Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

The largest monthly expense for most people is the cost of housing, and many renters have taken a significant financial hit in recent years. U.S. News reports that from June 2021 to June 2022, the average rent increase was 5%. Some states even reported double-digit growth. According to rent.com, the average rent for a one-bedroom apartment is $1,770 as of August 12, 2022. That number increases to $2,106 for a two-bedroom unit.

Challenges associated with a shaky economy—such as those that emerged during the Covid-19 pandemic—plus escalating grocery costs and soaring gas prices make rent even more difficult to afford. Some people have secured a second job just to make ends meet.

If you're running out of options, paying your rent using a personal loan can be something to consider. We'll go over when it makes sense to take out a loan for rent, best loans based on your situation, pros and cons, and other alternative options.

Can You Use a Personal Loan to Pay Rent?

Yes, personal loans can be spent on almost anything, including rent. You could also put the loan toward emergencies or essential spending, such as a medical procedure or for utilities. If you're unemployed or having a hard time making ends meet, a loan can offer a lifeline to cover your necessary expenses.

However, make sure that you carefully examine all of your options first before taking out a loan. Assess whether you can afford to repay the loan and if you can wisely manage the extra debt given your current financial situation.

Best Loans to Help with Rent Payments

- Best for Bad Credit: Upgrade

- Best for Good Credit: SoFi

- Best for Limited Credit History: Upstart

- Best for Fast Funding: LightStream

- Best for No Fees: PenFed Credit Union

Loan results will vary based on creditworthiness, loan purpose, loan amount, and other factors.

Best for Bad Credit

Upgrade

- Loan Amounts$1,000 – $50,000

- Loan Terms24 – 84 months

- APR Range8.49% - 35.99%

- Minimum

Credit Score560 or aboveA credit score is used to indicate the creditworthiness of an applicant, but it is only one of several factors considered for approval. These credit scores alone are not guarantees for approval and should only be used as guidelines.

Borrowers with less-than-stellar credit profiles may find Upgrade personal loans accessible, and its quick funding and flexible payment due dates convenient.

Overview

Upgrade offers personal loans that are accessible to those with not-so-ideal credit scores. The low loan minimum of $1,000 also makes it an easy choice for those with small financing needs. However, borrowers in certain states will be subject to higher minimum loan amounts. With this lender, you can expect to pay an origination fee. Borrowers can view their rate before applying without impacting their credit score. Overall, Upgrade is worth considering if you’re looking for a lender that is willing to work with lower credit scores and offers loans with competitive rates and flexible terms.

Pros

- Accessible to borrowers with bad credit

- Flexible loan terms

- Joint applications allowed

- Secured loan options

- Direct payment to creditors

Cons

- Has origination fees

- No physical branches

- Higher APRs than some competitors

Best for Good Credit

SoFi Personal Loans

- Loan Amounts$5,000 – $100,000

- Loan Terms24 – 84 months

- APR Range8.99% – 29.49%

- Minimum

Credit Score680 or aboveA credit score is used to indicate the creditworthiness of an applicant, but it is only one of several factors considered for approval. These credit scores alone are not guarantees for approval and should only be used as guidelines.

SoFi's personal loan offering comes with no fees required and a high loan maximum that may be a good fit for those seeking large loans.

Overview

SoFi offers a competitive personal loan product that boasts no origination fees, no late fees, and a high maximum loan amount of $100,000. SoFi is one of only a handful of lenders offering loans as large as $100,000. If you need a substantial loan to cover a considerable expense, like a home renovation, SoFi’s high maximum can be a strong option. One standout feature of SoFi is that it offers unemployment protection, which might allow you to pause payments if you lose your job. Same-day funding is also available for qualified borrowers

