Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

Novo is a financial technology company that offers a business checking account with a variety of features but very few fees. If you're an independent contractor or freelancer, you have a relatively new business or you're generally fee-averse, it can make sense to bank Novo.

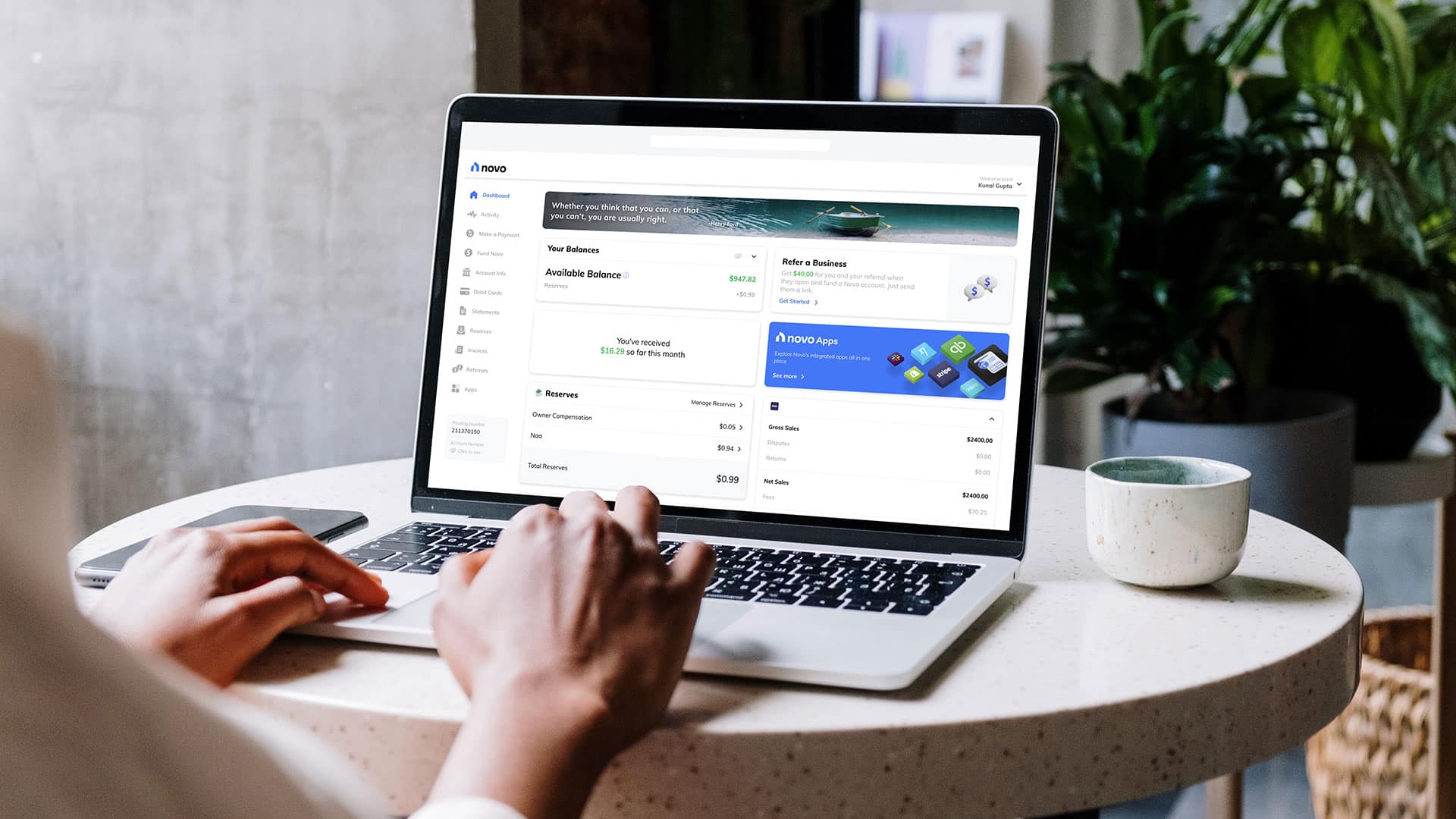

In this Novo review, you'll learn about how the digital-only business checking account works, which features it offers and whether it's the right fit for you and your small business.

About Novo

Novo is a fintech company, not a bank. However, it partners with Middlesex Federal Savings to offer its banking services and to make sure your deposits are FDIC-insured.

