Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

With travel season fast approaching, Amazon's Prime Visa Credit Card can be a great option if you're looking to earn more rewards on your travel purchases. In addition to offering an unlimited 5% back on Amazon.com and Whole Foods purchases, you can also get an unlimited 5% back on bookings through Chase Travel. Even as a non-Prime member, you're still in an excellent position to reap rewards with 3% back on every flight, hotel stay, and travel-related purchase made through Chase Travel. Whether it's a weekend escape or a grand vacation, your travels just got more rewarding.

Now, let's get into how Prime members can maximize their travel experiences with the Prime Visa Credit Card. Imagine earning an impressive 5% back on all your travel bookings through Chase.

Prime Visa Credit Card

- Our Rating 3.5/5 How our ratings work

- APR20.49% - 29.24% (Variable)

- Annual Fee$0

$0 with Prime membership

-

Sign-Up Bonus

$200Gift Card

Get a $200 Amazon Gift Card instantly upon approval exclusively for Prime members

This card is a good fit for consumers who do a lot of shopping at Amazon and Whole Foods because they can earn an unlimited 5% cash back on purchases there. Cardholders also earn some cash back on other purchases, with decent rates for restaurants and gas stations. If you already have or plan to get a Prime membership, using this card could quickly earn you sizable cash back.

Overview

With high rewards rates, this card could make up for the required Prime membership fee if you shop a lot at Amazon and Whole Foods. Non-Prime members can qualify for the Prime Visa Credit Card, which is pretty similar but with lower rewards rates.

