Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

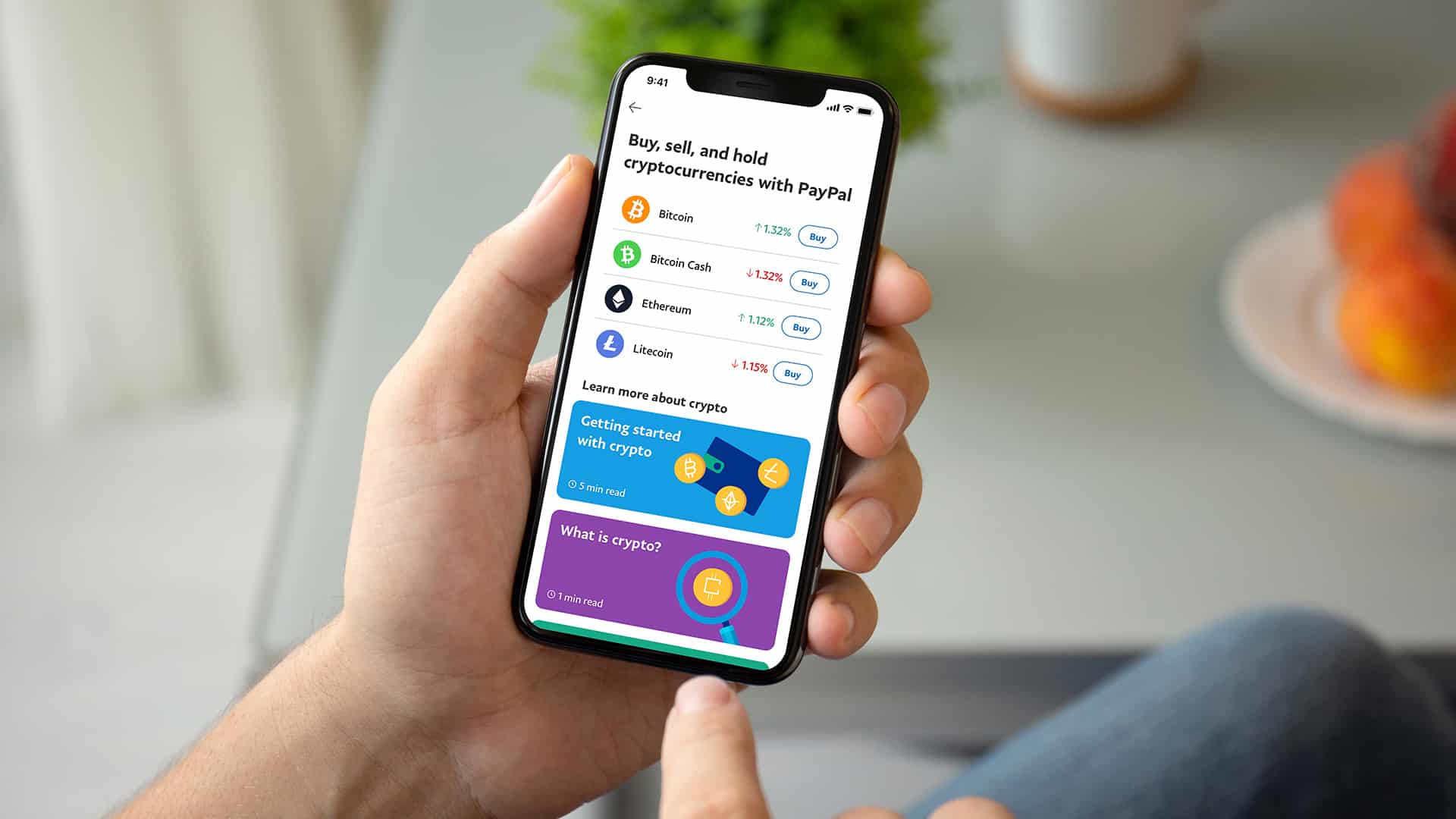

If you own cryptocurrency and are not quite sure what to do come tax time, you’re not alone. About 15% of Americans owned crypto in 2022, according to research from J.P. Morgan. And since one of the big allures of crypto is its ability to bypass a lot of the traditional financial systems and regulations, it’s no surprise that many people are unsure whether — and how — to report it on their taxes.