Pros

- No origination fees, no prepayment penalties and no late fees

- Loans up to $100,000

- Unemployment protection available

- Autopay rate discounts

- Co-borrower allowed

- Same-day funding available

Cons

- No physical branches

- High minimum loan amount

- Good credit likely required

Best for Limited Credit History

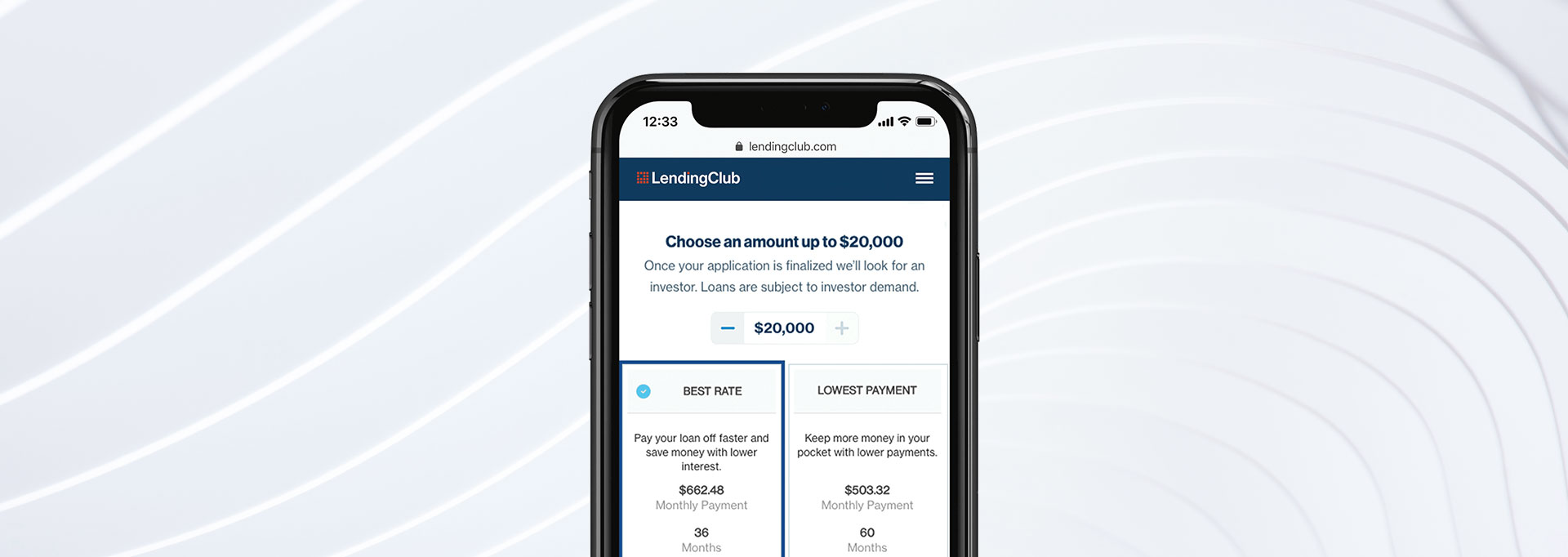

Upstart

- Loan Amounts$1,000 – $50,000

- Loan Terms36 or 60 months

- APR Range7.8% - 35.99%

- Minimum

Credit Score300 or aboveA credit score is used to indicate the creditworthiness of an applicant, but it is only one of several factors considered for approval. These credit scores alone are not guarantees for approval and should only be used as guidelines.

Using artificial intelligence to help evaluate borrowers, Upstart is a unique lending platform that looks beyond your credit score for personal loan approval.

Overview

Upstart is a first-of-its-kind online lending platform that uses artificial intelligence to help make smarter lending decisions. This means the company considers factors beyond a borrower’s credit score to help determine creditworthiness. Upstart indicates its model has resulted in 43% lower rates for borrowers than traditional credit score models.

Beyond your credit score, Upstart will also look at your employment history, income and level of education when deciding whether to approve you for a loan. The company states that borrowers with credit scores as low as 300 might be able to get approved for a personal loan, though that loan may come with a relatively high APR.

Upstart’s rates are fairly competitive and loan funds are disbursed as soon as one business day after approval. This lender charges origination fees, so it’s important to read the fine print before applying.

Pros

- Considers factors beyond your credit score in lending decisions

- Loans up to $50,000

- Fast funding time

- Check rate without affecting credit score

- Low minimum credit score requirement

Cons

- No physical locations

- Limited repayment terms

- Has origination fees

- High maximum APR

- Not available in Iowa or West Virginia

Best for Fast Funding

LightStream

- Loan Amounts$5,000 – $100,000

- Loan Terms24 – 144 months

- APR Range7.49% – 25.49% (with autopay)

- Minimum

Credit Score660 or aboveA credit score is used to indicate the creditworthiness of an applicant, but it is only one of several factors considered for approval. These credit scores alone are not guarantees for approval and should only be used as guidelines.