Pros

- No annual fee

- High rewards rates

- Sign-up bonus offer

- Can redeem rewards as soon as the next day

- No foreign transaction fees

Cons

- Must have a Prime membership for highest rewards rates

- No intro APR offer

How to Earn 5% Back on Chase Travel with the Prime Visa Credit Card

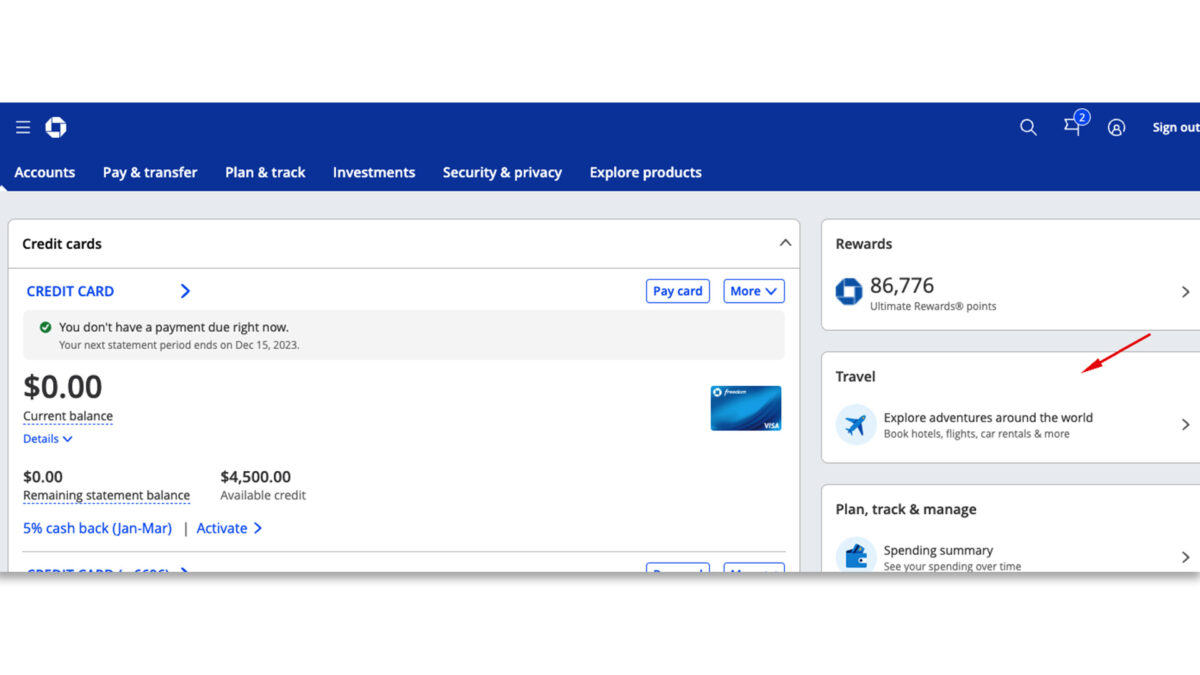

1. Sign in to your Chase account. Click the Travel section.

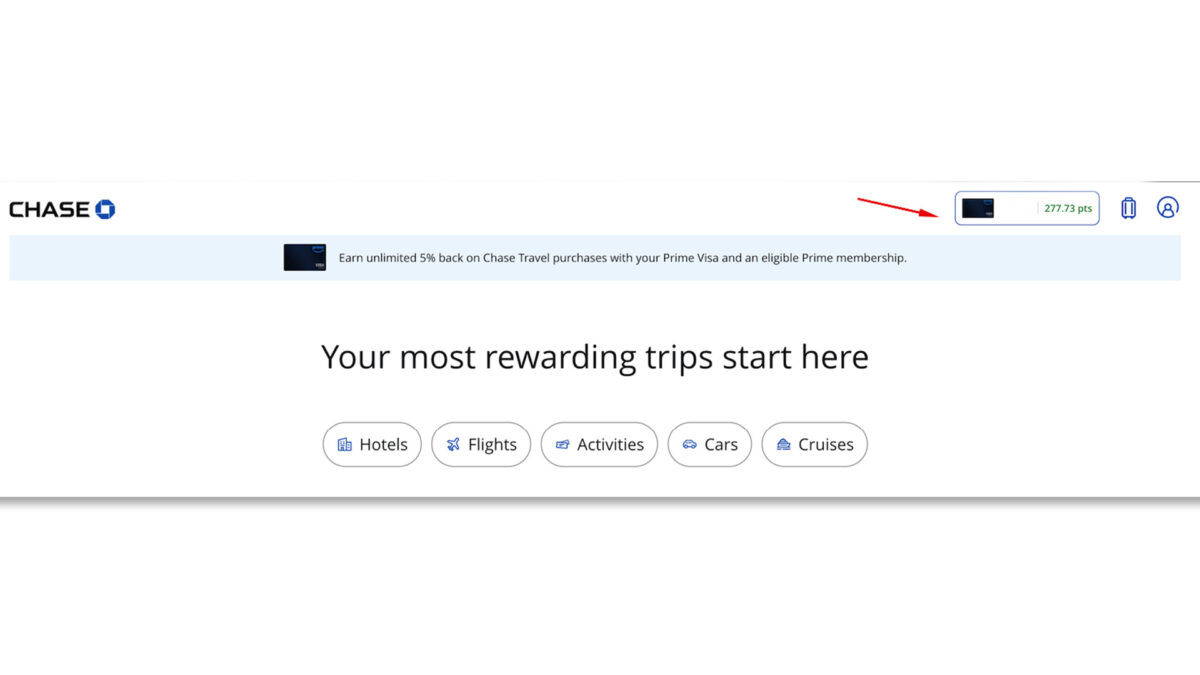

2. Make sure your Prime Visa Credit Card is selected.

If you own multiple Chase credit cards, choose your Prime Visa by tapping the card image in the top right corner.

