Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain. Non-Monetized. The information related to Chase credit cards was collected by Slickdeals and has not been reviewed or provided by the issuer of these products. Product details may vary. Please see issuer website for current information. Slickdeals does not receive commission for these products/cards.

Refer-a-friend programs can be an easy way to earn extra money online and to help your loved ones make extra cash too. Many types of businesses use referral programs as an advertising strategy to attract new customers. Depending on where you bank, you might be able to take advantage of referral bonus opportunities through your financial institution.

Below are our picks for the top bank referral programs available. Discover whether your bank or credit union makes the list and find out if it might be time to consider switching banks if one of the financial institutions below offers better perks, products or rates than you're currently receiving.

| Bank | Referral Bonus | Requirements |

|---|---|---|

|

$50 |

Open Essential Checking or Rewards Checking |

|

|

$50 |

Open eligible Chase account |

|

|

$50 |

Referral form |

|

|

$100 |

Receive direct deposit of $200+ in 45 days of opening |

1. Axos® Bank: $50 Referral Bonus

Axos Bank is a full-service online bank that was founded over two decades ago. The FDIC-insured bank offers a variety of financial products and services, including numerous options for online checking accounts, savings accounts, CDs and several types of loans (e.g., mortgages, auto loans and personal loans). The Axos Bank Rewards Checking account stands out by offering customers a competitive APY.

Referral bonus: When your referral opens a new Essential Checking or Rewards Checking account, the bank will deposit a $50 bonus into your Axos account and your associate's new account, as well.

How to Get a Referral Bonus From Axos Bank

To earn a referral bonus from Axos Bank, you and your referral must complete the following steps:

- Share your unique referral link (available in your online account) with a friend.

- Your referral uses the link to open an Essential Checking or Rewards Checking account and adds funds to the account.

- Once the steps above are complete, the bank will deposit $50 into your account and the account of your referral. (Note: Your referral must receive at least $1,000 in direct deposits within 90 days from account opening to qualify for their bonus.)

You can earn unlimited Refer-a-Friend credits for referring others to Axos Bank. However, you can't earn a bonus for referring yourself. Axos may also limit the number of new-account bonuses you can receive to one per calendar year.

Axos Rewards Checking Account

This product is currently not available via Slickdeals. All information about this product was collected by Slickdeals and has not been reviewed by the issuer.

- Our Rating 5/5 How our ratings work

- APYUp to 3.30%

Earn up to 3.30% APY for completing qualifying activities.

- Minimum

Deposit RequiredN/A -

Intro Bonus

Up to $500Expires July 31, 2024

Cash in on up to a $500 bonus† and up to 3.30% APY* with a new Rewards Checking account. Just use promo code RC500 before July 31.

Axos Bank Rewards Checking gives customers the chance to earn up to a 3.30% APY on their deposits with no monthly fees. These are all terrific features for a checking account, but Axos is digital-only, so if you deal with cash regularly it’s probably not the best fit for you.

Overview

While it takes a bit of work to unlock the maximum interest rate, Axos Rewards Checking customers can potentially earn an impressive 3.30% APY. This account also does not include any monthly fees.

Pros

- Strong APY compared to similar accounts

- No monthly maintenance fee or monthly minimum balance

- No overdraft or non-sufficient fund fees

- Unlimited domestic ATM fee reimbursements

Cons

- Several qualifying activities required to earn maximum interest

- No physical branch locations

2. Chase Bank: $50 Referral Bonus

Chase Bank is one of the largest banks in the United States. Eligible customers can open checking accounts, savings accounts, CDs, money market accounts, credit cards and mortgages. However, if you're trying to find the best high-yield savings accounts with high APYs, know that interest rates at Chase tend to be low.

Referral bonus: Customers can earn a $50 bonus through the Chase referral program for each friend who opens a qualifying Chase checking account.

How to Get a Referral Bonus From Chase

Qualifying for a Refer-a-Friend bonus from Chase Bank is a three-part process:

- Request a unique referral link from Chase by entering your information into the online form.

- Earn $50 when someone uses your referral link to open a qualifying account and completes qualifying activities

- Your referral earns $50 when they open an eligible Chase checking account and complete qualifying activities. (Qualifying activities may include debit card purchases, Chase QuickDeposit℠, online bill payments, Zelle® or ACH credits.)

Chase limits the number of referral credits you can receive per year to 10—up to $500 in total bonuses.

3. TD Bank: $50 Referral Bonus

TD Bank is a traditional brick-and-mortar bank with around 1,100 branches (mostly on the East Coast). Customers can open checking accounts, savings accounts and CDs. Eligible borrowers may also take out mortgages, auto loans, credit cards, home equity lines of credit and more. But if you're looking for the best CD rates or savings accounts with higher APYs, TD Bank might not be your best option. However, with generous sign-up bonus offers on its checking and savings accounts, TD Bank earns a spot on Slickdeals' Best New Bank Bonuses and Promotions list.

Referral bonus: When you refer a friend who opens an eligible TD Bank account, you can earn $50 and so can your referral.

