Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

CIT Bank Money Market Account

- Our Rating 4/5 How our ratings work

- APY1.55%

Annual Percentage Yield is accurate as of March 31, 2023. Interest rates for the CIT Bank Money Market account are variable and subject to change at any time without notice.

- Minimum

Deposit Required$100

CIT Bank's Money Market Account doesn’t offer the highest interest rate out there, but you can open an account with only $100, and there's no ongoing minimum balance requirement. This account also doesn't charge any monthly fees, which helps it stand out from other similar accounts.

Grow Your Savings Faster With CIT Bank's Money Market Offer

It’s not just high-yield savings accounts that help people earn elevated interest on their savings balances. The best money market accounts will also help you reach your financial goals.

The CIT Bank Money Market account helps you save up emergency funds while earning interest on your account balance. This Money Market account offers a 1.55% APY, which is higher than that of your average checking or savings account.

Pros

- Strong APY

- No monthly fee

Cons

- No included debit card or checks

CIT Money Market Features

The CIT Money Market is a high-interest account that offers a 1.55% APY on your savings balance, which is higher than many savings accounts.

The account is a hybrid between a savings and a checking account, and it lets you save money, earn interest and withdraw and transfer your money — all from a single account.

If you’re saving up for an emergency fund, a downpayment on a home or some other goal, the CIT Money Market is an interest-earning account to save your money.

APY and Interest

The CIT Money Market currently offers an APY of 1.55%. Interest is compounded daily, paid monthly and 3x higher than the national APY.

This APY is not tiered; so there are no minimum balance thresholds in order to earn the full interest rate.

Note that APY rates will fluctuate with the market. To lock in your savings at an APY, consider either CIT Banks' No-Penalty CD or Term CDs.

Fees and Minimums

With a minimum opening deposit of $100, you can easily open an account for short or long term savings while earning interest on your entire daily balance.

This money market account charges no monthly fees, and as long as you don’t exceed the six transactions per statement cycle, you won’t pay any fees whatsoever.

Member FDIC

CIT Bank is a member of the Federal Deposit Insurance Corporation (FDIC insured), which means your deposit accounts are insured up to $250,000 per depositor, for each account ownership category.

You know your money is safe and secure in the CIT Money Market account.