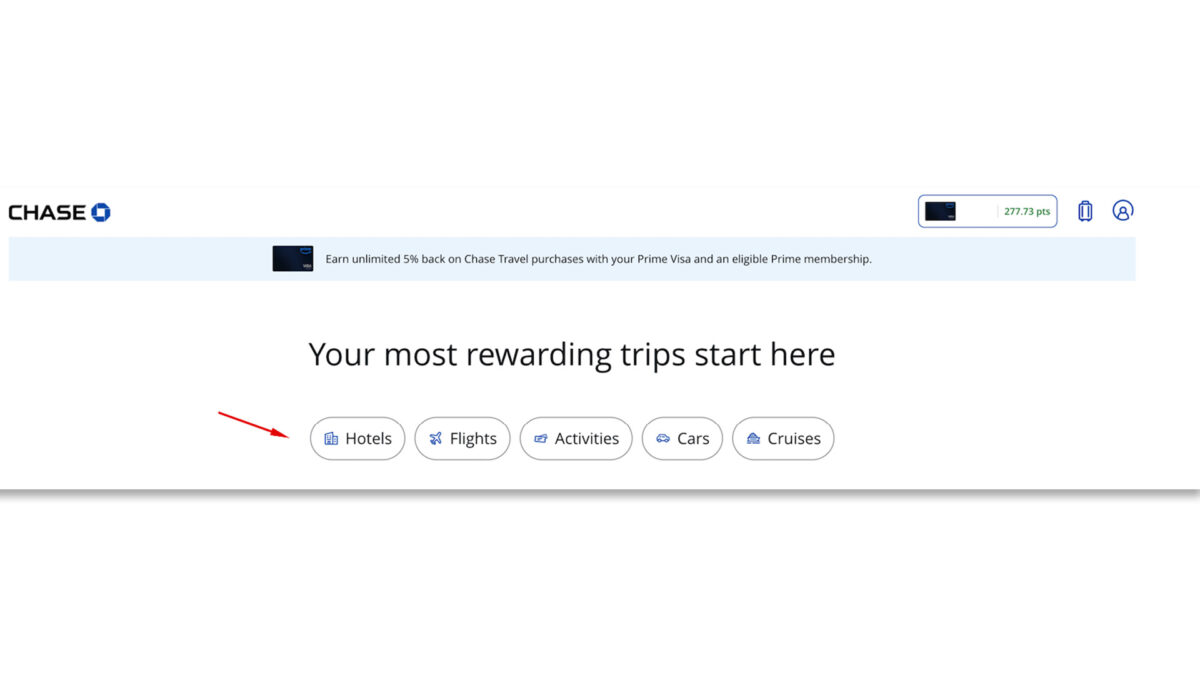

3. Choose your travel booking.

Select what you want to book: hotels, flights, activities, rental cars, or cruises.

To book a hotel, search by destination and refine your choices using filters like price, amenities, ratings, property type, number of bedrooms, and neighborhood.

When booking a flight, adjust your search with filters for cost, airline, flight times, and departure airport. Similar filters are available for activities, rental cars, and cruises.

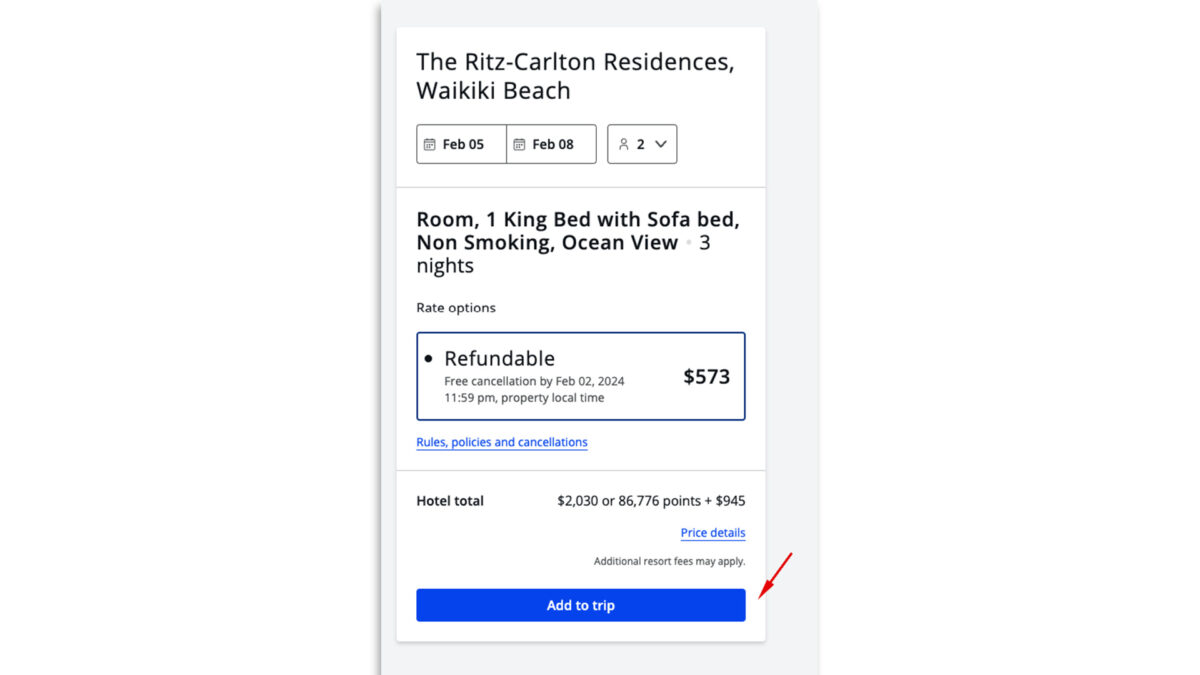

4. Click "Add to trip" to confirm your booking.

Once you're satisfied with your travel selections, confirm your booking by clicking "Add to trip." You can include multiple bookings in your trip cart.