How to Get a Referral Bonus From TD Bank

To refer a family member or friend to TD Bank and earn a bonus, follow these steps:

- Complete the TD Bank "Share the Green" referral form (downloadable pdf).

- Distribute a completed referral form to your family member or friend.

- Have your loved one take the referral form to a TD Bank store to open a personal checking account.

- TD Bank will pay you up to 10 referral fees of $50 each per year for a maximum overall bonus of $500.

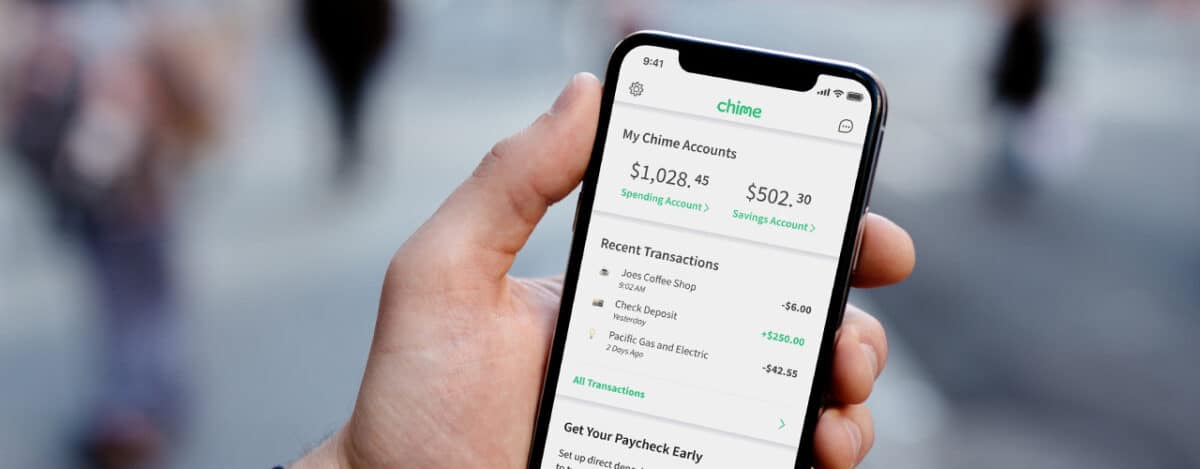

4. Chime: $100 Referral Bonus

Chime is a financial technology company that lets users send and receive money and take advantage of several other banking services via its mobile app. While Chime is technically not a bank, it works with both The Bancorp Bank, N.A., and Stride Bank, N.A, which are both FDIC-insured banks. Deposit accounts, like Chime Checking, are insured up to the standard maximum deposit insurance amount of $250,000 through these partner banks.

Referral bonus: Chime users can get a $100 bonus when they refer someone new to Chime and that person gets a direct deposit of at least $200 to their Chime account.

How to Get a Referral Bonus From Chime

Here are the steps to getting a Chime referral bonus:

- Log in to the Chime app and navigate to the Settings section.

- Tap “Invite Friends, get paid.”

- Pick who you want to invite from your contacts and tap Send.

- You can also share your invitation on social media by just pasting in the link.

- Your friend must be new to Chime and use your invitation to sign up.

- Your friend needs to enroll in direct deposit and receive at least one direct deposit of $200 or more within 45 days of opening their account.

- Once all the above steps are complete, you and your friend both receive $100.

Chime® Checking Account

This product is currently not available via Slickdeals. All information about this product was collected by Slickdeals and has not been reviewed by the issuer.

- Our Rating 4.5/5 How our ratings work

- APYN/A

- Minimum

Deposit RequiredN/A - Intro Bonus N/A

The Chime® Checking Account is a convenient, hassle-free way to do your banking. The account doesn't charge a monthly fee, annual fee, transfer fees or minimum balance fees, and also includes some helpful features like early direct deposit – which lets users access their paycheck up to 2 days early – and a Chime Visa® Debit Card.

Disclaimer: Banking services and debit card provided by The Bancorp Bank N.A. or Stride Bank, N.A., Members FDIC, pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa debit cards are accepted.

Overview

With handy filters like early direct deposit –which lets you access your paycheck up to 2 days early – FDIC insurance, and a Chime Visa® Debit Card, The Chime® Checking Account is a fantastic online checking option.

Pros

- No monthly fees or maintenance fees

- Included Chime Visa® Debit Card

- No minimum opening deposit

- Receive paychecks up to two days early with direct deposit

Cons

- No physical branch locations

Bottom Line

Pretty much everyone needs at least one bank account, and it’s normal to switch banks from time to time. So if you’re planning on opening a new account, why not get a bonus for referring a friend along the way? Referral bonuses can put a little extra cash in your pocket, usually for doing very little work. Some of the bigger bonuses are attached to accounts that require you or your friend to maintain big balances, but some, like the ones on our list, have fairly easy requirements. It’s always best to do your homework as you shop around for the best bank for your needs. If you find one with a referral bonus, that’s just icing on the cake for those who can’t pass up a good deal.

Related Article

Related Article