The nitty-gritty rules for how crypto is taxed can get a little complex. For this reason, it can be helpful to hire a tax professional to work out the details with you. Crypto is largely unregulated, but the IRS treats it like property. This means you have to report your gains and losses. Knowing important taxing information ahead of time will help you keep better records and ensure you only pay what is owed.

When Do You Have to Report Crypto On Your Taxes?

Anytime you handle crypto, it’ll be either a taxable or non-taxable event. You will have to report taxable crypto events on your taxes, but you won’t have to report non-taxable events.

Taxable Crypto Events

Here’s a quick rundown on some common taxable crypto events that have to be reported on your tax return:

- Mining crypto: If you successfully use your computer to mine crypto, the IRS considers that income just as if you were panning for gold.

- Selling crypto: Anytime you sell crypto for cash, the IRS considers it a taxable event.

- Spending crypto: If you use your crypto to buy a pizza or any other good or service, it’s a taxable event.

- Trading one crypto for another: If you trade your bitcoin for Ethereum, for example.

- Receiving crypto as a reward or payment: If you’re a freelancer and your client pays you in crypto, or if you receive some free crypto as an airdrop, it’s considered taxable income just as if you’d earned it as cash.

Non-Taxable Crypto Events

However, some of the things you can do with your crypto aren’t considered taxable events, and so either aren’t reported on your taxes, or are reported elsewhere as noted:

- Buying crypto: If you bought crypto with your own cash and didn’t do anything else with it, it’s not a taxable event.

- Holding crypto: If you bought crypto in a prior tax year and you’re still hanging onto it (or should we say HOLDing onto it), you won’t be taxed on it until it leaves your possession.

- Donating crypto: If you donate your crypto to a registered 501(c)(3) charity, you won’t owe taxes on it, but you can claim it as a deduction just as if you’d donated cash.

- Gifting crypto to someone: You can gift your crypto to someone tax-free, although if you’re donating more than $15,000 worth of crypto, you will need to report it on your taxes.

- Receiving crypto as a gift: If someone gifted you some crypto out of the goodness of their hearts, you don’t need to report it on your taxes.

Related Article

Related Article

9 Best and Cheapest Online Tax Services in July 2024

What About State Income Tax and Crypto?

Things get a bit murkier when it comes to how states tax crypto. Some states, like Washington, don’t have any income tax at all, while others levy a fee. If your state doesn’t require you to file a return for income tax, you don’t have to worry about reporting crypto to your state.

Some states, like California and Kansas, follow federal tax rules when reporting crypto: you’ll tax virtual currencies as you would cash. But because crypto is so new, most states haven’t had time (or understanding) to adequately write it in their tax code. In these instances, it’s a good idea to chat with a tax professional familiar with crypto works in your state for the best guidance.

How Crypto Is Taxed

Crypto can be taxed a couple of different ways depending on how you first got it, and/or how it leaves your hands.

How to Report Crypto as Income on Your Taxes

You’re familiar with the idea of how we all pay income taxes on money that we earn, like from a job or from interest on our savings accounts. If you received your crypto in similar ways (mining it, getting it as an incentive such as an airdrop, or receiving it as payment for something), you’d need to report that as income on your taxes just the same.

