Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

LightStream

- Loan Amounts$5,000 – $100,000

- Loan Terms24 – 144 months

- APR Range7.49% – 25.49% (with autopay)

- Minimum

Credit Score660 or aboveA credit score is used to indicate the creditworthiness of an applicant, but it is only one of several factors considered for approval. These credit scores alone are not guarantees for approval and should only be used as guidelines.

LightStream is a solid online lender offering no fees, high loan maximums and low-rate personal loans for several purposes.

Personal Loan Lender with Competitive Rates and Fast Funding

LightStream, the online lending arm of Truist, offers personal loans with competitive APRs and repayment terms as long as 144 months. Borrowers also benefit from no origination fees, no late fees, and a high maximum loan amount of $100,000. But LightStream’s minimum loan amount is a hefty $5,000, so it may not be your best option if you need to borrow a small amount.

Pros

- Low minimum APR

- No origination fees, no late fees

- High loan maximum of $100,000

- Autopay discount

- Joint applications allowed

Cons

- Rates and terms vary by loan purpose

- No soft pull prequalification

- Must have good-to-excellent credit

- No physical branches

Loan Uses

Borrowers with good credit looking for low rates and fast funding will appreciate what LightStream offers. It has one of the lowest APRs among competitors, though your actual rate will depend on the loan amount, purpose, and your credit history. For instance, you’ll get a different rate if you use your loan for consolidating credit card debt versus covering medical costs. LightStream loans can be used for several purposes, including:

- Home improvements: Whether you’re installing solar panels, putting in a pool, or renovating your kitchen, a LightStream loan is an option.

- Vehicle purchases and refinances: Loan proceeds can be used to purchase or refinance cars, boats, RVs, motorcycles, and aircraft. LightStream offers its lowest rates for these purposes.

- Pre-K to 12th-grade education costs: While you can’t use a LightStream loan to pay college costs, you can use the proceeds to cover costs associated with Pre-K to 12th-grade education.

- Medical bills: If you have an unexpected or expensive medical procedure, LightStream offers personal loans up to $100,000 to help finance the cost.

- Adoption: Those expanding their family can use a LightStream loan to pay for adoption expenses.

- Weddings: LightStream offers wedding loans with relatively low APRs to help you pay for your special day.

- Debt consolidation: LightStream also offers debt consolidation loans, which can be used to access a lower rate and streamline your monthly payments.

There are a few restrictions on how you can use your loan, though, which are pretty common with other lenders too. LightStream loans can’t be used for college tuition and fees, refinancing student loans, or refinancing an existing LightStream loan.

LightStream Loan Details

|

APR Range |

7.49% – 25.49% (with autopay) |

|

Loan Amount |

$5,000 – $100,000 |

|

Loan Terms |

24 – 144 months |

|

Credit Score |

660 or above |

|

Funding Time |

As soon as same day after approval |

|

Prequalification Option? |

No |

|

Co-Signer Allowed? |

No |

|

Joint Applicant Allowed? |

Yes |

|

Income Requirements |

Not disclosed |

|

Origination Fee |

None |

|

Late Fee |

None |

|

Prepayment Penalty |

None |

|

Discounts |

Autopay Discount: 0.50% |

Highlights and Perks

LightStream has a lot to offer for borrowers who are in need of a loan. Some notable perks include:

- Lengthy repayment terms: LightStream has some of the longest repayment terms out there, with the highest being 12 years on specific loans.

- Relatively low fixed rates: The minimum APR on a LightStream loan is one of the lowest among competitors, and its highest maximum APR is comparable to other lenders.

- High maximum loan amounts: Unlike most lenders, LightStream has a high loan cap of $100,000, making it suitable for those in need of a large loan. Although only qualified borrowers will be eligible for a loan of that size.

- No fees: Borrowers pay no origination fees, no late fees, and no prepayment penalties. Not having to pay these fees can help you cut down on borrowing costs.