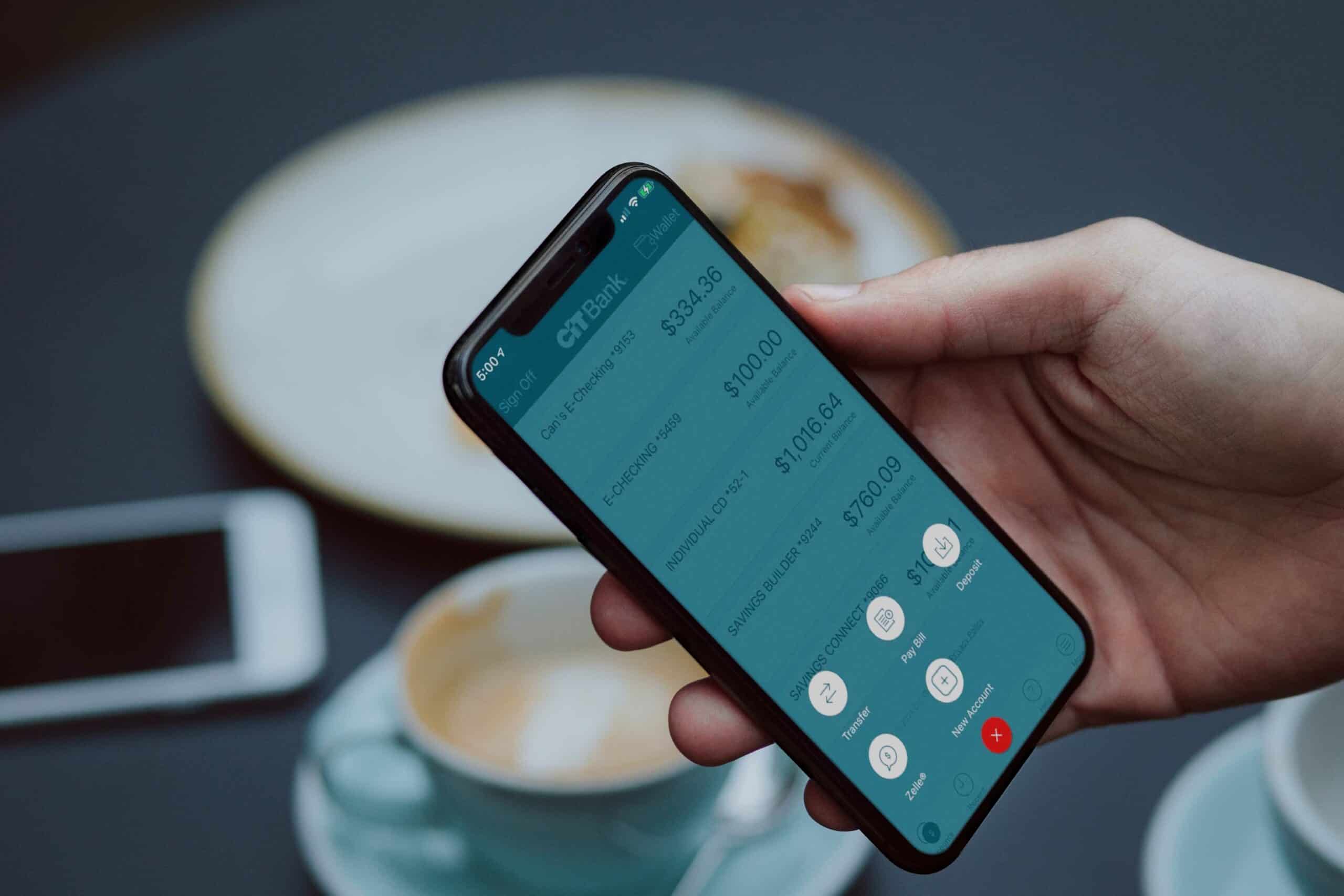

How to Access Money

You can quickly and easily access your funds in your CIT Money Market account through your desktop or the CIT Bank mobile app 24 hours a day, seven days a week. With the app, you can also deposit checks and make transfers.

Additionally, you can access money easily through third-party services like Zelle and Bill Pay.

However, you’re limited to six transactions – withdrawals and transfers – per statement cycle. If you make more than six transactions, you will be subject to an excessive transaction fee of $10 per transaction, which is assessed from the first transaction. There’s a $50 monthly cap.

If you overdraft, you’ll be charged a $50 fee. An outgoing wire fee for domestic transactions only will cost $10 fee for an account with a daily average balance of less than $25,000, and $0 for balances of more than $25,000. There are no monthly service fees.

How to Open an Account

To open a CIT Money Market fill out its secure online form, which should only take about 10 minutes.

- Provide banking details: Visit the homepage and tap “Open an Account.” State whether you’re a new customer, you already have a CIT bank account or you’re resuming your application. You’ll have to provide CIT with your primary home address and email address, your phone number and your Social Security number.

- Fund your account: Transfer the $100 minimum opening balance through EFT, mail-in check or wire.

- Email confirmation: When your account is open, you'll receive an email confirmation

CIT Bank Money Market vs. CIT Bank Savings Accounts

In addition to a high-yield money market account, CIT Bank also offers two high-yield savings accounts.

CIT Bank Savings Connect Account

- Our Rating 4.5/5 How our ratings work

- APY4.65%

Annual Percentage Yield is accurate as of July 27, 2023. Interest rates for the Savings Connect account are variable and subject to change at any time without notice.

- Minimum

Deposit Required$100 - Intro Bonus N/A

CIT Bank's Savings Connect account is one of our top picks for high-yield savings accounts. Featuring a competitive flat APY on all balances, it can go head-to-head with most of the top savings accounts available. What's more, you don't have to do anything special to earn this high interest rate; many similar accounts (including some offered by CIT) only offer their highest interest rates to customers who complete certain requirements.

In many ways, the CIT Savings Connect account is the better of the two options. Customers enjoy an incredibly healthy APY of 4.65%, and the account requires a $100 minimum opening deposit.

CIT Bank Savings Builder Account

- Our Rating 3/5 How our ratings work

- APYUp to 1.00%

Earn 1.00% APY by maintaining a balance of $25,000 or more, or by receiving a single deposit of $100 or more each month. Annual Percentage Yield is accurate as of September 22, 2022. Interest rates for the Savings Builder account are variable and subject to change at any time without notice.

- Minimum

Deposit Required$100 - Intro Bonus N/A

While it doesn't offer an especially strong interest rate, many of the features included in CIT Bank's Savings Builder account are designed to encourage you to save. To earn the maximum APY on this account, you need to either maintain a high account balance or regularly make deposits, both of which incentivize responsible saving.

The CIT Savings Builder account requires a $100 minimum deposit when you open the account, and it's a little more complicated when it comes to earning interest, which is unfortunate, since it only offers an APY of 1.00%.

With a CIT Savings Builder, you'll earn 0.40% interest on balances less than $25,000. However, that APY climbs to 1.00% when you have a monthly deposit of $100 more. In essence, it pays to save. Similarly, balances of $25,000 or more also earn 1.00% APY without needing a $100 or more monthly deposit. So, a Savings Builder account is a good place to earn high interest on a chunk of your savings without worrying about monthly deposits.

Both accounts are also designed to work with the bank's high-yield checking account. The CIT eChecking account earns up to 0.25% and offers all of the convenience expected of online checking accounts, including debit card, check writing privileges and mobile banking. Read our full review of the CIT eChecking account.

But, like the CIT Money Market account, there's a six-withdrawal limit. Also, the money market account charges a $10 fee for each excess withdrawal. It also charges $25 each time you overdraft your account.

So which is best? It really depends on how you use it. If you simply want an account where you can park your money and don't plan to take withdrawals very often, the money market account may be a better choice.

However, it's important to keep the money market account's fees in mind. Even if you get charged just one fee in a year, it could defeat the purpose of the higher interest rate.

Money Market Account vs. Money Market Fund

Keep in mind that a money market account is not the same as a money market fund. The latter is an investment that is not FDIC insured and has a fluctuating rate of return, while the former is FDIC insured and has a locked-in interest rate.

Bottom Line

This account is ideal if you have a savings goal. For instance, you may want to build an emergency savings account, save up to buy a home or pay off some medical debt. Maybe you have a home improvement project or a big trip coming up. Park your money in the CIT Money Market Account, and at the moment you need your money, it’ll be there for you.

Ready to open a CIT Bank Money Market Account? Start here.