LightStream is a solid online lender offering no fees, high loan maximums and low-rate personal loans for several purposes.

Overview

LightStream offers personal loans for several purposes, including debt consolidation, medical expenses, home improvement, weddings, car purchases and more, making this worth considering for those seeking flexibility. The lender offers relatively low rates compared to competitors, including autopay discounts. Its personal loans also have no origination fees or late fees, which can help keep borrowing costs low. However, borrowers will likely need to have good-to-excellent credit in order to be approved for a LightStream personal loan. Overall, it’s a good lender to add to your shortlist if you’re looking for flexible funding, no fees and a low APR. Lightstream may also disburse loans as soon as the same day you’re approved, making this lender a worthy choice if you need fast funding.

Pros

- Low minimum APR

- No origination fees, no late fees

- High loan maximum of $100,000

- Autopay discount

- Joint applications allowed

Cons

- Rates and terms vary by loan purpose

- No soft pull prequalification

- Must have good-to-excellent credit

- No physical branches

Best for No Fees

PenFed Credit Union

- Loan Amounts$600 – $50,000

- Loan Terms12 – 60 months

- APR Range7.99% – 17.99%

- Minimum

Credit Score700 or aboveA credit score is used to indicate the creditworthiness of an applicant, but it is only one of several factors considered for approval. These credit scores alone are not guarantees for approval and should only be used as guidelines.

PenFed offers no fees and small personal loans as low as $600.

Overview

While you will need to become a PenFed member if you decide to get a personal loan there, anyone can apply for membership and the process is quick and simple. Many lenders have relatively high minimum loan amounts, but PenFed offers loans as small as $600, with no origination fees and competitive APRs. If you’d like to view personal loan rates with PenFed, you can do so without impacting your credit score.

Pros

- Pre-qualification is available

- No origination fee, hidden fees or prepayment penalties

- Borrow as little as $600

- Allows co-borrower

- Funding as early as 1-2 business days after approval

Cons

- Must be a member to receive the loan

- No option for direct payment to creditors for debt consolidation

Pros and Cons of Using a Loan to Pay Rent

In general, borrowing money to cover rent should only be done as a last resort. However, if you can repay the loan fast and are in a short-term bind, getting a loan for rent might be something to consider. Here are some benefits and drawbacks to taking out a rent loan.

Pros

- Funding can be quick

- Can be a safety net for emergencies

- Flexible uses

Cons

- You could fall into a debt trap

- Not everyone qualifies for a low rate

- Can harm credit if you miss payments

Pros

- Funding can be quick: Most lenders are able to provide funding within a week after approval. Some lenders can even offer same-day or next-day funding after approval. The funds are deposited straight into your bank account to be used as you see fit.

- Can be a safety net for emergencies: A loan can be a useful safety net that helps you cover one or two months of rent while you wait for your first paycheck. For instance, if you’re in the process of switching jobs or waiting to get your security deposit back from your previous landlord, a personal loan can be an option.

- Flexible uses: Personal loans can be used for a variety of purposes. You can cover rent, utilities, or even day-to-day spending with your loan funds. The only things you cannot use your loan for are for gambling, college tuition, or to finance illegal activities.

Cons

- You could fall into a debt trap: If you have no way to repay the loan, you could fall into a debt trap with fees for late or missed payments. Make sure you have the financial resources to repay the loan before taking one out.

- Not everyone qualifies for a low rate: Only borrowers with good credit will qualify for lower rates. If you have bad credit, you'll likely face higher rates, which will make the loan extremely expensive.

- Can harm credit if you miss payments: Repaying a loan is a big responsibility, and if you miss payments, your credit score could take a dip. A lower credit score may also make it harder to find a rental property because most landlords will run a credit check.

Getting a Personal Loan When You’re Unemployed

How Do I Qualify for a Rent Loan?

Perhaps you need help paying rent because you lost your job or have no income. Even if you have less-than-perfect credit, you may still be eligible for a personal loan.

Here are some of the factors that can determine whether you qualify for a personal loan:

- Credit score: While there are no hard and fast rules regarding the kind of credit score you need to have, banks may look more favorably on applicants that have scores in the "good" to "excellent" range, which is approximately 670 or above.

