Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

Tax season can be a stressful time, even if you hire someone else to prepare and file your return for you. But for many of us, having a professional handle everything is worth it because it ensures that your taxes are prepared and filed accurately. What you may not expect though, is that the cost of tax preparation can be quite reasonable for most filers.

How Much Does It Cost to Have Someone Do Your Taxes?

The average cost of having someone do a simple non-itemized Form 1040 and state return is $220, according to recent data from the National Society of Accountants.

That may not seem like a big deal compared to the average tax refund, which was $3,054 according to IRS data from October 2023. But the more of that cash you can keep, the better.

Related Article

Related Article

9 Best and Cheapest Online Tax Services

Who Does the Preparation and Filing?

If you decide to file your own tax return, you could be able to do it without paying anything at all. If you decide to hire a tax professional, however, expect to pay an average of $220 for a basic federal and state return.

Tax Preparation Services

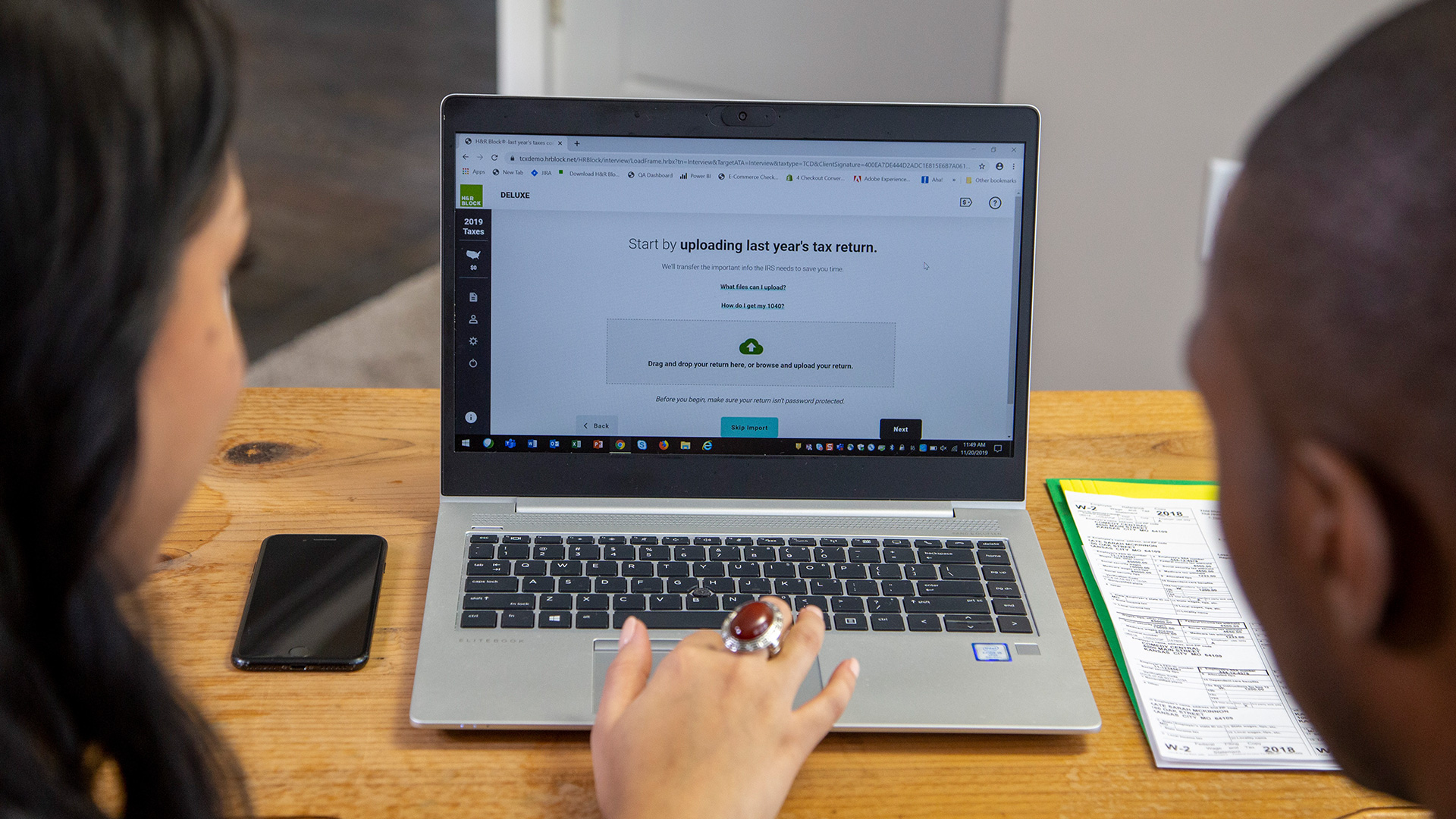

There are several tax preparation services you can use to file your taxes on your own, each one guiding you through the process to make it simpler and more convenient. Most offer a free version but come with up-charges, sometimes on incredibly basic things like adding a state return or deducting your student loan interest.