Novo officially launched its small business banking platform in 2018 and is headquartered in Miami, Florida. It doesn't currently offer any other products or services outside of its banking platform.

Novo Bank Account Review

Novo offers a solid number of features and services despite not charging any monthly fees. Small business owners can send and track invoices, set up cash reserves, integrate with various services, get savings with select merchants and more.

Here's everything you need to know about how the largely fee-free Novo account works and whether it's the right fit for you.

Account Fees and Balance Requirements

Novo and its partner bank, Middlesex Federal Savings, don't charge any monthly fees. Additionally, they don't charge fees for any of the following services:

- Early account closing

- Incoming and outgoing ACH transfers

- Incoming domestic and international wire transfers

- Paper statements

- Bank checks

- Physical check bill payments

- Debit card replacements

The business checking account also doesn't charge ATM fees and will even refund any ATM fee you pay to a third-party provider. Unlike some other banks that only offer this benefit on domestic ATMs, the Novo bank account offers ATM fee refunds worldwide.

Note, however, that there are a few fees you may come across, depending on how you use your account. For example, there's a $27 fee for non-sufficient funds and uncollected funds returned to your account, and if you want an outgoing Express ACH transfer, you'll pay 1.5% of the transaction amount, with a minimum of $0.50 and a maximum of $20.

Fortunately, there's no minimum balance requirement to speak of, but Novo does recommend an initial deposit of $50 when you open your account.

Interest

The Novo Business checking account is not an interest-bearing account, so you won't earn any interest on your balance. If that's an important feature for you, you may consider alternatives such as BlueVine Business Checking, Axos Bank Business Interest Checking, American Express Business Checking or other small business checking accounts.

Invoicing

Business account holders can create, send and track invoices within the Novo mobile app. There's no charge for the invoicing feature, and there's also no limit to how many you can send.

Novo also allows you to integrate your account with Stripe, Square and PayPal to accept payments, but you may end up with third-party fees. Alternatively, you can request ACH transfers or paper checks and skip the fees.

Reserves

Your Novo Business checking account comes with sub-accounts that you can use to set aside some money for various goals. You can create up to 10 Reserve accounts for specific upcoming expenses, estimated tax payments, emergency savings, business owner distributions and more.

You can also set up automatic transfers by allocating a certain percentage of your cash inflows into each of your Reserve accounts when money comes in.

Novo Perks

When you bank Novo, you'll get access to thousands of dollars in savings with select merchants. Here's a summary of what's currently available:

- Stripe: $5,000 in fee-free card processing and access to betas and events.

- Google Cloud: $300 in Google Cloud credits and free usage of more than 20 products.

- Google Ads: $500 in credits when you spend $500 on ads.

- Gusto: Your first month free on any Gusto payroll package (valued at $100 in savings).

- Intuit QuickBooks: A 30% discount on your first six months with any QuickBooks Online package (valued at $150 in savings).

- HubSpot: A 30% discount on your first year's subscription (valued at $1,400 in savings per seat) and 15% off subsequent years.

- Constant Contact: A 50% discount on your first six months of Plus (valued at $150 in savings).

- Zendesk: Free six months on any Zendesk Suite licenses and up to 100 seats.

- Snapchat: $150 in Snapchat Ads credits.

Depending on the nature of your small business, the Novo checking account could offer far more value than similar bank accounts.

Novo Boost

With the Novo Boost feature, small business owners who receive payments through Stripe can get paid faster without an extra fee. The service provides you with access to your money within hours of payment instead of days.

Referral Bonus

The Novo account doesn't currently offer a bank account bonus for new account holders, but it will give you a $100 bonus if you refer an eligible business owner who meets the company's requirements. You can earn up to 10 bonuses for a total of $1,000.

Some rules to keep in mind for the referred user:

- They must be new to Novo.

- They must use your referral code when applying.

- Their account must be approved and opened.

- They must have credits of $100 or more in the first 30 days, and they must maintain that balance or more for the next 30 days.

- They must make an external deposit.

Note that referral bonuses are considered miscellaneous income, so Novo will send you a form that you'll need to use to report it on your tax return.

Novo Debit Card

You'll receive a physical debit card that you can use for point-of-sale purchases, and you can also set up virtual cards for online transactions.

This not only allows new account holders to spend money before receiving their debit card, but it also provides additional security through encryption and the ability to freeze and unfreeze the card whenever you want.

If you have one or more business partners, you can add them as users, and each one can get their own debit card.

