Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

Non-Monetized. The information related to Chase credit cards was collected by Slickdeals and has not been reviewed or provided by the issuer of these products. Product details may vary. Please see issuer website for current information. Slickdeals does not receive commission for these products/cards.

Not all available financial products and offers from all financial institutions have been reviewed by this website.

Costco members can enjoy big savings on bulk products, but if you're planning to pay with a credit card, the wholesale club only accepts Visa at physical locations. What's more, the retailer doesn't fall under the standard grocery or supermarket spending categories, so rewards cards that are generally good for grocery shopping may not be a good fit for Costco purchases.

Fortunately, several Visa credit cards can offer bonus rewards on Costco purchases or a high rewards rate on all your purchases. Here are our top picks for the best credit cards to use at Costco.

Best Credit Cards for Costco Shopping

Whether you're buying groceries to feed a lot of mouths or you're just a sucker for the retailer's rotisserie chicken or hot dog combo, these credit cards can be a great way to maximize your Costco purchases.

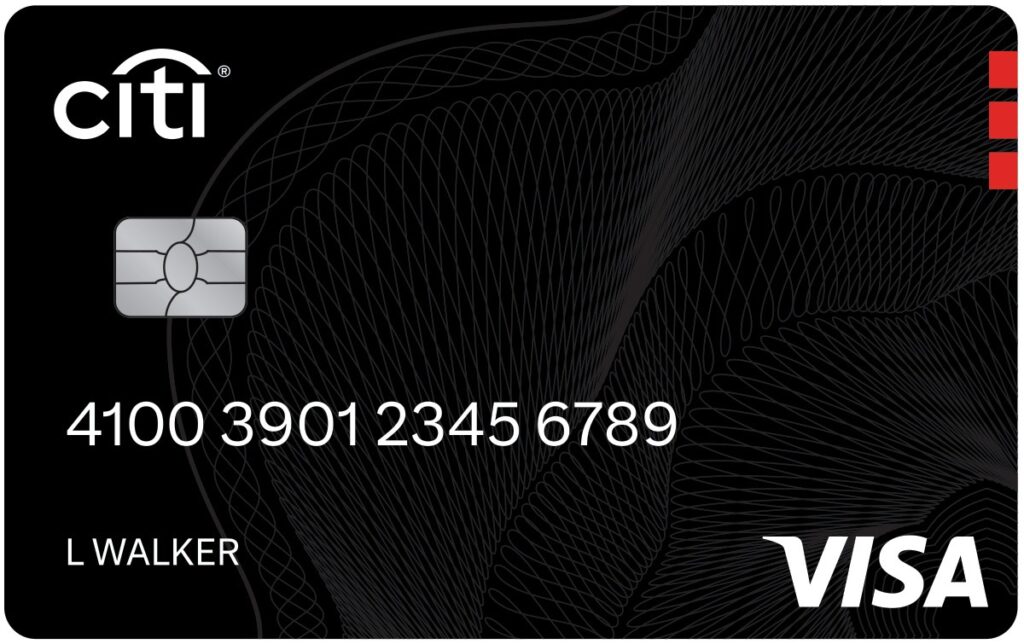

Costco Anywhere Visa® Card by Citi

- Our Rating 4.5/5 How our ratings work

- APR18.74% - 26.74% (Variable)

- Annual Fee$0

Active Costco membership required

- Sign Up Bonus $0Cash Bonus

The Costco Anywhere Visa® Card is a credit card from our partner Citi made exclusively for Costco members. It comes with cash back potential on annual gas and EV charging purchases, on restaurant and travel purchases, and at Costco and Costco.com. With a generous rewards rate for dining, groceries, gas and Costco purchases, this card can add up to big savings.