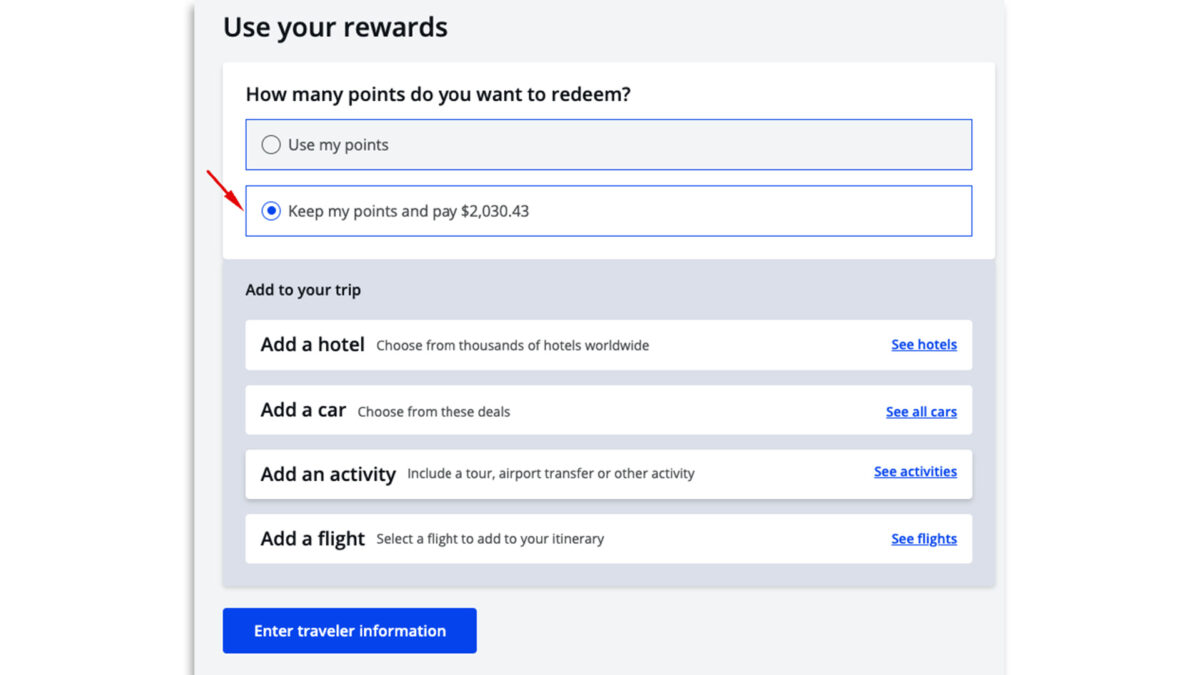

5. Choose your payment option.

If you want to earn 5% back on Chase Travel with your Prime Visa Credit Card, choose the "keep my points and pay" option. Or, you can choose to pay using points.

You can also add additional bookings such as a rental car, hotel, flight, or other travel activity to your booking.

