Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

Bilt Mastercard®

- Our Rating 4.5/5 How our ratings work

- APRSee site for details.

- Annual Fee$0

The Bilt Mastercard is absolutely worth it if you’re a renter interested in maximizing your rewards potential. Being able to earn points on rent without paying transaction fees is huge. But what makes “points” valuable is how you use them. Bilt’s loyalty program is comparable to Chase Ultimate Rewards because it has 10 travel partners in common with Chase.

A No-Annual-Fee Powerhouse for Renters and Future Homeowners

The Bilt Mastercard® is a game-changing credit card that offers strong rewards on rent payments, generous category bonuses and premium travel perks – all with no annual fee. If you’re currently a renter (and future homeowner) and spend frequently on travel and dining, you’ll get a lot of value out of this card’s straightforward cash-back rewards structure. Plus, the opportunity to earn double the points on purchases made on the 1st of every month means you’ll rack up rewards even faster.

Pros

- Earn points on rent without the transaction fee

- Generous earnings on dining and travel

- Strong rental car and purchase protections

Cons

- Doesn't earn points on mortgages

Card Highlights

The Bilt Mastercard® appeals both to frequent travelers and consumers who want a simple rewards card.

Some of the card's highlights include:

- Earn 1x on rent payments without paying transaction fees

- Earn 3x points on dining, 2x points on travel

- Earn 1x points on other purchases

- Double points on Rent Day

- Use the card 5 times each statement period to earn points

- Transfer points to around a dozen airlines and hotels, including World of Hyatt and Virgin Atlantic Flying Club

- Points can be used toward down payment on a home

- No annual fee

- No foreign currency conversion fees

What Our Credit Card Experts Are Saying

“The Bilt Rewards Mastercard is hands down one of the most rewarding cards in my wallet. I can earn 1 point per dollar on rent payments, which is one of my biggest spending categories, without having to pay transaction fees. While I use this card primarily for rent, I also like it for its 2X rewards on travel and 3X on dining, which is doubled on the first day of every month (dubbed “Rent Day”). On the first day of every month, the Bilt Mastercard is my go-to credit card for dining and travel purchases.”

Sign-Up Bonus

The Bilt Mastercard® does not offer a welcome bonus for new card sign-ups.

While this is a definite disadvantage compared to other credit cards with bonus offers, the Bilt Mastercard® can still be worthwhile for many consumers. If you earn substantial rewards from the card every year, the lack of a sign-up bonus might not matter to you.

For those who do care about sign-up bonuses, Bilt occasionally offers a promotion where new cardholders earn 5 points per dollar on qualifying purchases over their first five days. However, this temporary earning period isn’t offered consistently, and does not apply to rent payments.

How Rent Payments Work

Rent payments through Bilt are made directly to your landlord using your Bilt Mastercard®.

If your property only accepts checks, you can still pay with your card through the Bilt Rewards app and Bilt will send a check on your behalf. If you pay your rent through a property management portal, Bilt will provide a Bilt Rent Account that you can pay your rent with no transaction fee. In both instances, your rent will be put on your credit card statement

Earning Rewards

The Bilt Mastercard® earns up to 3 points per dollar in popular spending categories such as dining and travel. Its most notable rewards feature is the ability to charge rent to your credit card, and earn up to 100,000 points every calendar year without paying transaction fees.

Here are the earning rates for the Bilt Mastercard®:

- 3X points on dining

- 2X points on travel

- 1X points on other purchases (including rent payments without the transaction fee up to 100,000 points per calendar year)

- Learn More

The only catch? You must make at least five transactions each statement period to earn points.

Earn Double Points on Rent Day

Besides the regular earning rate, Bilt runs a double points promotion on the first day of every month. You can earn up to 10,000 points on the first of each month on non-rent spending categories:

- 6X points on dining

- 4X points on travel

- 2X points on other purchases (minus rent)

In order to qualify for these rewards, you need to use the card five times each statement period.

Redeeming Rewards for Travel

Bilt Rewards are one of the most flexible point currencies. But what makes “points” valuable is how you use them. Bilt has 14 airline and hotel partners that allow you to transfer points at a 1:1 ratio.

Bilt's airline partners include:

- Aer Lingus AerClub Avios

- Air Canada Aeroplan

- Air France/KLM Flying Blue

- British Airways Executive Club

- Cathay Pacific Asia Miles

- Emirates Skywards

- Hawaiian Airlines HawaiianMiles

- Iberia Plus

- Turkish Airlines Miles & Smiles

- United MileagePlus

- Virgin Atlantic Flying Club

Bilt's hotel partners are:

- IHG One Rewards

- World of Hyatt

With Bilt, you must transfer a minimum of 2,000 points at a time, unlike the 1,000-point transfer threshold from programs like Amex Membership Rewards, Capital One miles, Citi ThankYou Points from our partner Citi, and Chase Ultimate Rewards. Bilt has several transfer partners in common with these competitor programs.