Overview

The Costco Anywhere Visa® Card is a credit card from our partner Citi made exclusively for Costco members. It comes with 5% cash back on gas at Costco and 4% cash back on other eligible gas and EV charging purchases (up to $7,000 combined spend per year, and then 1% after). Additionally, earn 3% back on restaurant and eligible travel purchases, 2% back at Costco and Costco.com and 1% everywhere else. Aside from the $7,000 caveat, there are no other limits on what you can earn with this card.

Pros

- Generous cash back on gas, restaurants, travel and of course, Costco purchases

- No foreign transaction fees

- No annual fee

Cons

- No sign-up bonus

- You'll need a Costco membership to apply for the card

Best For: Gas Rewards

The Costco Anywhere Visa® Card by Citi, one of our partners, is a credit card made exclusively for Costco members. It comes with 5% cash back on gas at Costco and 4% cash back on other eligible gas and electric vehicle (EV) charging purchases (up to $7,000 in combined spend each year, then 1% after), 3% back on restaurant and travel purchases, 2% back on other purchases at Costco and Costco.com and 1% on other purchases.

One unique feature of the Costco Anywhere Visa Card is how you get your cash back. While most credit cards give you a monthly credit or a credit when you hit a certain rewards level, the Costco Anywhere Visa Card offers an annual rewards credit for all of your cash back earned. Also, this co-branded Citi credit card doesn't have an annual fee, but you will need to be an active Costco member to enjoy its benefits.

Wells Fargo Active Cash® Card

- Our Rating 4.0/5 How our ratings work

- APR18.49%, 24.49%, or 28.49% (Variable)

- Annual Fee$0

-

Welcome Bonus

$200Cash Bonus

Earn a $200 cash rewards bonus after spending $500 in purchases in the first 3 months.

If you’re a fan of earning cash rewards for your day-to-day spending, you need a credit card that rewards you for purchases outside of popular bonus categories like travel, grocery stores and gas stations. With the Wells Fargo Active Cash® Card, you earn 2% cash rewards on purchases without the fuss of tracking specific bonus categories.

Overview

With the Wells Fargo Active Cash® Card, you receive 2% cash rewards on purchases. There’s no need to register for anything, and there are no limits on the amount of cash rewards you can earn.

This stands in stark contrast to many rewards credit cards that tempt you with bonus rewards for specific purchases. These cards typically offer a mere 1% rewards rate on the vast majority of charges that don’t qualify for a bonus. And with many of these cards, the amount of purchases that are eligible for your bonus is capped, restricting the overall potential value.

Pros

- Earn unlimited 2% cash rewards on purchases

- No annual fee

- Automatic cellphone protection when you pay your monthly bill with the card

Cons

- Points don't transfer to travel partners unlike other card currencies

- No bonus earning categories

Best For: High Rewards Rate on Everything

Many rewards credit cards tempt you with bonus rewards for specific purchases, but with the Wells Fargo Active Cash® Card (Rates and Fees), you simply receive 2% cash rewards on purchases. There’s no need to register for anything, and there is no annual fee to carry this credit card in your wallet.

Plus, get up to $600 of cellphone protection against damage or theft when you pay your monthly cell phone bill with your eligible Wells Fargo card. (subject to a $25 deductible).

Wells Fargo Active Cash® Card applicants can earn a $200 cash rewards bonus after spending $500 on the card within the first three months of account opening. Additionally, new accounts receive a 0% intro APR for 12 months from account opening on purchases and qualifying balance transfers (18.49%, 24.49%, or 28.49% variable APR after low intro APR period). Qualifying balance transfers must be made within 120 days from account opening. Balance transfers made within 120 days from account opening incur a 3% or $5 fee (whichever is greater). After that, a balance transfer fee of up to 5% (minimum $5) applies. Read our full review of the Wells Fargo Active Cash® Card.

