Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain. Non-Monetized. The information related to Chase credit cards was collected by Slickdeals and has not been reviewed or provided by the issuer of these products. Product details may vary. Please see issuer website for current information. Slickdeals does not receive commission for these products/cards.

As a parent, you’re responsible for teaching your child many important life skills — including how to

A savings account can provide hands-on opportunities to

How a Kid's Savings Account Works

A child’s savings account is a special type of deposit account a bank or credit union designed for minor children ( regular savings accounts, but can come with additional kid-centric perks.

Some unique features of a child's savings account can include:

- Parents can limit the child's account access

- Low or no monthly account fees

- Low or no opening balance requirements

- Financial literacy tools and resources online

Federal law does not place restrictions on

Benefits of Opening an Account with Your Child

There can be several benefits to opening a

Keep an eye on your child’s savings and withdrawal activity.Deposit funds into your child’s savings ac count (and allow others to do the same).Limit or avoid bank account fees, depending on the financial institution.

Once your son or daughter turns 18, your financial institution may allow you to convert a joint savings account to a traditional deposit account without limitations. If converting the account isn’t an option, you could always search for a different savings account

Explore the Best Free Checking Accounts

Visit the Marketplace

What to Look for In a Child’s Savings Account

The best savings accounts for kids may have

High Annual Percentage Yield (APY)

The average national deposit rate for savings accounts

No Fees

No one likes to lose a portion of their savings on monthly bank fees. As you’re searching for the right savings account for your child, it’s probably wise to

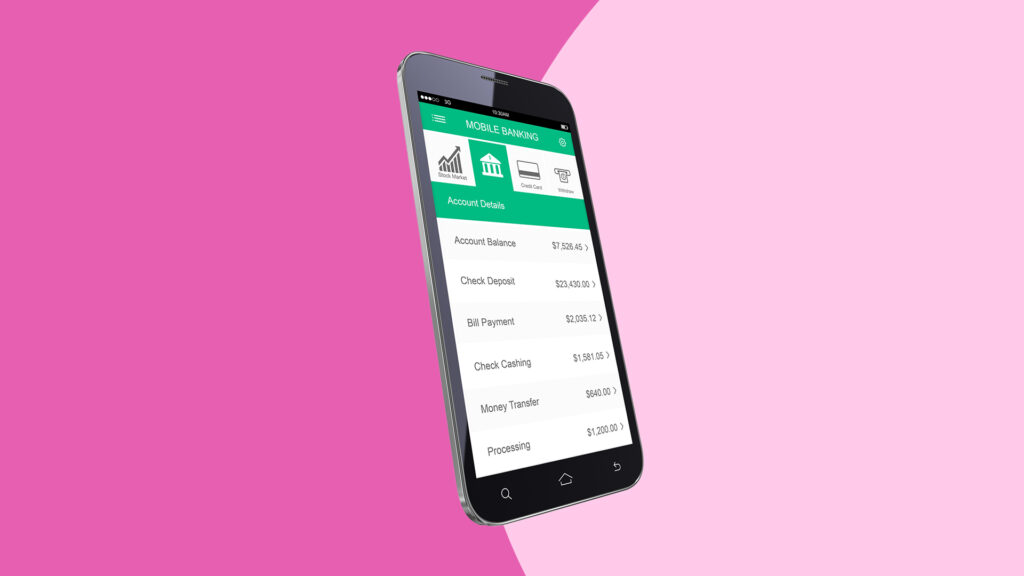

User-Friendly App or Online Resources

One of the primary goals of opening a savings account for your child is to begin (or improve) their financial education. If you can

Savings Goals

Some savings accounts may allow your child to work toward

FDIC Insurance

The best savings accounts (for you or your child) should

Children’s Savings Accounts vs. Custodial Accounts

It’s important to note that there’s a

With custodial accounts, your

Motivating Your Child to Save

Once you choose the right savings account for your child, you can start using it as a

Choose a Goal

Let your

Help Your Child Earn Money

Consider giving your child opportunities

Provide Savings Incentives

One of the primary

Related Article

Related Article

Best High-Yield Savings Accounts (October 2025)

Add Responsibility

A young child might not understand how to

Next Steps

Teaching your child smart financial habits at a young age can go a long way toward setting them up for future success. And a kid-friendly savings account can be an effective tool to help you impart the foundational money lessons your son or daughter needs to learn.