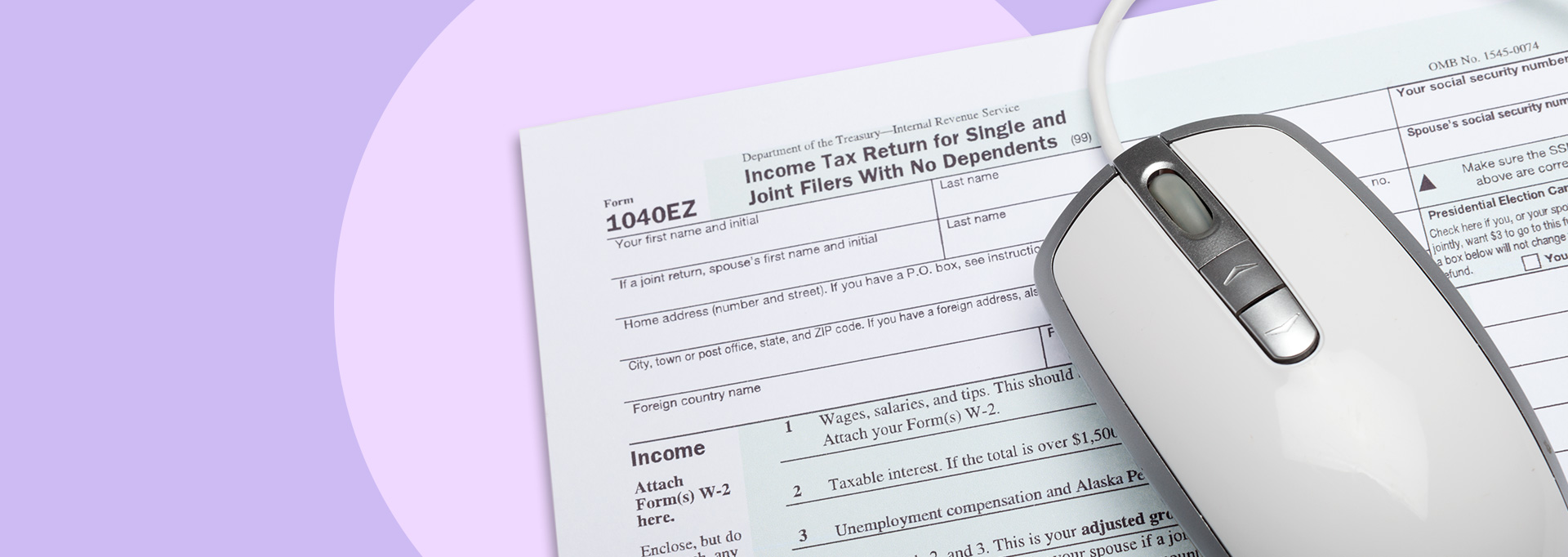

To report your crypto as income on your taxes:

- Check “Yes” on the box on the first page of Form 1040 that asks whether you received any crypto as a reward or payment.

- Then you’d report that income on either Schedule 1 (for rewards and incentives) or Schedule C (for self-employment income, including freelance work).

- When you record your income on Schedule 1 or Schedule C, you’ll convert the value of your cryptocurrency to U.S. dollars. More on that below.

How to Calculate Crypto Deductions and Capital Gains

When you get rid of your crypto through a taxable event (selling, trading, or spending it), you’ll need to calculate whether you had a gain or a loss.

Here's some general guidance on how you'd do that:

- Check “Yes” on the box asking if you “sold, exchanged, gifted or otherwise disposed of a digital asset” on the first page of the Form 1040 tax return.

- Use Form 8949 (Sales and Other Dispositions of Capital Assets) to report your gains and losses. You’ll record the “cost basis” (i.e., the value, in dollars, of the crypto when you bought it) and the “proceeds” (i.e., the value, in dollars, of the crypto when you sold, spent or traded it).

- Then, subtract your cost basis from your proceeds to calculate your capital gains or losses.

- If the value is negative (i.e., you got rid of the crypto at a loss), you may be able to claim that as a deduction on your taxes.

- If it’s positive (i.e., you got rid of the crypto for a gain), you’ll owe capital gains tax.