Bilt transfers can take place instantaneously in some cases, while other partners can take several business days to receive your transferred points.

An Advantage for Frequent Hyatt Travelers

Hyatt is particularly valuable because the only other program you can transfer Hyatt points from is Chase Ultimate Rewards. Having another source for Hyatt points is incredibly valuable, considering World of Hyatt is one of the best hotel loyalty programs.

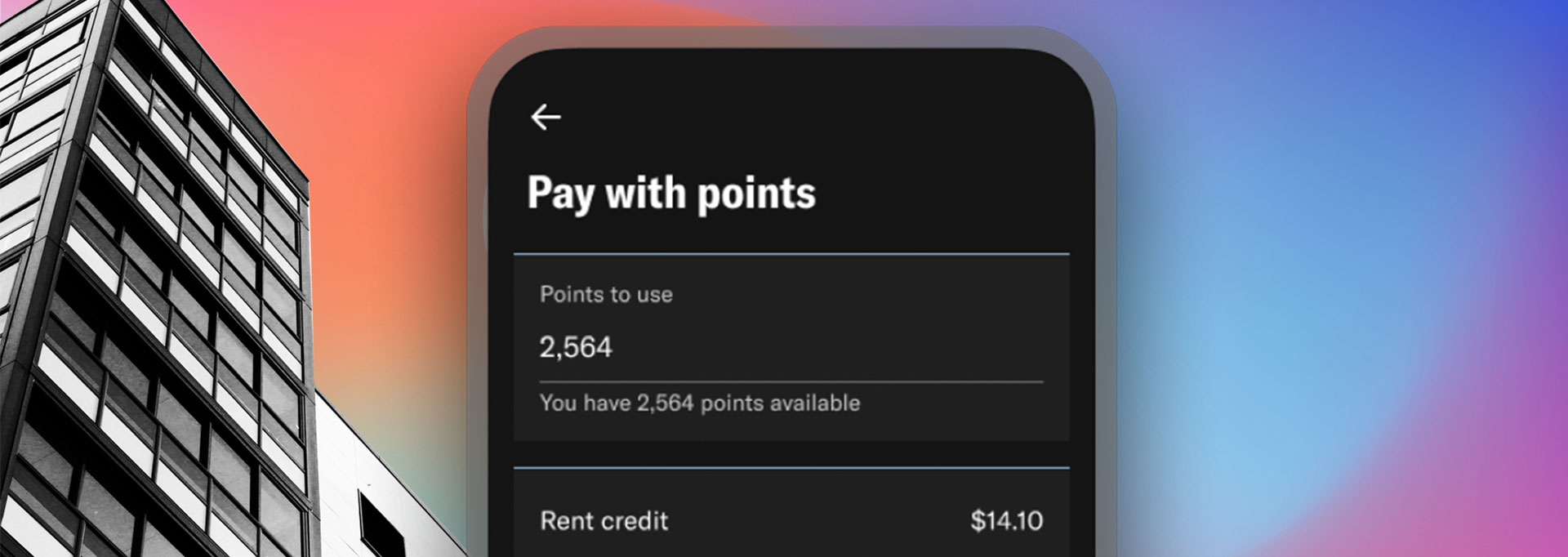

Non-Travel Redemptions

If you don’t want to use your Bilt points for travel, you have plenty of other options.

- Credit on your next rent statement: Slickdeals values Bilt points at 0.55 cents per point when you redeem them for rent.

- Toward a home's down payment: You can leverage your points toward homeownership by redeeming them at a rate of 1.5 cents per point.

- Fitness and shopping: You can also redeem Bilt points for fitness classes and merchandise through the Bilt Collection. Points are worth around 1 cent toward these items.

Card Benefits and Perks

For a zero-annual-fee card, the Bilt Mastercard® offers plenty of perks, several of which are more commonly offered on premium cards with high annual fees.

Here’s what you can expect as a cardholder:

- No foreign currency conversion fees

- Double points, trivia, and freebies on Rent Day

- Build credit history through rent payment reports

- BiltProtect, which limits credit utilization

- Lyft credits

- Travel benefits, including Trip Delay Reimbursement, Trip Cancellation and Interruption Protection and Auto Rental Collision Damage Waiver

- Flexible point redemption options

- Cellular Telephone Protection

Overall, Bilt’s benefits lineup is substantial and practical. Learn more by reading Bilt's Guide to Benefits.

Rent Day Bonuses

On the first of every month, Bilt’s Rent Day activities give you a number of bonus ways to earn points for free. On Rent Day, you earn double points on purchases (except rent) and can access various freebies.

For example, the May 2023 Rent Day promotion offered Bilt members a 100% bonus when transferring Bilt points to Flying Blue (Air France and KLM's loyalty program).