- Income: Some lenders have minimum income requirements in order to qualify for a loan. This is to ensure you have the ability to repay the loan. If you have no income, it can be harder to get approval, but it can be possible if you bring on a co-signer or co-borrower.

- Debt-to-income ratio: Your debt-to-income ratio is a calculation of how much of your monthly income goes towards paying debts. For example, if you have $3,000 in monthly debt payments, such as from a mortgage, credit card payments, and a car note, and your gross monthly income is $6,000, your debt-to-income ratio would be 50%. Lenders prefer a low debt-to-income ratio.

The key is to make sure you do some research before applying. Even if you have less-than-ideal credit, you may still qualify for a loan. Check each lender's requirements and find one that can offer you the best deal based on your needs and what you can afford.

Related Article

Related Article

How to Prequalify for a Personal Loan, and Why It Can Be a Good Idea

How to Apply for an Emergency Rent Loan

Here is what you can generally expect when applying for a personal loan:

- Shop around and compare rates. It’s always a good idea to shop around. You can prequalify for a loan to see rates and loan terms between different lenders. Most lenders conduct a soft check when you prequalify, so you won't have to worry about your credit taking a dip.

- Read the fine print. Always comb through the fine print to watch out for any personal loan fees, such as prepayment penalties for paying off your loan early or origination fees that might be deducted from your loan amount (which means you'll need to request a higher loan amount).

- Prepare your documents. Each lender may require different documents, but in general, you'll need to provide proof of income such as tax returns and proof of identity, along with other documents as requested by the lender.

- Apply for the loan. Once you've chosen a lender, submit a formal application for the loan along with your documents. Most applications can be done online, but some banks may require that you finish an application in person.

5 Best Emergency Loans for Same or Next-Day Funding

Alternatives to Getting a Rent Loan

If you decide that a personal loan is not the right fit for you, here are some alternatives to consider.

Emergency Rental Assistance (ERA) Programs

ERA programs provide help with utility and rent payments during tough economic times, and some local or state agencies have these available for residents. You can apply as a renter, and landlords can also apply on behalf of tenants, which may be an attractive option for them because it may help sustain their rental income. Also, ERA funds can be used to find a new home to rent or to keep paying rent where you are.

Add a Side Hustle

Another option is to jump into the gig economy and pick up some side jobs. There are a lot of opportunities to make some extra cash, especially online. For example, many delivery companies have hired gig workers to pick up and drop off deliveries. This can be a way to bring in some additional income if you're out of work.

Friends and Family

If you're fortunate enough to have friends and family who are willing to help, see if they can offer assistance with your rent. Have a clear plan on how much you need and the repayment terms. Write down all the details so there is no misunderstanding between the parties, and so you can avoid hurting any existing relationships you have.

Should I Consider a Personal Loan for Rent?

A personal loan to cover rent can be a helpful option when you need it, but it's generally considered a last resort due to the high rates and potential to fall further into debt.

Using a personal loan to pay rent might be a good idea for people capable of repaying the loan within a short timeframe and those who are optimistic about finding employment soon. However, a personal loan may not be ideal if you don’t know how much you'll ultimately need or when you'll be able to work again.

If you do end up applying for a personal loan to cover your rent, do your research and plan accordingly to ensure the loan shows up in time before your rent is due.

FAQs

-

The short answer is yes, particularly if your rental agreement requires full payment on a certain date. Your rental agreement should stipulate situations in which a tenant can be evicted, and failing to pay rent in full is a common reason for eviction. There may be one caveat, however: If the eviction process has already started and the landlord accepts a partial payment, this may reset the eviction process altogether. Double check your local tenant-landlord laws in your area.

-

This will vary by lender, but many personal loans can be sent to your bank account within a few days after the loan is approved. Some lenders may even be able to offer next-day funding after approval.

-

Some lenders offer loan maximums of up to $100,000, but few borrowers will qualify and be approved for such a high amount. The amount you can borrow will depend on your credit score, income, existing debts, and other qualifying factors. If you have a strong credit score and high income, you may qualify for a higher loan amount at low rates.

-

Yes. You can still be approved for a loan even if you don't have a job, but you'll need good credit and another source of income. Other sources of income include a spouse’s income, investments, rental property income, retirement benefits, alimony, child support, and unemployment benefits. Lenders may also want to see that you can make regular payments on time.