App Integrations

Novo makes it easy to integrate your checking account with more than 15 other platforms, including Shopify, Etsy, Xero, QuickBooks, eBay, Amazon, WooCommerce and many more.

Customer Service

Novo has a wealth of resources on its website that you can use to answer any questions you might have. If you have more specific questions and you don't want to dig for an answer, you can contact its customer service team by emailing [email protected].

Unfortunately, Novo does not offer service over the phone, and its support hours are Monday through Friday from 9:00 a.m. to 6:00 p.m. Eastern time, so if you have an issue over the weekend, you'll have to wait.

Novo Checking Account Eligibility

Novo's checking account is available for U.S.-based business owners. Though it doesn't matter whether you're a U.S. citizen or an international founder, you'll need to be a U.S. citizen with a Social Security number to open an account.

It's also important to note that not all small businesses are eligible for a Novo bank account. More specifically, the fintech company prohibits the following types of companies:

- Cryptocurrency

- Privately-owned ATMs

- Marijuana/cannabis

- Gambling

- Crowdfunding

- Money services

- Adult entertainment

Note that you may need to provide certain documentation during the application process, which may include your government-issued ID, articles of incorporation and an operating agreement.

What Novo Leaves Out

The Novo bank account offers a lot of value for having no monthly fees, but there are some key features some business owners may want and can't have. Here are some of the key ones:

- Paper checks: Novo allows you to send checks as payment via the Novo app, but you can't get a checkbook with paper checks.

- No branches: Because the bank is online-only, there are no brick-and-mortar branches where you can get in-person service.

- Cash deposits: You can deposit checks via the Novo mobile app, but you can't deposit cash at any ATMs. The only way around it is to buy a money order and deposit that, but money orders are limited to $1,000 and typically require a small fee.

- Outgoing wire transfers: While you can receive both domestic and international wire transfers with no fee, you can't send them directly with your account. Fortunately, you can integrate your account with Wise (formerly TransferWise) to send wires if needed, but it's another hoop you have to jump through.

- Recurring bill payments: You can use the Novo app to pay bills, but you can't set up recurring payments.

- Employee cards: If you decide to bank Novo, you can add multiple users, so they have their own debit card, but with that, they'll gain full access to the account, which may not be a good idea for most business owners.

Novo Business Checking: Pros and Cons

It's not always easy to find a business checking account that fits your needs, so a Novo account may or may not be the right fit for you. Here are some benefits and drawbacks to consider before you apply.

Pros

- Easy-to-use mobile app: According to some Novo reviews on Trustpilot, it can be easy to set up your account and make in-app banking decisions.

- Valuable banking services: For no monthly fees or minimum balance requirements, business owners get a lot of value through the Novo Business checking account.

- No ATM fees: Having unlimited ATM fee refunds is a huge benefit, especially if you manage some portion of your finances in cash. (However, Novo isn't the best if you handle a lot of cash, see the "Cons" section for more details.)

Cons

- Some features are limited: If you want to make cash deposits, receive checks, set up recurring bill payments or get in-person customer service, this business account may not be right for you.

- Limited customer service options: If an urgent matter comes up outside of customer service hours, you're out of luck. What's more, you're stuck with email interactions, meaning it can take longer to resolve your issue compared to a phone call.

- No interest: There are some high-yield business checking accounts out there, or at least checking accounts with a high-yield savings account attached to them, but Novo isn't one of them.

Is the Novo Business Checking Account Right for You?

The Novo checking account can provide a lot of value to businesses that primarily interact with their customers and clients online. If you need cash deposits, paper checks or in-person service, you're better off with another bank.

But if you don't use the various services and features that Novo lacks, it might not be a big deal for you. And if using some of Novo's services, such as invoicing, app integration and Reserves, means you can get a lot more done with one platform rather than needing to use multiple, that can be a huge win.

With that said, it's always a good idea to shop around and compare multiple options before you settle on one. As you do, it's important to think about which features are most important to you.

Also, consider what your deal-breakers are. While some business bank accounts offer a lot of valuable features and perks, if they're missing something that's really important to you, it might not be worth it.

The good news is that Novo is a largely fee-free checking account, so you don't have to commit a lot to try it out. You can open an account and try it out for a few months to decide whether it's the right fit or not. Whatever you do, take your time to research and compare the different business checking accounts that are available. The process can take some time, but it's worth it to ensure that you get the best banking option for you.