Bank of America® Customized Cash Rewards Credit Card

- Our Rating 4/5 How our ratings work

- APR17.74% - 27.74% Variable APR on Purchases

- Annual Fee$0

-

Bonus Offer

$200Cash Bonus

$200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

The Bank of America® Customized Cash Rewards credit card is a solid choice for many people who want to maximize their everyday spending. The card is one of the top cash-back credit cards on the market because it provides flexibility with its top rewards bonus category. It’s especially worth considering if you’re a Preferred Rewards member with the card issuer.

Overview

The Bank of America® Customized Cash Rewards card is a good cash back card for people who don’t spend a lot each month. It has flexibility with the 3% cash back on the category of your choice (choose between gas, online shopping, dining, travel, drugstores or home improvement and furnishing), and you can change which one you go with each month. Since it’s a Visa card you can also use it at Costco and get 2% back, which is the rate for wholesale clubs and grocery stores. However, once you’ve spent the quarterly limit of $2,500 in purchases combined between the 3% and 2% categories, you only get 1% back after that.

Pros

- Ample bonus spending categories

- No annual fee

- Sign-up bonus

Cons

- bonus spending categories capped at $2,500 in combined quarterly purchases

Best For: Flexible Rewards

If you want a lot of flexibility with your credit card rewards, look no further than the Bank of America® Customized Cash Rewards Credit Card. That said, check your spending habits to determine how quickly you'll hit the quarterly spending limit on bonus rewards.

Chase Freedom Unlimited®

- Our Rating 4.5/5 How our ratings work

- APR18.49% - 27.99% (Variable)

- Annual Fee$0

-

Sign Up Bonus

$200Cash Bonus

Intro Offer: Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening

We like that the card offers a high flat rewards rate but also provides accelerated rewards on some common everyday spending categories. You’ll also get access to the Chase TravelSM portal, which allows you to use your cash-back earnings for travel rewards, gift cards and more. If you make this your primary card for most purchases you can quickly rack up a lot of rewards.

Overview

The Chase Freedom Unlimited card is unique for a couple of reasons. First, it comes with purchase protection and extended warranty protection you don’t see with some other cash-back cards. Second, you earn cash back in the form of points and when paired with another annual-fee earning Chase product, you can get even more value if you love to travel by transferring to partners.

That’s because while the Freedom cards are marketed as cash-back credit cards, they actually offer points. You can use those points to book travel through Chase at a rate of 1 cent per point.

Pros

- No category bonuses to remember; earn at least 1.5% back on everything

- No annual fee

- Generous travel and purchase protection benefits

Cons

- Can't transfer Chase points unless paired with another annual-fee Chase product

Best For: High Base Rewards Rate

The Chase Freedom Unlimited® is a valuable all-around credit card with no annual fee. This cash-back card earns a rewards rate of 5% cash back on travel booked through Chase TravelSM, 3% back at drugstores, 3% back on dining, including takeout and eligible delivery services and a flat-rate 1.5% back on other purchases. There are no rotating categories to track, caps on how much you can earn or excluded purchase categories.

To top it off, new cardholders can earn a bonus worth $200 after spending $500 on purchases within the first 3 months from account opening. This is competitive with the best sign-up bonuses currently available. Read our full review of the Chase Freedom Unlimited Card.

Which Credit Card Is Right for You?

As you consider the best credit cards to use at Costco, make sure you're also considering rewards rates for other purchases, as well as other card benefits and features and annual fees. Carefully consider these and other top Visa credit cards to determine which card can offer you the most value overall.

Also, keep in mind that the best rewards credit cards are typically reserved for consumers with good credit, which is typically a FICO® Score of 670 or higher. Be sure to review your credit before you apply to evaluate your approval odds.

Frequently Asked Questions

-

Costco ended its exclusive partnership with American Express in 2016. Currently, the wholesale club doesn't accept Amex credit cards in-store, at the pump or online.

-

Costco has an exclusive partnership with Visa for in-store and gas credit card purchases. That said, you can use a Mastercard debit card for those purchases. Costco also accepts Mastercard credit cards online.

Related Article

Related Article