The basic idea of capital gains tax is simple. If you hold onto your crypto for over a year, you’ll owe the long-term capital gains tax, which ranges from 0% to 20% based on your taxable income. For most people, the long-term levy is a better deal than the short-term capital gains tax you pay when you hold your crypto for less than a year. The short-term capital gains tax ranges from 10% to 37% and is taxed the same as the regular income you’d earn from your job.

Since the world of crypto changes fast and people make split-second buy-or-sell decisions, it’s probably a fair bet that you’ll be paying the short-term capital gains tax rate. But if you have nerves of steel and can HODL it for longer than a year, you’ll usually pay far less in taxes on it.

How to Convert Crypto to Dollars on Your Taxes

You’d confuse a lot of IRS workers if you reported shares of bitcoin or any other crypto directly on your taxes. Instead, the IRS requires you to convert the value of your crypto into U.S. dollars in a specific way.

Whenever you receive or dispose of crypto, like when you buy it and sell it, it’s a good idea to make a habit of recording how much crypto you got along with its trading price for that day. If you forgot to record it, don’t worry: you can still look up the historical price on that day. Then, you’d convert your shares to U.S. dollars, which you’d record on your tax forms.

For example, if you bought 0.05 BTC on May 26, 2022, and sold it on November 25, 2022, you can enter this information into a price calculator and discover that your purchase was worth the equivalent of $1,466.87 when you bought it (your cost basis), and $826.33 when you sold it (your proceeds). That means you sold it for an equivalent loss of $640.54, and these are the actual numbers you’d report on your tax forms.

$826.33 - $1,466.87 = -$640.54 (loss)

Things get a bit trickier if, like many people, you keep a standing balance in your wallet that you add and subtract from as you transact in crypto. How do you know which specific units you’re buying or selling?

The default method the IRS recommends is the FIFO (first in, first out): any time you sell or use your crypto, you’ll use the oldest crypto shares as your cost basis, removing them from your accounting ledger as you go. There are other methods, however, such as HIFO (highest in, first out), which may save you more money, but can be more complex. The FIFO method is the most popular since it is considered the most conservative accounting method.

A Tax Professional Can (And Probably Should) Help You

Cryptocurrency is taxed just like any other income you earn or investments you make, with one added wrinkle: you’ll need to convert the value of your crypto to U.S. dollars on your taxes. The nitty-gritty details that determine whether you need to pay taxes on your crypto, and the best accounting systems to use to shrink your tax bill, can get a little confusing. It’s best to chat with a tax professional who can guide you to the right answers if you’re ever unsure how to file lawfully.

Related Article

Related Article

Tax Hack: How to Get a Cash Bonus With Your Tax Refund

Frequently Asked Questions

-

If you bought crypto with your own money and didn’t sell it during the year, you don’t have to report crypto on your taxes. If you mined it, received it as payment, traded it with another cryptocurrency or used it to buy something, however, you do have to report it.

-

If you don’t report your crypto when you should have, the IRS considers it tax evasion — even if you didn’t know you were required to report it. The IRS has started cracking down on this, too; you could owe expensive penalties and interest, and even go to jail, depending on the circumstances. Since blockchain transactions are permanent, you won’t be able to hide them very easily.

-

No, you won’t pay any taxes on lost or stolen crypto, but you won’t be able to claim those losses as deductions on your taxes either. You could previously report what’s known as a “casualty loss,” but the 2017 Tax Cuts and Jobs Act did away with the deduction protecting you from theft and loss. Now, you can't claim any lost or stolen items as deductions on your taxes unless it results from a federally-declared disaster.

-

If your crypto value is down, but you still have it in your wallet, you don’t have to report it. But if you sold it, used it to pay for something, or traded it for another crypto, you do have to report it, even if you lost money. You’d report this by completing Form 8949 (Sales and Other Dispositions of Capital Assets) and Schedule D (Capital Gains and Losses) along with your regular Form 1040 tax return.