Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

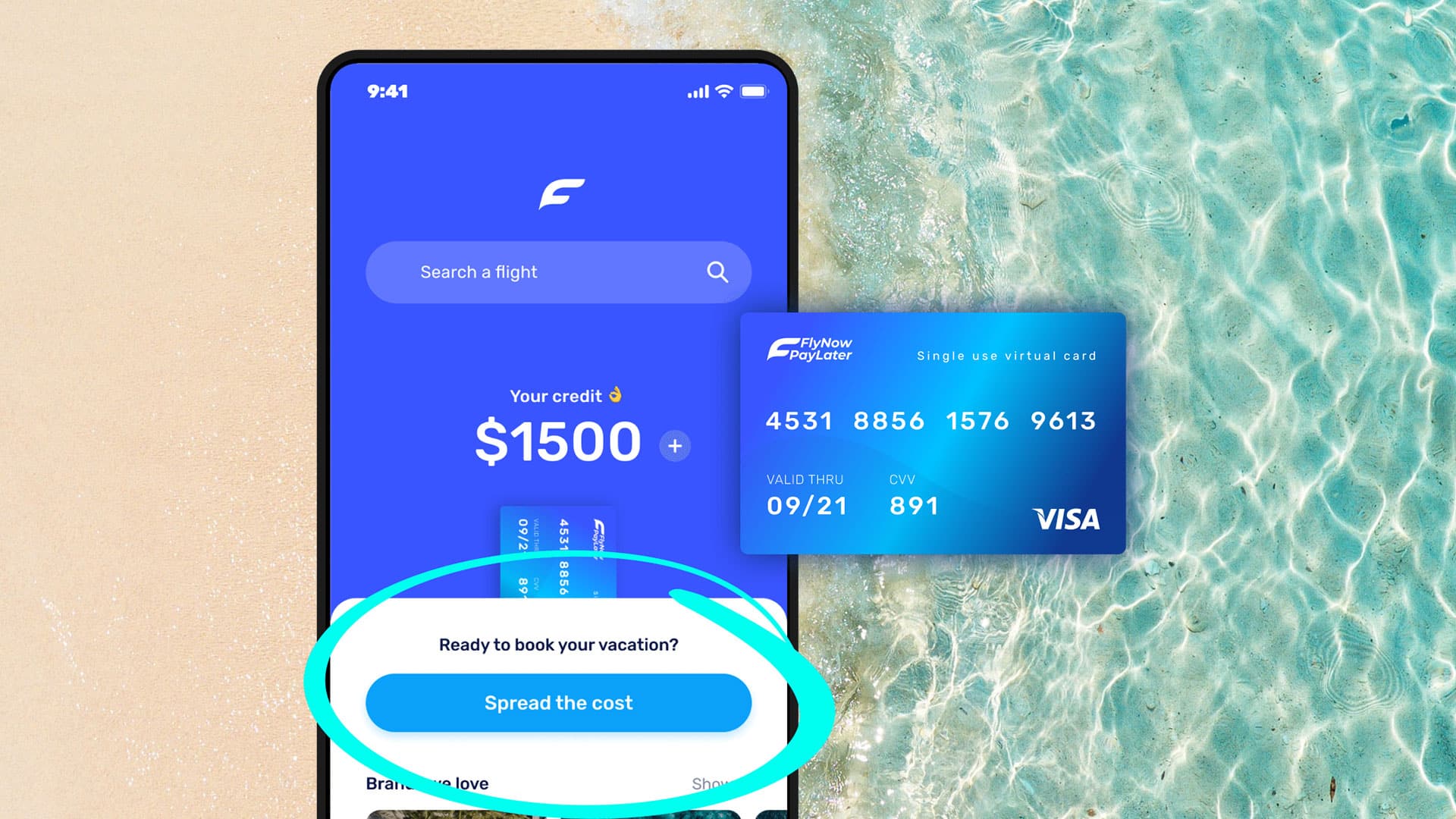

If you don’t have cash on hand to pay for travel expenses, Fly Now Pay Later has a solution. The payment service helps travelers pay for their vacation bookings in monthly installments, with interest. But is it the right option for you?

Here’s more about how Fly Now Pay Later works, who can use it, the pros and cons, and some alternative options.

What Is Fly Now Pay Later?

Fly Now Pay Later is a global fintech Buy Now, Pay Later (BNPL) company that was founded in 2015 by Jasper Dykes. It’s designed to serve travelers who need to secure an installment loan to pay for their vacation with flexible repayment options.

Eligible travelers can initiate a loan through the Fly Now Pay Later app, or on select partner websites by selecting the BNPL option at checkout. The installment loan can be used to pay for flight tickets, hotels, cruises and more. Loans to U.S. consumers are issued by Later Financial Services in partnership with Cross River Bank.

How It Works & What to Know

Below are the details and requirements for this payment option.

Eligibility

To qualify for Fly Now Pay Later, you must meet these requirements:

- Be a U.S. citizen or permanent resident

- Have a U.S. cell phone number

- Be at least 18 years old (19 if you’re a Nebraska or Alabama resident)

- Pass a credit check

- Have a debit card registered to the same address you provide on your application

Credit Score

The company doesn't disclose a minimum score that’s required to qualify for a loan. When a borrower submits an application, a soft credit check is performed to review their creditworthiness. A soft credit pull doesn’t impact your credit score.

