Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

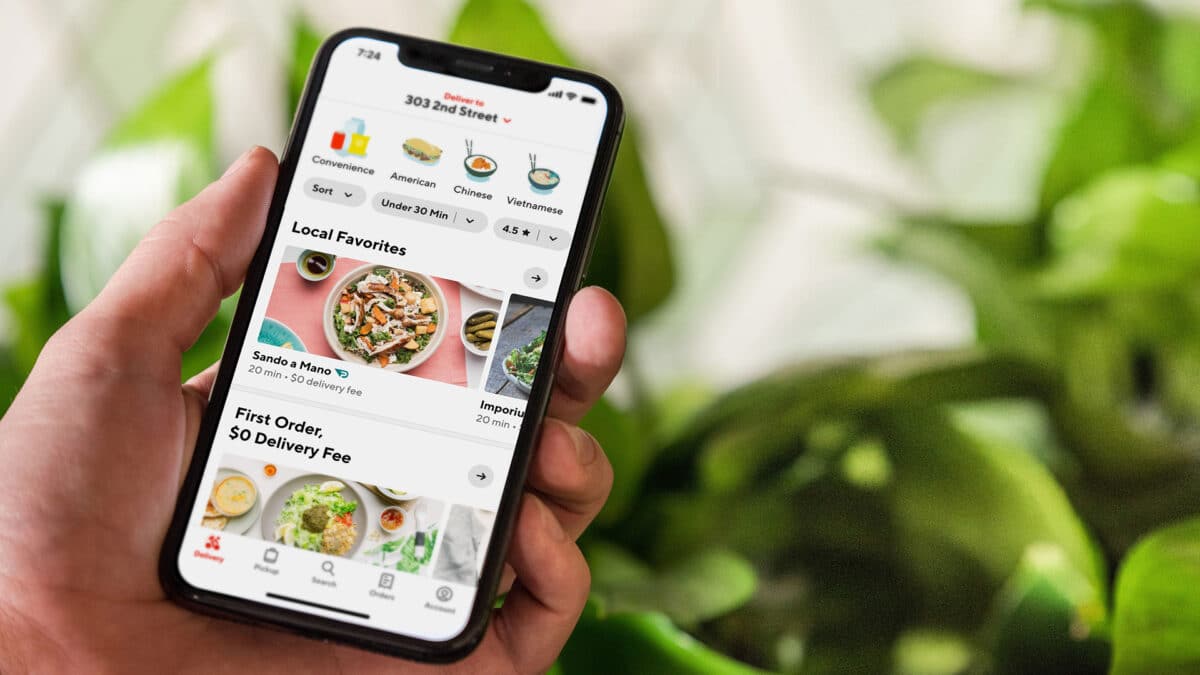

Chase and DoorDash have launched a new co-branded credit card, the DoorDash Rewards Mastercard®, that offers up to 4% cashback on DoorDash orders and discounts for new cardholders. Here are the new credit card details to help you determine if it's a good fit for your needs.

What is the DoorDash Rewards Mastercard®?

The DoorDash Rewards Mastercard® is a no-annual-fee credit card specifically tailored to frequent DoorDash customers. The card offers a welcome bonus of $100 bonus cash after spending $500 in the first three months and a free year of DashPass. It also provides decent travel and purchase protections, including car rental insurance, trip interruption/cancellation insurance, and extended warranty.

Quick Tip

Chase and DoorDash have been partnered up for a while now and if you’re a current Chase credit card user you likely have access to their DashPass perk through DoorDash. Check if your Chase card applies.

What are the benefits of the DoorDash Rewards Mastercard®?

- Earn 4% cash back on DoorDash and Caviar orders

- 3% cash back on dining when purchased directly from a restaurant, online, or in-store

- 2% cash back at grocery stores, online or in-store

- 1% cash back on all other purchases

- $25 off the first two shipping orders of $100 or more through December 31, 2023

- 10% off one convenience, grocery, alcohol, or DashMart order every month through August 31, 2023

- Monthly $5 credit toward your first DoorDash order each month as an eligible DashPass member through September 30, 2023

- Complimentary DashPass membership for the first year (worth $96)

- Secondary car rental insurance, trip cancellation/interruption insurance, purchase protection, and extended warranty

- No foreign transaction fees

Is the DoorDash Rewards Mastercard® for you?

The DoorDash Rewards Mastercard® is designed for heavy DoorDash users who want to earn generous rewards and discounts on their DoorDash orders. However, the earning rates outside of DoorDash purchases are not that unique. If you don't use DoorDash often, there are other cash-back credit cards that will serve you just as well, if not better.

Final Thoughts

The DoorDash Rewards Mastercard® offers significant rewards and benefits for frequent DoorDash customers. However, it may not be the best option for everyone, especially if you don't use DoorDash frequently. Before applying for any credit card, compare your options based on your average spending.

As always here’s a friendly reminder for the best credit card practices to follow:

- Pay your bill each month to avoid interest charges or late fees

- Make payments on time

- Only spend what you can afford to pay