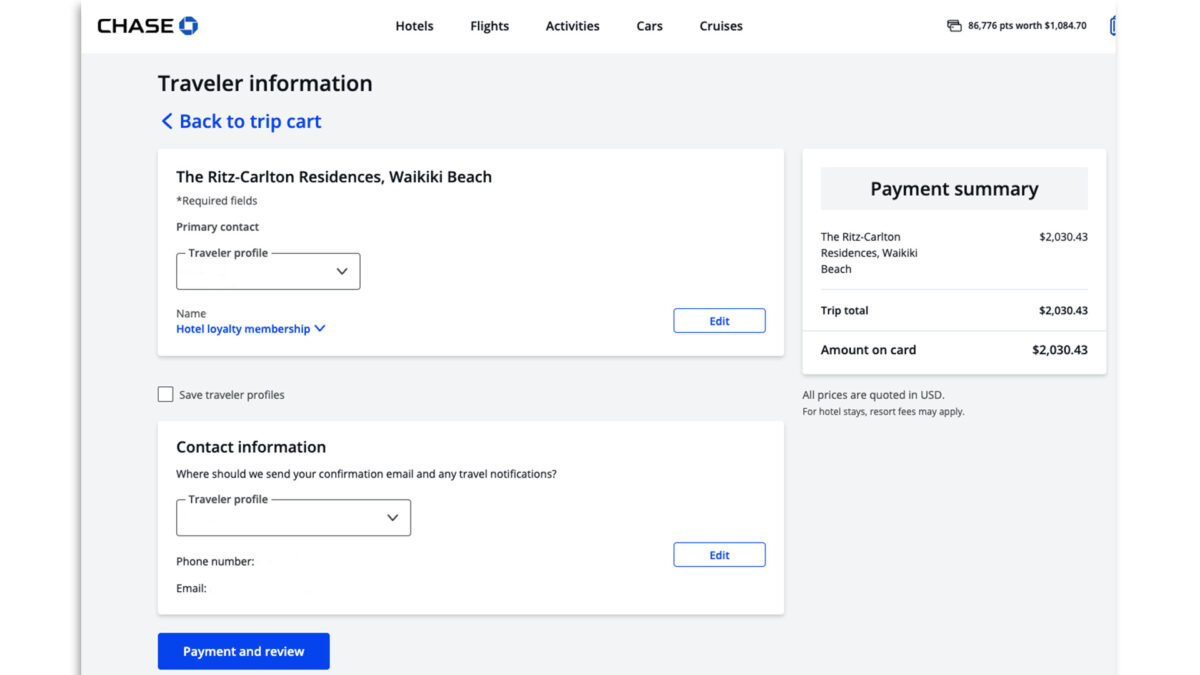

6. Enter your traveler details.

Enter your traveler details, including any applicable loyalty program information.

7. Provide your payment details.

Continue to the payment details and confirm that all the booking information is correct.

8. Complete the booking.

Complete the step to finalize the transaction.

After your billing cycle, you’ll get 5% back in points if you paid with your Prime Visa Credit Card. Each point is equal to one cent. So a $100 flight will earn you 500 points, equal to $5 in cash back.

Recommended Travel Credit Cards

| Credit Card | Intro Bonus | Annual Fee | Rewards Rate | Learn More |

|---|---|---|---|---|

|

|

60,000Chase Ultimate Rewards Points

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠. Dollar Equivalent: $1,380 (60,000 Chase Ultimate Rewards Points * 0.023 base) |

$95 |

1x- 5xPoints

Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more. |

Apply Now |

|

|

50,000Southwest Rapid Rewards Points

Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening. Dollar Equivalent: $700 (50,000 Southwest Rapid Rewards Points * 0.014 base) |

$69 |

1x - 2xPoints

Earn 2X points on Southwest® purchases. Earn 2X points on Rapid Rewards® hotel and car rental partners. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services; select streaming. Earn 1X points on all other purchases. |

Apply Now |

|

|

$200Cash Bonus

Earn $200 in cash back after you spend $1500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® points, which can be redeemed for $200 cash back. |

$0 |

1% - 5%Cashback

Earn 5% cash back on purchases in your top eligible spend category each billing cycle, up to the first $500 spent, 1% cash back thereafter. Also, earn unlimited 1% cash back on all other purchases. Special Travel Offer: Earn an additional 4% cash back on hotels, car rentals, and attractions booked on Citi Travel℠ portal through 6/30/2025. |

Apply Now Rates & Fees |

|

|

70,000Citi ThankYou® Points

Earn 70,000 bonus ThankYou® Points after spending $4,000 in the first 3 months of account opening, redeemable for $700 in gift cards or travel rewards at thankyou.com. Dollar Equivalent: $1,260 (70,000 Citi ThankYou® Points * 0.018 base) |

$95 |

1X-10XPoints

10x on Hotels, Car Rentals, and Attractions booked through CitiTravel.com 3x -- Earn 3 Points per $1 spent on Air Travel and Other Hotel Purchases 3x -- Earn 3 Points per $1 spent on Restaurants 3x -- Earn 3 Points per $1 spent on Supermarkets 3x -- Earn 3 Points per $1 spent on Gas and EV Charging Stations 1x -- Earn 1 Point per $1 spent on All Other Purchases |

Apply Now Rates & Fees |