Report Rent Payments to Credit Bureaus

If your landlord is part of the Bilt Rewards Alliance, you can have your rent payments reported to credit agencies each month. This can help you build credit or improve your credit score in the long run with each on-time rent payment.

BiltProtect

One potential issue around paying your rent with your credit card is that you risk maxing it out and increasing your utilization rate. Your utilization rate is the percentage of your credit limit you use every month. You want to keep your utilization rate under 30%, or else it negatively impacts your credit score.

Bilt has a solution for it in the form of BiltProtect. When you submit your rent payments with BiltProtect turned on, a debit will be initiated from your linked bank account to pay your rent. That way, you can use your credit line for other purchases while maintaining a low utilization rate.

Lyft Credits

Through Mastercard, Bilt cardholders get a $5 Lyft credit for every three rides taken in the calendar month. These savings can stack up if you use the service frequently. Plus, in many markets, Lyft is cheaper than Uber.

Travel Benefits

If there's one thing we've learned from the pandemic, it's to never travel without benefits. Whether it’s your flight or rental car, you want to be protected in case of a cancellation or loss. The Bilt Mastercard® offers several types of travel benefits that normally come with higher-end cards.

- Trip Cancellation and Interruption Protection: If your trip is canceled due to a covered reason, you’ll get reimbursed up to $5,000 per covered traveler for the cost of non-refundable common carrier tickets. Covered reasons include illness or death. If you travel, it's well worth the peace of mind.

- Trip Delay Reimbursement: What’s more stressful than a trip cancellation? Trip delays. Suddenly you have to pay for extra meals and maybe even a hotel stay you didn’t plan for. With trip delay coverage, you’ll get reimbursed up to $200 per covered traveler for eligible expenses incurred due to a delay of six hours or longer. Covered reasons include weather, mechanical issues, and air traffic control delays.

- Auto Rental Collision Damage Waiver: If your trip includes a rental car, you want a primary rental collision damage waiver from your credit card. Yes, you can pay around $15 a day or get it at no cost for using your eligible credit card. If you’re involved in an accident, you won’t have to file a claim with your own insurance. The Bilt Mastercard® offers primary coverage (except to New York residents) of up to $50,000 against collision or theft. You must charge the rental to your Bilt Rewards card to qualify and decline the rental company’s collision loss/damage insurance.

- Cellular Telephone Protection: Bilt’s cellphone protection covers up to $800 against damage and theft. You are subject to a $25 deductible and must pay your monthly cellphone bill with the with the Bilt Mastercard.

See the Bilt's Guide to Benefits for more details.

No Foreign Currency Conversion Fees

The Bilt Mastercard® has no foreign currency conversion fees. You can use your credit card abroad without incurring the 3% fee that may be typical with no-annual-fee cards.

Card Drawbacks

The Bilt Mastercard® comes with a few caveats that keep it from being the perfect card for everyone.

- No welcome bonus: The card does not come with a welcome bonus. But some users have reported that Bilt may offer an unofficial promotion of 5X points on eligible spending for five days. Your mileage may vary, and not all new users will have access to this promotion.

- Capped earnings: Earnings on rent payments are capped at 100,000 points per calendar year.

- Minimum transactions required: You must make at least five credit card transactions per billing period to earn points. If you pay rent with the card each month through a linked checking account but don’t meet the five-transaction spend requirement, you will earn a flat 250 Bilt points on your rent transaction.

Annual Fee

The Bilt Mastercard® has no annual fee, which makes it easy to justify keeping the card in the long term. You don’t have to compare the benefits you’re getting against an annual fee every year to figure out if it’s worth it.

APR

Bilt charges a variable APR (see site for details) on purchases depending on your creditworthiness, and the rate may vary based on the U.S. prime market.

This card does not offer a 0% intro APR interest period like some other credit cards.

Other Fees

Bilt does not charge foreign currency conversion fees, making this a good card to keep in your wallet for international travel.

However, there are fees for cash advances, balance transfers and late payments.

Recommended Credit Score

You need good-to-excellent credit to qualify for a Bilt Mastercard, which is generally defined as a credit score of at least 670 or higher. If you’re not there yet, you might want to follow our tips for improving your credit score before applying.

Having a banking relationship with Wells Fargo may also help. Banks value loyal customers who have one or more account types. A checking account can go a long way in displaying your value as a customer.

How the Bilt Mastercard® Compares

The Bilt Mastercard® is best compared to Chase credit cards that earn Ultimate Rewards points. That’s primarily because Chase and Bilt have 10 out of 14 transfer partners in common.