- Wide range of loan uses: There are few restrictions on how borrowers can use loan proceeds.

- Joint applications: LightStream allows joint applications if you’d like to apply for a loan with a trusted family member or friend.

- Rate discount: This lender also has a unique rate beat program, which could give you a rate that’s 0.10% lower than competing lenders, provided you meet certain qualifying requirements. LightStream’s rates are already competitive, so this program is a big value-add for prospective borrowers seeking the lowest possible APRs.

Drawbacks and What to Look Out For

Despite LightStream’s benefits, there are some drawbacks to be aware of too.

- Rates vary by loan and purpose: Its rates differ based on the loan purpose and loan term. So if you need a loan to cover medical costs, you could end up with a higher rate than you would if you needed to refinance an existing auto loan. Longer terms also have higher rates, though this is also common with other lenders too.

- No prequalification option: LightStream also doesn’t let prospective borrowers prequalify for its loans, which can be a useful option for those who want to shop around for the best rates. And while it doesn’t disclose a specific credit score requirement, it mentions that borrowers should have good to excellent credit to qualify for loans. So if your credit isn’t great, you’ll likely need to consider other lenders or apply with a co-borrower with stronger credit.

Related Article

Related Article

How to Prequalify for a Personal Loan, and Why It Can Be a Good Idea

How to Qualify

While LightStream doesn’t disclose its exact credit score requirements, it does indicate you’ll need good credit to qualify for a loan. But it defines ‘good credit’ in its own way, not as having a certain credit score. So you’ll also need to meet specific requirements to be considered a good-credit borrower, including having an established credit history, consistent income, sufficient assets, manageable debt, and a positive payment history.

Unlike some lenders, LightStream does allow joint applications, meaning you can apply with a co-borrower if you choose. Doing so may increase your chances of approval if you don’t have a long credit history. Just keep in mind your co-borrower will share equal responsibility for repaying the loan. Like many other personal loan lenders, LightStream doesn’t let you apply with a cosigner.

Application Process

- Apply online: You can only apply for a LightStream personal loan online. To do so, you’ll need to share some basic personal information, as well as information about your assets, current debts, and current employment. If you’re applying with a co-borrower, you’ll also need to provide the same type of information for them.

- Hard credit pull: After you submit your loan application, LightStream will do a hard credit pull and review your FICO score and reports.

- Approval: If you meet LightStream’s qualifying criteria, you can get approved for a loan. But first, you’ll need to accept your loan agreement. This lender offers approval decisions fairly quickly, though it doesn’t specify an exact timeframe.

- Funding: Loan proceeds can be disbursed as soon as the same day you’re approved. But you’ll need to verify your identity with a Visa or Mastercard before the loan is issued (no charges will be issued). If you prefer, you can also schedule a specific date for disbursement within up to 30 or 90 days of approval, depending on the loan purpose.

Example of Loan Payments

Borrowers who take out a 60-month, $10,000 home improvement loan with an 8.49% APR would have total monthly payments of around $205. Total interest payments over the life of the loan would be around $2,278 if you repaid the loan in five years.

Calculator your estimate loan payments using our personal loan calculator.

Reputation

While LightStream has an A+ Better Business Bureau (BBB) rating, its overall customer feedback can leave you second-guessing your decision. Reviews on the BBB and TrustPilot are fairly lukewarm, with applicants expressing concerns about bad customer service and being denied loans despite having high credit scores.

Though many reviews are not positive, some satisfied borrowers praise LightStream’s simple and quick approval process and competitive interest rates. Others mention great experiences with this lender’s customer service team. While looking at others’ experiences can be useful when researching lenders, it’s up to you to decide if working with a certain lender is the best choice for your situation.