Personal Loan Pros & Cons: When Are They a Good Idea?

Loan Amount & Repayment Terms

If approved for financing, you can borrow between $100 and $3,000 at checkout when booking through a partner website. Available repayment terms include a three-, six- or 12-month plan.

Annual Percentage Rate

Fly Now Pay Layer's advertised APR as of August 2022 ranges from 9.99% to 29.99%. The rate you receive is based on your creditworthiness and purchase amount, and certain eligible travelers might be offered a 0% APR.

Down Payment

Depending on your creditworthiness and the repayment option you choose, a down payment might be required. If you don’t have enough cash on hand to make the down payment, you might not be able to book your trip with Fly Now Pay Later.

Fees

You might be charged a transaction fee or installation fee, depending on the details of your plan. However, there are no early repayment fees if you choose to pay off your plan early.

If you’re late on a payment, you may have to pay late fees; however, the company doesn't disclose the late fee amount.

Customer Satisfaction

Fly Now Pay Later has a great 4.2 out of 5-star rating on Trustpilot based on more than 2,500 reviews. A large number of reviewers mentioned how easy the service is to ease and praised customer service representatives for their quick responses. However, a few negative reviewers complained about having trouble getting refunds.

How to Use Fly Now Pay Later

There are two ways to use Fly Now Pay Later.

- You can sign up for installment payments by downloading the app

- Register for the BNPL service at checkout through a partner website, like Expedia, Kiwi.com or Booking.com.

Using the App

- Download the app and create an account: If you choose to download the app, you have to create a profile which takes about two minutes. During this step, you’ll need to provide the following information:

- Name

- Date of birth

- Social Security number

- Cell phone number

- Annual income

- Address

- Provide documentation: You’ll also need to upload a selfie, along with a copy of your Driver’s license or US passport, to verify your identity.

- Agree to a soft credit check: Once you've provided the information above, select the box agreeing to a soft credit check before submitting your application.

- Application reviewal & results: If your application is approved, you'll be issued a credit limit and the option to create a virtual, single-use card for the amount you need.

- Start booking: After your virtual card is created, you can use it to book your trip within the app.

Through a Partner Website

Alternatively, you can register for the service online through a retail partner’s website.

To do this:

- Visit the partner’s website

- Select your desired travel

- Select the Fly Now Pay Later option at checkout

Payments are automatically deducted from your debit card each month. You can also make additional payments via the app without worrying about a prepayment penalty. If you need to adjust your due date, you can do so; however, if your bill is due within seven days, this change will be reflected in the next month.

Fly Now Pay Later Partner Airlines

Airline partners may change regularly, but here is a brief sampling of Fly Now Pay Later's airline partners:

- Air Serbia

- Alternative Airlines

- Azores Airlines SATA

- British Airways

- Eastern Airways

- Emirates

- Flymble

- Kenya Airways

- Malaysia Airlines

- Philippine Airlines

- Royal Air Maroc

- Royal Brunei Airlines

- Royal Jordanian

- Ryanair

- RwandAir

- TAP Air Portugal

- Turkish Airlines

- United Airlines

- Virgin Atlantic

Fly Now Pay Later: Pros and Cons

Pros

- Convenient payment plans

- Easy application process

- No prepayment penalty

- 4.2 out of 5-star Trustpilot rating

Cons

- Borrowing limit might be restrictive

- A down payment might be required

- Potentially high APR

- Late fees may apply

Alternative Options to Fly Now Pay Later

If you believe Fly Now Pay Later isn’t right for you, here are some other available options for financing your next travel.

- 0% APR credit card. If you have good to excellent credit, you may qualify for a credit card that comes with an interest-free promotion period. As long as you pay off your balance in full before the promotional rate expires, you can avoid paying interest. The downside is that interest will accrue on any remaining outstanding balance.

- Travel credit card. Some of the best travel credit cards offer large sign-up bonuses to consumers who spend a certain amount of money. These reward bonuses can help you offset the cost of travel.

- PayPal Pay in 4. PayPal Pay in 4 allows you to spread the cost of a trip up to $1,500 across four bi-weekly pay periods. This plan option doesn’t charge interest, and you can use it to pay for hotels through its travel partners, like Expedia and Hotwire.

- Affirm. Affirm is another Buy Now Pay Later option. It lets you book directly with major travel websites like Priceline.com and Expedia.

- Travel savings account. If you don't have to travel immediately, you can park cash for future vacations in a high-yield savings account.

- Personal loans. For those who have significant travel expenses and are able to secure a lower interest rate through personal loans, this may be an option that can provide more flexibility in loan terms and limits.

Related Article

Related Article

Best Vacation & Travel Loans to Finance Your Next Getaway

FAQs

-

Yes, when you apply for a loan, a soft credit check is required during the application process. A soft credit check has no impact on your credit score.

-

Fly Now Pay Later doesn’t disclose its credit requirements. To learn if you’re eligible for the service, you’ll need to submit an application. That said, keep in mind you might be ineligible for the loan if you have bad credit, or if approved, you might receive a higher interest rate.

-

Yes, Fly Now Pay Later offers you an upfront loan to pay for a vacation, including a cruise, hotel or select amusement parks. Once approved, you can book your travel now and repay the amount you borrowed in small increments.

-

You can reach out to the company's support team in the app, by filling out a customer support inquiry through its website or via email at [email protected].

Featured photo: Slickdeals/Fly Now Pay Later