Cash App Taxes and the IRS Free File program are free services (though the IRS program is only available to taxpayers with an adjusted gross income of $79,000 or less).

Related Article

Related Article

TurboTax Review: Get a 100% Accuracy Guarantee

Where You Live

The National Society of Accountants found that the cost of hiring someone to file your return can vary wildly based on where you live. For example, if you want an itemized Form 1040 and state return, the average cost is $288 in Alaska and $486 in Hawaii. In contrast, the same service in Kansas averages out to $244 but is just $163 in Ohio.

TaxAct

This product is currently not available via Slickdeals. All information about this product was collected by Slickdeals and has not been reviewed by the issuer.

- Our Rating 4.5/5 How our ratings work

TaxAct has a robust accuracy and refund maximum guarantee that eclipses most competitors. Its no-frills tax service is easy to use and simple to navigate. It really shines with its Xpert Assist help service, which allows filers across all tiers to consult a tax expert, though the service now comes with a fee.

Overview

TaxAct’s filing software comes with four tiers: Free, Deluxe, Self-Employed, and Premier tiers. Whether you have the most basic tax filing needs or more complex filing as a freelancer or a business owner, TaxAct makes the process affordable and easy to navigate with its intuitive software. Keep in mind that filing a state return can come with a higher fee than other competitors.

Pros

- Maximum refund and accuracy guarantee

- Ability to import previous returns from other online tax softwares

Cons

- No free state return filing

- Live tax help from an expert now has a fee

The Number of Forms

The cost of your return will also depend on how complicated your tax situation is. For example, an itemized Form 1040 and state return will cost you $323 on average, $103 more than if you just take the standard deduction. And if you own a business, you'll add $192 on top of the cost for your standard tax forms.

How Much Should You Pay?

How much you should pay really depends on your situation. I did my taxes for free for years because they were mostly uncomplicated, even when including business expenses. But now that I own an S Corporation, the reporting process is much more complicated, so I pay someone to do all of it now.

If you're not sure, consider using a free service like Credit Karma and go through the process. If it covers everything you need, you can file for free. But if you get to the point where you're not 100% sure you're doing it right, your situation is too complex or you just don't want to deal with it, consider hiring a certified public accountant to help.

Savings Accounts for Tax Expenses

Whether you're expecting a refund this year or want to plan for a tax bill or tax prep help next year, setting aside some funds now is a smart move. The best high-yield savings accounts can help you put saving on autopilot and increase your tax fund a little each month or at every paycheck. And if you are getting a refund this year, you might want to stash it in a savings account and earn some interest until you need that cash.

Here are our picks for the best high-yield savings accounts.

Recommended High-Yield Savings Accounts

| Bank Account | APY | Features | Learn More |

|---|---|---|---|

|

|

4.85%

*Annual Percentage Yield (APY) is variable and is accurate as of 11/15/2024. Rate is subject to certain terms and conditions. You must deposit at least $5,000 to open your account and maintain $25 to earn the disclosed APY. Rate and APY may change at any time. Fees may reduce earnings. |

$5,000 min. deposit |

Open Account |

|

|

Up to 4.86%

Earn up to 4.86% APY on savings, and 0.51% APY on checking when you meet requirements. |

No minimum deposit |

Open Account |

|

Member FDIC |

0.50% - 3.80%

SoFi members who enroll in SoFi Plus with Direct Deposit or by paying the SoFi Plus Subscription Fee every 30 days or with $5,000 or more in Qualifying Deposits during the 30-Day Evaluation Period can earn 3.80% annual percentage yield (APY) on savings balances (including Vaults) and 0.50% APY on checking balances. There is no minimum Direct Deposit amount required to qualify for the stated interest rate. Members without either SoFi Plus or Qualifying Deposits, during the 30-Day Evaluation Period will earn 1.00% APY on savings balances (including Vaults) and 0.50% APY on checking balances. Only SoFi Plus members are eligible for other SoFi Plus benefits. Interest rates are variable and subject to change at any time. These rates are current as of 1/24/25. There is no minimum balance requirement. Additional information can be found at http://www.sofi.com/legal/banking-rate-sheet. See the SoFi Plus Terms and Conditions at https://www.sofi.com/terms-of-use/#plus. |

No minimum deposit |

Open Account |

CIT Bank Platinum Savings Account |

4.30%

Earn 4.30% APY on balances over $5,000. Balances of less than $5,000 earn 0.25% APY. Annual Percentage Yield is accurate as of February 5, 2025. Interest rates for the Platinum Savings account are variable and subject to change at any time without notice. |

$100 minimum deposit |

This product is currently not available via Slickdeals. All information about this product was collected by Slickdeals and has not been reviewed by the issuer. |