has been compromised, you can freeze your credit to prevent further damage to your history. For instance, if you’re notified by a retailer or healthcare provider that a scammer has accessed your name, email, or other data, you might consider a credit freeze.

- Your identity was stolen: Or you can do so if your identity has been stolen. In this case, you’ll also want to file a police report and take other measures to protect yourself.

- You've been a victim of fraud: Alternatively, fraud alerts or extended fraud alerts are an option if you suspect you’re a victim of fraud. While these alerts don’t completely block access to your reports like a credit freeze, they make it more difficult for a potential scammer to apply for a loan or open a credit line in your name, as lenders will need to verify your identity before approving you for financing. You could also use a credit monitoring service if you're worried about potential fraud.

- You were impacted by a company's data breach: You can also freeze your credit as a proactive measure to protect yourself if you've been affected by a data breach as a customer.

How to Freeze Your Credit

If you want to freeze your credit file, you can do so through Equifax, Experian, and TransUnion.

- Contact the major credit bureaus. Unfortunately, there’s not one website or number you can call to freeze your credit with the three credit reporting companies, so you'll need to complete the steps for all three bureaus separately.

- Fill out your personal information online: Expect to provide your personal information as part of the freezing process. You’ll likely need to answer some questions with each credit bureau to verify your identity.

- Verify your identity: The bureaus may ask that you provide a copy of a government-issued ID, your Social Security number, bank statements, and proof of current address to verify your identity.

Each individual bureau offers an option to place a freeze on your credit online, which can be more convenient than placing one over the phone or by mail. But it’s also possible to freeze by phone or mailing a paper form.

How to Unfreeze Your Credit

If you want to unfreeze your credit, you’ll need to do so with each of the credit reporting agencies.

To lift a freeze on your credit, you have several options:

- Log into the online account you created when you froze your credit

- Call each bureau directly, or

- Complete and mail in a form

Best Rewards Credit Cards

Visit the Marketplace

Benefits and Drawbacks of Freezing Your Credit

Benefits

- Peace of mind after identity theft

- Fraud protection

- Accessibility and flexibility

Cons

- Slower access to credit

- Possible missed benefits

- It has limitations

Benefits

- Peace of mind after identity theft: If you’ve been the victim of an identity thief, a credit freeze can help provide some protection from further violations of your privacy and personal information.

- Fraud protection: A primary benefit of a credit freeze is to protect your credit from potential fraud. And since consumers lost around $8.8 billion to fraudsters in 2022, per the FTC, limiting access to your credit reports can be wise.

- Accessibility and flexibility: It’s free to freeze your credit, and you can lift the freeze whenever you want. There’s no specific timeframe for which you need to leave it in place.

Drawbacks

- Slower access to credit: You won’t be able to get approved for a new credit card or loan while your security freeze is in place. If a potential lender runs your credit, they won’t be able to access your reports at all. This can be inconvenient, especially if you forget about your credit freeze or misplace your login info for online access to the credit bureaus.

- Possible missed benefits: In some cases, you might miss out on certain benefits like historically-low interest rates or large credit card sign-on bonuses if you don’t lift your freeze in a timely manner.

- It has limitations: Freezing your credit won’t prevent identity theft, though it can help protect you afterward. Unfortunately, it doesn’t protect you from everything. For instance, if someone steals your Social Security number, they could still file fraudulent tax returns in your name. A credit freeze won’t prevent this, but an identity theft protection service might help in this case.

The Bottom Line

Freezing your credit blocks third parties from accessing your credit reports. Like anything else, credit freezes come with pros and cons, and they don’t protect you from everything. But if you’re fairly risk-averse and you’re worried a scammer has accessed your information, placing a freeze on your credit could be a smart choice. You could also place a fraud alert, which will help ensure financing institutions verify your identity before approving a loan or credit line in your name.

Frequently Asked Questions

-

Anyone can freeze their credit, but whether a credit freeze makes sense for you depends on your situation and preferences. If you’ve been a victim of a data breach, placing a freeze on your credit reports may offer valuable protection. But you can also do so if you’re worried you could fall victim to identity thieves in the future.

-

You can freeze your credit for as long as you’d like. There’s no specific time period; instead, you simply contact each of the national credit bureaus to unfreeze your file when it makes sense for you. Unlike credit freezes, fraud alerts are typically placed for one year, and extended fraud alerts can be placed for seven years.

-

A credit freeze won’t harm credit reports or credit scores; you shouldn’t see a change to either. Freezing your credit simply restricts access to your credit file, though you will still be able to access your reports via annualcreditreport.com.

-

A credit freeze is a free service provided by the major credit bureaus, Equifax, Experian, and TransUnion. Setting up fraud alerts on your credit file is also free.

-

Unfreezing your credit is a fairly easy process, but the period of time it takes to lift a freeze will vary depending on how you do it. For instance, if you do so by logging into your online accounts with the credit bureaus or speaking with a representative over the phone, your freeze may be lifted within an hour. The process will be longer if you print and mail a form to lift your credit freeze.

-

You aren't required to, but you should freeze your credit report with all three major credit bureaus individually to maximize your protection. You'll need to place a freeze with each bureau individually, as there isn’t one website or number you can call to freeze all three credit reports at one time.