Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

When you first start saving money, you probably deposit or transfer cash to your savings account yourself based on either a budgeting plan or money you have left over at the end of the month. Yet this manual approach to savings has some drawbacks.

Unfortunately, all manual savings strategies carry some amount of risk. You may justify allocating your funds toward other expenses instead of adding money to your savings account like you planned. And if you don’t transfer cash from your budget to savings at the beginning of the month, you might overspend and dip into the funds you’ve set aside (on paper) to save.

Featured Accounts from Our Partners

| Account | APY | Minimum deposit required | Open Account |

|---|---|---|---|

|

|

4.01%

UFB Direct breaks balances into five tiers, but, currently, there is only one interest rate. |

N/A | Open Account |

|

|

4.10%

Earn 4.10% APY on balances over $5,000. Balances of less than $5,000 earn 0.25% APY. Annual Percentage Yield is accurate as of March 19, 2025. Interest rates for the Platinum Savings account are variable and subject to change at any time without notice. |

$100 | Open Account |

Over time, what could seem like small, occasional deviations from your budget may lead to meaningful setbacks where your financial plans are concerned.

An automatic savings strategy, however, could help you avoid these potential pitfalls. And some banks step up and create tools to make it easy to put your savings goals on autopilot. Below are four online banks that make it easy to automate your savings:

Ally Bank Online Savings Account

Ally Bank

As with many other banks, you have the option to schedule recurring transfers from your checking accounts (with Ally Bank or others) to your savings accounts. But Ally also gives you the option to round up certain transactions (such as debit card purchases and checks) to the nearest dollar to automate your savings even

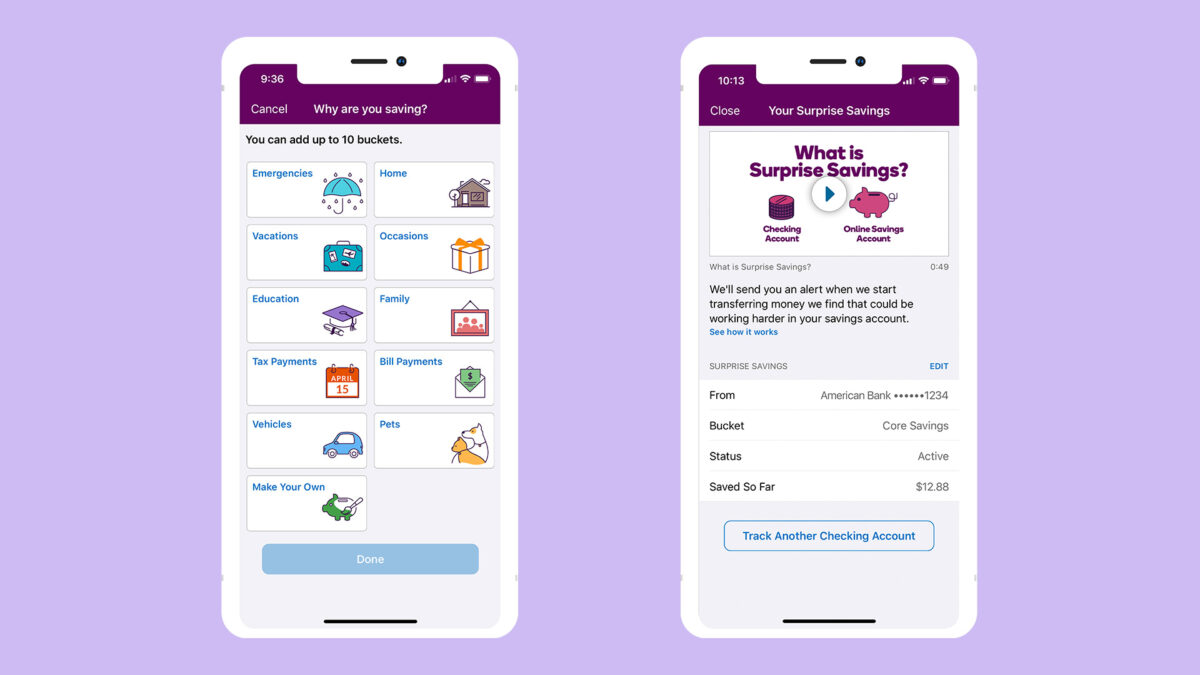

With the bank’s Surprise Savings feature, you also have the option to have Ally analyze your linked checking accounts and automatically transfer cash to your savings that isn’t set aside for bills. Finally, the bank also makes it possible to split your savings into separate categories and work toward multiple financial goals at

