Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

In my first job after graduating from the University of Colorado with a finance degree, I worked in a regional bank headquartered in the Denver area. Part of my responsibilities included overseeing the internal credit card collections department, a team of two extremely nice team members who also ran the safe deposit boxes on the second floor.

If you were late on your credit card bill and missed the first couple of automatic notices by email and snail mail, you would likely get a call from one of these team members asking for a payment or plan to pay. But if you still didn’t pay, we did more than make a phone call.

Keep reading to find out why I think it’s best to keep your bank accounts and credit cards at different banks.

Related Article

Related Article

How to Manage Multiple Bank Accounts and Credit Cards Like an Expert

What Happens When You’re Late on a Credit Card Payment

Every time you pay with your credit card, your credit card company pays the merchant on your behalf. Whether you wait to pay a day later or months later, your bank is putting its money on the line, trusting—based on your credit history—that you’re good for it and plan to pay your balance.

If you’re late on a payment due date, a series of events of increasing cost to you begins.

If You're a Week or Two Late

If you miss a due date by a week or two, you may fall within a grace period where the credit card company won’t do any more than charge interest. This depends on the issuer, however, so you may not get this grace period.

If You're 30 to 90 Days Late

Once you go past 30, 60 or 90 days after your due date, increasingly negative payment information shows up on your credit report, which can instantly damage your credit score for up to seven years.

If You Don't Pay Your Bill for a Longer Period

After a certain period of time, the bank may assume you don’t intend to pay it back. That’s when the collections process starts. Some banks handle collections internally, as we did for many of our credit card accounts. Others outsource debt collection or sell the bad debt to specialized collection companies for a discount, who then take over trying to recoup the account balance.

In most situations, the worst that will happen is damage to your credit report and credit score, along with a deluge of calls from debt collectors. You may ultimately wind up getting sued by your credit card company for the balance. But if your credit card company also has access to your checking and savings accounts, there’s another way it may try to recover the balance.

Beware the Payday Money Snatchers

When someone ignored our letters and calls, we would look at their overall account profile to decide on the next steps. For example, if they had checking or savings accounts with us, it only took a few clicks to see balances and account activity, including direct deposits and other payments.

In extremely rare situations, we would effectively garnish a customer’s wages to settle their outstanding credit card balance. If letters, emails, calls and messages went unanswered while there was no progress on a balance, we would assume the customer never intended to pay us back. The only option we had to get anything but losses would be to transfer funds from a customer’s checking or savings account to their credit card.

Related Article

Related Article

I Haven’t Used My Debit Card In Years. Here’s Why

I remember one time in particular when the transfer was made on the customer’s payday. After months of “not getting our calls,” we heard from them very quickly. They were rightfully upset, but the bank didn’t do anything that wasn’t allowed in the customer’s account agreement. Had they kept their credit cards and checking accounts at different banks, this would never have happened.

With about 15 years of hindsight, I feel pretty bad for the situation the customer was in. But from the bank’s perspective, the customer borrowed money they agreed to pay back and hadn’t. Because they ignored all attempts to make contact and still saw regular payroll deposits in their account, we had to assume the worst and take the only option for recourse.

While you’re likely great with your money and would never be late on your bills, if you’re going to be late on your credit cards, it’s not a bad idea to keep your money somewhere else.

Ways to Avoid Missing Your Credit Card Due Date

Before this customer lost a paycheck to pay off a relatively small portion of their outstanding credit card balance, the entire situation started with a missed payment. If you’re worried about the same thing happening to you and would rather enjoy the convenience of keeping all accounts under one login, consider these tips to always pay on time:

- Use automatic payments for at least your minimum balance: Start by setting up automatic payments for at least your minimum balance. This preserves your credit in case you forget to make a payment, but interest may still apply.

- Add text and email alerts: Most banks give you the option to get email, text or push notification alerts when payments are due. Take advantage!

- Stick to a budget: Some people wind up in trouble spending more than they can afford with credit cards. Never spend more than you can afford to pay off in full by the next monthly due date.

- Use balance transfers judiciously: If you’re running up against trouble paying, consider a zero percent balance transfer card to take the pressure off temporarily so you can regroup and pay down your balance interest-free.

Stay One Step Ahead of Late and Missed Payments

If you keep your bank and credit accounts at the same bank, consider yourself warned. Your bank may be able to use your checking account balance to pay off your card without telling you first, as it’s likely allowed in your account agreement.