Chase offers two credit cards that have similar benefits and earning rates to the Bilt Mastercard®. Here’s how the Chase Freedom Unlimited® and Chase Sapphire Preferred® stack up against Bilt.

| Bilt Mastercard® | Chase Freedom Unlimited® | Chase Sapphire Preferred® |

|---|---|---|

|

No welcome bonus |

Unlimited 1.5% during your 1st year |

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening |

|

No annual fee |

No annual fee |

$95 annual fee |

|

3x points on dining 2x points on travel 1x point on rent payments (up to 100,000 points per calendar year), without a transaction fee 1x points on other purchases |

5% on travel purchased through Chase Ultimate Rewards 3% on dining including takeout and eligible delivery services 3% on drugstore purchases 1.5% on all other purchases |

$50 statement credit on hotel stays booked through Chase 5x points on Chase travel 2x points on other travel purchases 3x points on dining, including eligible delivery and takeout 3x points on online grocery purchases except for Target, Walmart and wholesale clubs 1 point per dollar on all other purchases |

|

0% Intro APR for 15 months followed by 20.49% - 29.24% (Variable) APR |

21.49% - 28.49% (Variable) |

Do keep in mind that those applying for Chase credit cards should wait until they are past the 5/24 time period to improve their chances of approval.

Bilt Mastercard® vs. Chase Freedom Unlimited®

The Bilt Mastercard® and the Chase Freedom Unlimited® have a lot in common, from their similar earning rates and no annual fees to redemption opportunities through many of the same travel partners. You can’t go wrong with either - or both - in your wallet, since it won’t cost you anything to keep these cards open.

If you rent, the Bilt Mastercard® may give you a slight edge since you can earn rewards on your biggest monthly expense without paying the transaction fee. You’ll also have access to cellular telephone protection through the Bilt Mastercard® if you pay your monthly phone bill with it.

Conversely, if you only want to work with one rewards system and already hold a credit card that earns Chase Ultimate Rewards, you may want to choose the Chase Freedom Unlimited to consolidate your earnings.

Bilt Mastercard® vs. Chase Sapphire Preferred®

The Bilt Mastercard® and the Chase Sapphire Preferred® are a bit harder to compare side by side. While the Chase Sapphire Preferred comes with a $95 annual fee, that cost offsets the superior travel protection benefits included with the Preferred.

For many people, you can’t go wrong with having both the Bilt Mastercard® and the Sapphire Preferred since these two cards complement each other well by allowing you to earn in two generous rewards programs at once.

But if you absolutely have to pick, think about it this way: The Chase Sapphire Preferred may offer a slight edge in its travel protection and perks for frequent travelers, especially if those individuals do not pay rent and don't mind an annual fee. Consumers who don’t want the hassle of an annual fee and have rent as an expense may find more value with the Bilt Mastercard®.

Chase Freedom Unlimited®

- $0 Annual Fee

-

Sign Up Bonus

1.5%Extra Cash Back

Earn an extra 1.5% on everything you buy (on up to $20,000 spent in the first year) — worth up to $300 cash back. That’s 6.5% on travel purchased through Chase TravelSM, 4.5% on dining and drugstores, and 3% on all other purchases.

- 20.49% - 29.24% (Variable) APR

Secure application on issuer’s website

Chase Sapphire Preferred®

- $95 Annual Fee

-

$1,380

Editor's

Bonus EstimateLearn more about how we evaluate points and miles in our monthly evaluation guide.

-

Sign Up Bonus

60,000Chase Ultimate Rewards Points

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠. Dollar Equivalent: $1,380 (60,000 Chase Ultimate Rewards Points * 0.023 base)

- 21.49% - 28.49% (Variable) APR

Secure application on issuer’s website

Who Should Get the Bilt Mastercard®?

Earning valuable rewards at a $0 annual fee makes the Bilt Mastercard® a no-brainer for consumers who dine out frequently and rent a home or apartment. Rent is one of the biggest expense categories for most people, and the ability to earn points without paying transaction fees is huge.

The lack of a welcome bonus isn’t ideal, but the ability to earn points on your biggest spending category makes up for it. If you max out the 100,000 annual earnings on rent payment, it’s akin to a welcome bonus.

Even if you’re a homeowner, the Bilt Mastercard® can still make sense if you want a zero-annual-fee card. The card’s category bonuses, travel protections, and lack of a foreign currency conversion fee make it a competitive offering. Best of all? The points you earn can be redeemed in several ways, such as toward rent, shopping or converted to airline miles or hotel points.

Overall, this is a solid card that can fit into anyone’s wallet – renter or homeowner alike.

Ready to apply? Start here.

Frequently Asked Questions

-

Bilt Rewards point values vary based on how you redeem them. When used toward rent, Slickdeals values Bilt points at 0.55 cents apiece.

-

Bilt will not charge you a transaction fee if you pay rent through the Bilt app using your Bilt Mastercard®.

-

Bilt points can be transferred to about a dozen airlines and hotels including Hyatt, United Airlines and more.