If you’re considering opening an Ally Bank Online Savings Account, it’s helpful to know that the high-yield savings account features above-average APYs. Still, the best high-yield savings rates tend to be higher than what Ally has to offer if you take the time to shop

Nonetheless, the following perks could still make a savings account from the online bank worth considering.

- Above-average APY (but not the highest available)

- No monthly maintenance fee

- Convenient savings bucket feature

- No minimum balance or opening deposit requirements

- Multiple automated savings options (Round Ups Booster, Surprise Savings, and recurring

transfers)

UFB Direct Portfolio Savings Account

- Our Rating 5/5 How our ratings work

- APY4.01%

UFB Direct breaks balances into five tiers, but, currently, there is only one interest rate.

- Minimum

Deposit RequiredN/A - Intro Bonus N/A

The UFB Direct Portfolio Savings Account has a solid interest rate of 4.01% APY. Plus, there are no monthly fees and no minimum balance to open.

Overview

With one of the strongest high-yield savings interest rates on the market, as well as no monthly fees or minimum opening deposit, UFB Direct’s Portfolio Savings Account is an extremely attractive package.

Pros

- Strong interest rate

- No maintenance fees or minimum monthly balances

- Free complimentary ATM card

- Mobile app and SMS banking

Cons

- No signup bonus

Another bank that makes it simple to automate your savings is the UFB Direct Portfolio Savings Account. You use the UFB Direct mobile app to schedule recurring transfers from your checking account to your savings account with just a

On top of the user-friendly automatic savings process, UFB Direct offers one of the top high-yield savings accounts available at the

The UFB Direct Portfolio Savings Account features several standout perks, including the following.

- Strong interest rates

- No monthly maintenance fees

- No minimum deposit requirement

- ATM card

access

CIT Bank Platinum Savings Account

- Our Rating 4.5/5 How our ratings work

- APY4.10%

Earn 4.10% APY on balances over $5,000. Balances of less than $5,000 earn 0.25% APY. Annual Percentage Yield is accurate as of March 19, 2025. Interest rates for the Platinum Savings account are variable and subject to change at any time without notice.

- Minimum

Deposit Required$100 -

Intro Bonus

Up to $300

Open a new Platinum Savings account with promo code PS2025 to earn a bonus worth up to $300. Within 30 days from the account open date, transfer a one-time deposit of $25,000 -$49,999.99 for a bonus of $225, or transfer a one-time deposit of $50,000+ for a bonus of $300. The bonus will be fulfilled within 60-days from the funding date.

The CIT Bank Platinum Savings account offers one of the top APYs on the market right now, and CIT's flexible transfer options make it easy to access your money. So long as you're able to consistently maintain an account balance of $5,000 (the minimum amount required to earn this account's top APY) you'll likely find a lot of value in this account.

Overview

With the CIT Bank Platinum Savings Account, customers earn 4.10% APY on balances over $5,000. However, for accounts with less than $5,000, the APY falls to 0.25%. This account features a minimum opening deposit requirement of $100 and does not charge monthly maintenance fees. Accountholders also get free transfers to and from connected bank accounts, which even extends to non-CIT accounts.