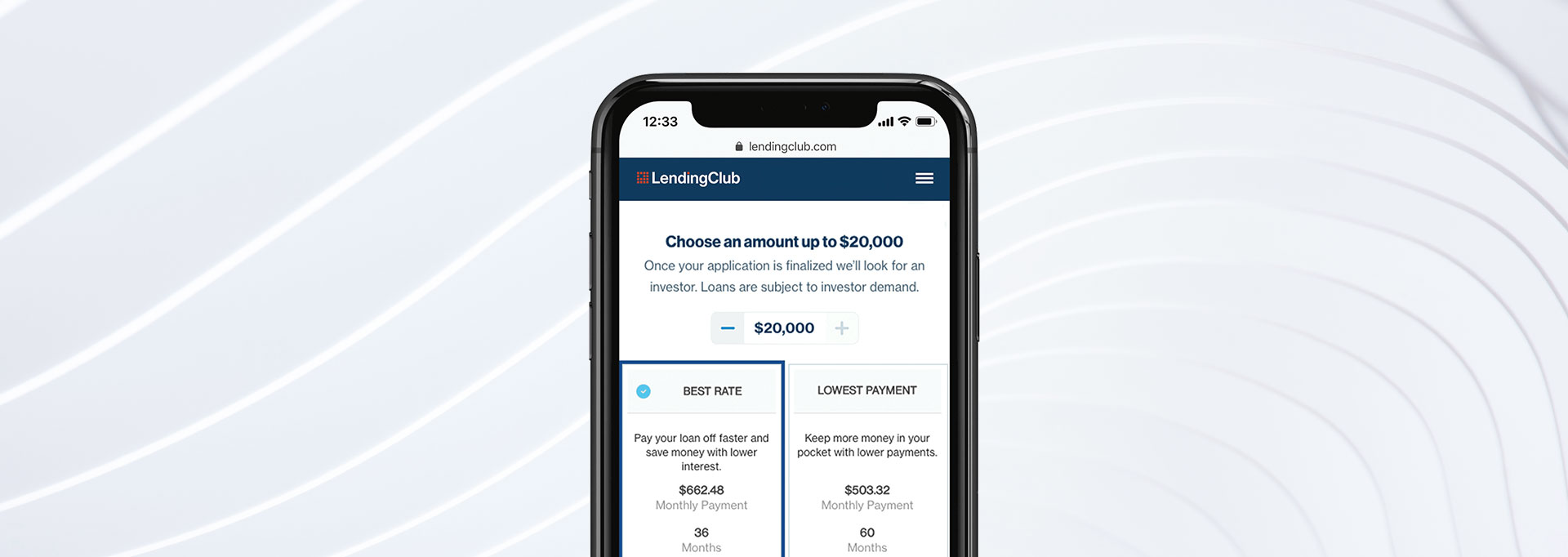

How LightStream Compares

LightStream has competitive loan products overall, offering significantly longer repayment terms than some competitors. For instance, Upgrade only offers repayment terms of up to 84 months. You could get a 144-month repayment term with a LightStream loan, depending on your loan purpose.

LightStream’s rates may also be lower depending on how you use your loan. It offers different rates for different loan purposes.

Here is how LightStream stacks up to other lenders.

FAQs

-

When you apply for a personal loan with LightStream, you’ll undergo a hard credit inquiry, which most lenders conduct as part of the loan application process. This inquiry will cause your score to dip by a few points temporarily.

However, a LightStream personal loan could also improve your credit over time if you make payments responsibly. These payments are reported to the credit bureaus and could help you build a positive payment history. You may also see your credit score increase if your personal loan improves your overall credit mix.

-

Yes, LightStream is a legit online lender that’s been issuing loans to consumers for over ten years. It's part of the financial services company Truist, which was formed in 2019 after BB&T and SunTrust banks merged.

-

Though LightStream looks at other factors besides your credit score in its loan decisions, you’ll likely need good or excellent credit to qualify for one of its personal loans. Borrowers with poor credit may want to consider applying with a co-borrower with stronger credit or looking at other lenders with more flexible credit score requirements.

-

If you qualify, you could get approved for a loan of up to $100,000 with LightStream. This is a very high loan amount compared with what many other lenders offer.