Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain. Non-Monetized. The information related to Chase credit cards was collected by Slickdeals and has not been reviewed or provided by the issuer of these products. Product details may vary. Please see issuer website for current information. Slickdeals does not receive commission for these products/cards.

A recession happens when a country experiences a prolonged period of decline in economic activity. Currently, economic experts disagree about whether the United States is heading for a recession. Some authorities on the subject feel that a recession is inevitable. Others believe the probability of a recession is low. Yet one fact is certain — if a recession does occur, it could have a negative impact on your household finances.

Regardless of the outcome, it's wise to make a plan for your personal finances ahead of time. Below are five tips that can help you prepare your finances for a recession, just in case.

1. Pay Down Debt

From a financial perspective, it's never a good idea to carry large amounts of high-interest debt. When a potential recession is looming, however, paying down high-interest debt matters even more than usual. This is especially true when it comes to accounts with revolving interest rates. As the Federal Reserve raises the federal funds rate, credit card issuers and lenders tend to do the same and those revolving APRs may climb even higher.

Credit card debt has the potential to be expensive. According to the Federal Reserve, the average credit card interest rate was 16.65% in Q2 2022 (interest assessing accounts). To make matters worse, revolving an outstanding balance on your credit cards can drive up your credit utilization ratio and might lower your credit score as an unfortunate byproduct.

If you don't already have a plan to pay down your debt, you should aim to create one as soon as possible. On a positive note, there are many ways to pay down debt. Depending on your situation, you may want to consider some combination of the strategies below when you build your personal debt-elimination plan.

Debt Payoff Strategies

- Choose a debt payoff approach, like the debt snowball or debt avalanche.

- Consider consolidating your debt with a balance transfer credit card or personal loan to reduce interest.

- Pick up a side hustle and generate more income to put toward your debt.

- Avoid impulsive spending to stay away from new debt.

2. Update Your Budget

A budget can be a useful tool when it comes to your finances. Creating a budget puts you in the driver's seat and lets you decide what you want your money to do for you. And thanks to the wide variety of personal finance apps available, making a budget and managing your finances is easier than ever.

If you don't use a budget already, it's important to create one with the possibility of a recession looming near. And if you're already in the habit of budgeting, it may still be worthwhile to take a look at your spending habits and see if you want to make any changes.

To start, consider doing some research to see where your money has been going for the last couple of months. You can find much of this information by checking your bank statements and credit card statements. If you're someone who uses a lot of cash, consider tracking your spending for at least 30 days. Once you have a list of your expenditures, break those purchases down into categories. Then you should have a good idea of how much you've been spending on housing, gas, car maintenance, groceries, dining, entertainment, shopping, and more.

Next, look for ways to be frugal and save money. Here are a few cost-cutting ideas to help inspire you:

- Call your utility and mobile phone providers and try to negotiate lower rates.

- Use coupons or the Slickdeals browser extension to save money when you need to make online purchases.

- Get creative and find ways to cut down on your grocery bill costs.

- Consider eating out less or spending less on other non-essential expenses.

- Take advantage of credit card rewards to save money on travel expenses and more.

Remember that cutting expenses in one area can free up funds to use toward other financial goals that matter to you.

3. Pad Your Savings

Having money in savings can be a lifesaver during uncertain economic conditions. So, it's no wonder that many financial experts recommend saving at least three to six months' worth of expenses in an emergency savings fund. Others may feel more comfortable having an emergency fund that's large enough to cover their expenses for up to a year.

Of course, many people still have a long way to go when it comes to building an adequate emergency fund. If you're worried about not having enough money in savings yet, you are not alone. According to the Federal Reserve, 32% of American adults did not have enough savings to cover a $400 unexpected expense in 2021.

If you need to grow your savings, updating your budget might be a good place to start depending on your situation. Cutting expenses can often free up extra cash that you can use to create a financial cushion for yourself. You might also look for ways to earn additional income (e.g., asking for a raise, working a side gig, selling unwanted items, etc.) and use any extra money you earn to increase your savings as well.

Quick Tip

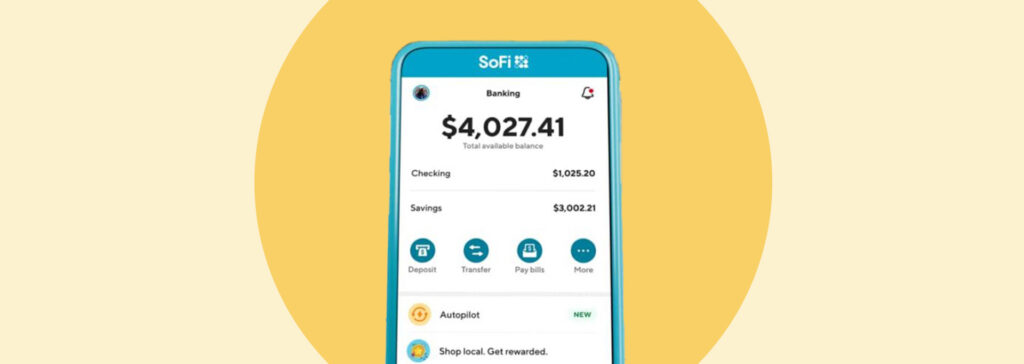

Consider putting your emergency fund in a high-yield savings account that’s separate from your regular bank. With a high-yield account you could earn higher interest, and keeping the money with a different financial institution might help reduce the temptation to spend it on non-emergency expenses.

4. Avoid Panic With Long-Term Investments

The stock market can behave in unsettling ways during a recession. It's normal to worry about your 401(k) losing money, along with your other investments. Yet it's important not to panic and make rash decisions where those investments are concerned. Depending on your situation, it might be best to leave your investments alone and ride out the wave until the market rebounds — especially if you don't plan to retire anytime soon.

If you work with a financial advisor, the best time to talk to them is now — before a recession begins (depending on what the future holds). A trusted financial advisor can make sure you're on track to reach your financial goals and can help you figure out if your portfolio's diversification strategy could use any updates.

5. Check Your Credit

Good credit can be a valuable financial asset. Most people know that a good credit score makes it easier to qualify for competitive financing offers from lenders and credit card companies. Yet not only can good credit save you money in the form of lower interest rates and fees, but it might also help you save money on insurance premiums, utility deposits, and more.

Because your credit matters so much, it's wise to make a habit of checking your three credit reports frequently. The Fair Credit Reporting Act (FCRA) gives you the right to claim a free credit report from Equifax®, TransUnion®, and Experian™ once every 12 months. (Visit AnnualCreditReport.com to claim your free reports.) During the COVID-19 pandemic, you can also check your credit reports for free every week, though this offer is set to expire on December 31, 2022.

Reviewing your credit reports often can help you make sure they stay in the best shape possible. Taking this initiative may also help you discover potential problems like fraud or credit reporting errors right away if they happen to you. Knowing that you have good credit that you can rely on when you need it can be reassuring, especially during uncertain times.