Pros

- Strong APY for balances over $5,000

- No monthly service fee

- Unlimited withdrawals (uncommon perk of savings accounts)

- Free electronic bank transfers to checking accounts (even if it isn't a CIT checking account)

Cons

- APY on lower balances is unimpressive

- No fee-free ATM network

- Minimum opening deposit required

- No physical branches

CIT Bank is another financial institution that stands out where automatic savings features are concerned. The online bank makes it simple to schedule recurring transfers from your checking accounts to your savings accounts through the mobile app or online bankin

In addition to the automated savings features, the CIT Bank Platinum Savings Account is an impressive option to consider if you want to earn more interest on your savings. You’ll need to deposit at least $5,000 to qualify for the elevated APY on this high-yield savings account. But if doing so is an option for you, you can enjoy several noteworthy benefits.

- Highly competitive APYs for balances over $5,000

- Zero monthly maintenance fees

- Free electronic bank transfers to checking accounts (CIT Bank or otherwise)

- Unlimited

withdrawals

Capital One 360 Performance Savings

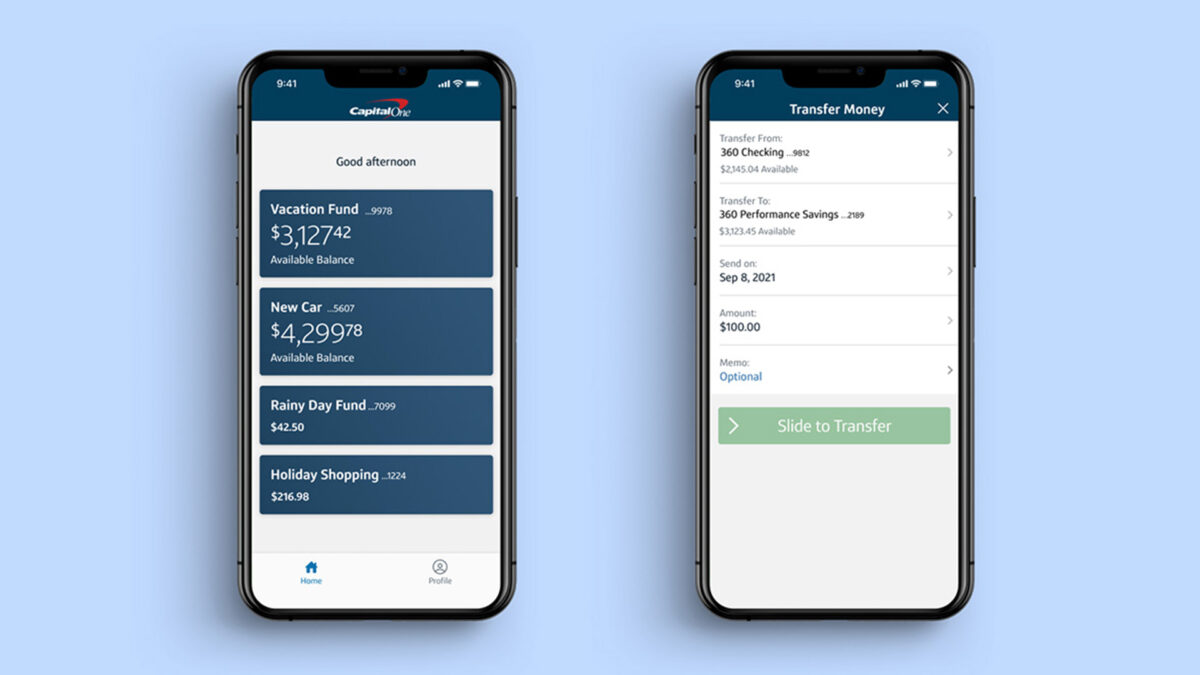

Saving money could be an easier goal to achieve thanks to the automatic savings plan options that are available with the

The Capital One 360 Performance

- Above-average interest rates (but not the highest available)

- No monthly maintenance fees

- Use up to 25 Performance Savings accounts to reach savings goals

- No minimum deposit

required

Bottom Line

No matter where you are in your financial journey, saving money is an important part of the process. Perhaps you’re building an emergency fund for the first time. Or maybe you’re saving money for retirement and other financial goals.

When you make the task of saving money automatic, it can help reduce the likelihood that you’ll spend your cash in ways you hadn’t intended. And if you can find a bank that makes the job of saving money easier and more rewarding, even better.