Your best option is to stay on top of those credit card payments and due dates. Good credit has many long-term benefits for your finances, and missed payments can wind up costing you a fortune in late fees, interest and higher interest rates later on. However, if you always pay your credit cards on time, you have little to worry about when it comes to keeping your accounts at the same bank.

FAQs

-

No, a checking account and a debit card are two different types of banking products. A checking account is an account you hold with a bank or financial services provider that allows you to make payments directly from that account and receive direct deposits.

A debit card is a card you often get with a checking account that lets you withdraw money from that account through an ATM and use it to make purchases.

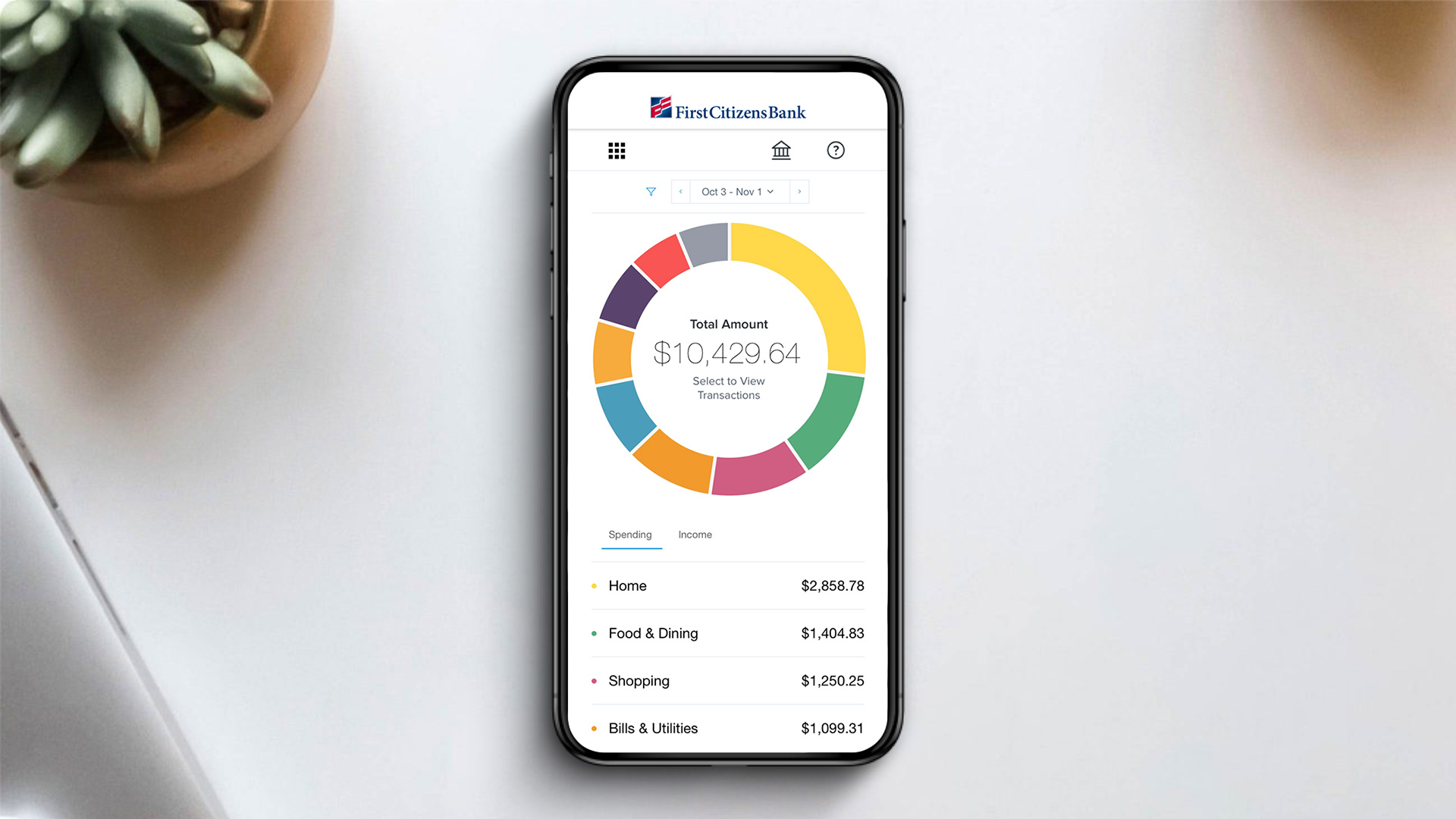

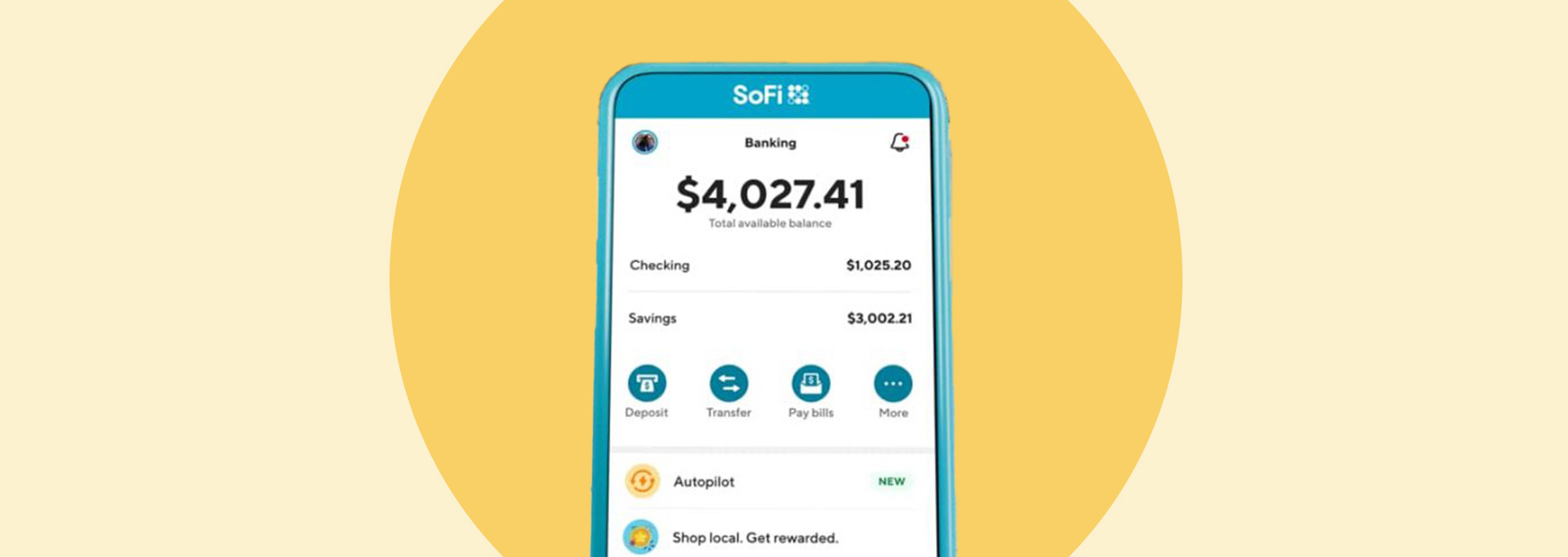

In some ways, your debit card is like a checking account in the palm of your hand, especially when you combine it with a banking app. For example, you can use your debit card to pay businesses and bills, and you can also check your balances, make transfers and withdraw money from ATMs. For many people, a debit card is all they need to do all of their banking, and checks are unnecessary.

-

Whether a credit card is better than a check depends on your needs and money management preferences. In many ways, a credit card is more convenient than checks because you can use it at point of sale machines, both in person and online, to make purchases within moments. Many businesses no longer accept checks due to the rise in check fraud, which makes a credit card, debit card or cash your only payment options at some businesses.

With a credit card, you’re issued a loan from the credit card company that you have to pay back, often with interest if you don’t pay the balance by the end of the month. With a check, you’re taking money directly out of your bank account—money you already have. For people who want to avoid debt, paying with checks—if they’re accepted—may be a preferable option.

-

A checking account typically comes with a debit card, so if you have one—and choose to use both—you’re really dealing with a single financial instrument: a checking account. The safety of each depends on how well you protect either your debit card, your PIN and your checkbook.

If someone were to steal your debit card and know your PIN, they could empty your account in minutes. By the same token, if someone were to steal your checkbook, they could write a check to someone and forge your signature, stealing your money just as easily. On the other hand, credit cards have extra fraud protections in place, which can make it relatively safer than a debit card.

-

If you want to avoid going into debt and feel you may not be able to repay what you charge to a credit card before your balance starts to accrue interest, a checking account may be a better option. However, if you have a credit card that gives you frequent flyer miles or other kinds of reward points or cash back, and you’re confident you can make payments before you start to accrue interest, a credit card may be a better choice because it can save you money.

However, some people prefer the physical paper trail that comes with paying using a check with a checking account. You can get the checks sent back to you after they’ve been cashed, which enables you to keep track of when each check went through, as well as maintain a tangible copy of each check you issue.