Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

For non-U.S. citizens living and working in the U.S., getting a loan might seem difficult. While it is true that the personal loan process can be more involved and complex for non-citizens, it is possible to get approved. We'll walk you through how to apply for a loan if you're not a citizen, and some options to consider.

Can Non-U.S. Citizens Get Approved for Personal Loans?

Yes, non-U.S. citizens or permanent residents can qualify for personal loans, but lenders and traditional banks may have stricter credit or income requirements. There are lenders out there that do specialize in lending to nonresidents, which can increase your chances of getting approval.

Here are some things that lenders may look at when determining your eligibility:

- Strong credit history: You'll need to establish a solid credit score in the U.S., which can generally take several months to at least a year. Demonstrating consistent payment history on utilities, rentals or other bills might help as well.

- Financial stability and employment: Lenders want to see that you're able to repay the loan, and having steady employment and income can boost your eligibility. You may have to prove your income with documents like bank statements or paystubs.

- Proof of residency: You may have to show proof that you’re living in the country legally by presenting a copy of your Green Card or visa. If you haven't received your card yet, a copy of the temporary visa in your passport may be acceptable.

- Having a co-signer: Most lenders may require that you apply with a co-signer who has good credit, as this person will be responsible for paying the loan in the event you default.

Loans for non-citizens are very similar to personal loans for U.S. citizens. However, the most significant difference is that the process could take a bit more paperwork, verification, and time.

Best Personal Loans for Co-Signers & Co-Borrowers

Why Borrowing Is Challenging for Non-U.S. Citizens

Lenders consider non-U.S. citizens to be high-risk borrowers, regardless of their visa status or income background. Many visa holders are only in the U.S. for a limited period of time and may leave the country eventually — and once they do, it can be hard to enforce loan payments as U.S. laws do not apply to them when abroad.

Best Personal Loans for Non-U.S. Citizens

Here are a few personal loans that are accessible to those with permanent resident status or living in the U.S. on a valid visa.

- Best for Debt Consolidation: Achieve

- Best for No Fees: LightStream

- Best for Fast Funding: LendingClub

- Best for Secured Loans: Best Egg

- Best for Limited Credit: Upstart

Loan results will vary based on creditworthiness, loan purpose, loan amount, and other factors.

Best for Debt Consolidation: Achieve

Achieve

- Loan Amounts$5,000 - $50,000

- Loan Terms24 - 60 months

- APR Range8.99% - 35.99%

- Minimum

Credit Score620 or aboveA credit score is used to indicate the creditworthiness of an applicant, but it is only one of several factors considered for approval. These credit scores alone are not guarantees for approval and should only be used as guidelines.

Achieve personal loans are accessible to fair credit borrowers, and several rate discounts are available for eligible borrowers.

Overview

While some personal loan lenders only work with borrowers who have good or excellent credit, borrowers with fair credit may also qualify for an Achieve personal loan, as the minimum credit score requirement is just 620. Some borrowers can also benefit from Achieve’s interest rate discounts, which can be obtained in one of three ways: if you add a qualified co-borrower, if you show proof of sufficient retirement funds, or if you are using loan funds to pay off creditors. If you’re looking for a lender with competitive rates and fast funding (within 24 to 72 hours of approval), Achieve is a solid choice. But keep in mind that Achieve is not available in all states.

Pros

- Minimum APR is relatively low

- May work with fair-credit borrowers

- Loans up to $50,000

- Rate discounts may be available for certain borrowers

- Fast approval and funds sent within 24-72 hours of approval

Cons

- Longer funding time than some competitors

- High minimum loan amount

- Relatively short maximum repayment term

Best for No Fees: LightStream

LightStream

- Loan Amounts$5,000 – $100,000

- Loan Terms24 – 144 months

- APR Range7.49% – 25.49% (with autopay)

- Minimum

Credit Score660 or aboveA credit score is used to indicate the creditworthiness of an applicant, but it is only one of several factors considered for approval. These credit scores alone are not guarantees for approval and should only be used as guidelines.

LightStream is a solid online lender offering no fees, high loan maximums and low-rate personal loans for several purposes.

Overview

LightStream offers personal loans for several purposes, including debt consolidation, medical expenses, home improvement, weddings, car purchases and more, making this worth considering for those seeking flexibility. The lender offers relatively low rates compared to competitors, including autopay discounts. Its personal loans also have no origination fees or late fees, which can help keep borrowing costs low. However, borrowers will likely need to have good-to-excellent credit in order to be approved for a LightStream personal loan. Overall, it’s a good lender to add to your shortlist if you’re looking for flexible funding, no fees and a low APR. Lightstream may also disburse loans as soon as the same day you’re approved, making this lender a worthy choice if you need fast funding.

Pros

- Low minimum APR

- No origination fees, no late fees

- High loan maximum of $100,000

- Autopay discount

- Joint applications allowed

Cons

- Rates and terms vary by loan purpose

- No soft pull prequalification

- Must have good-to-excellent credit

- No physical branches

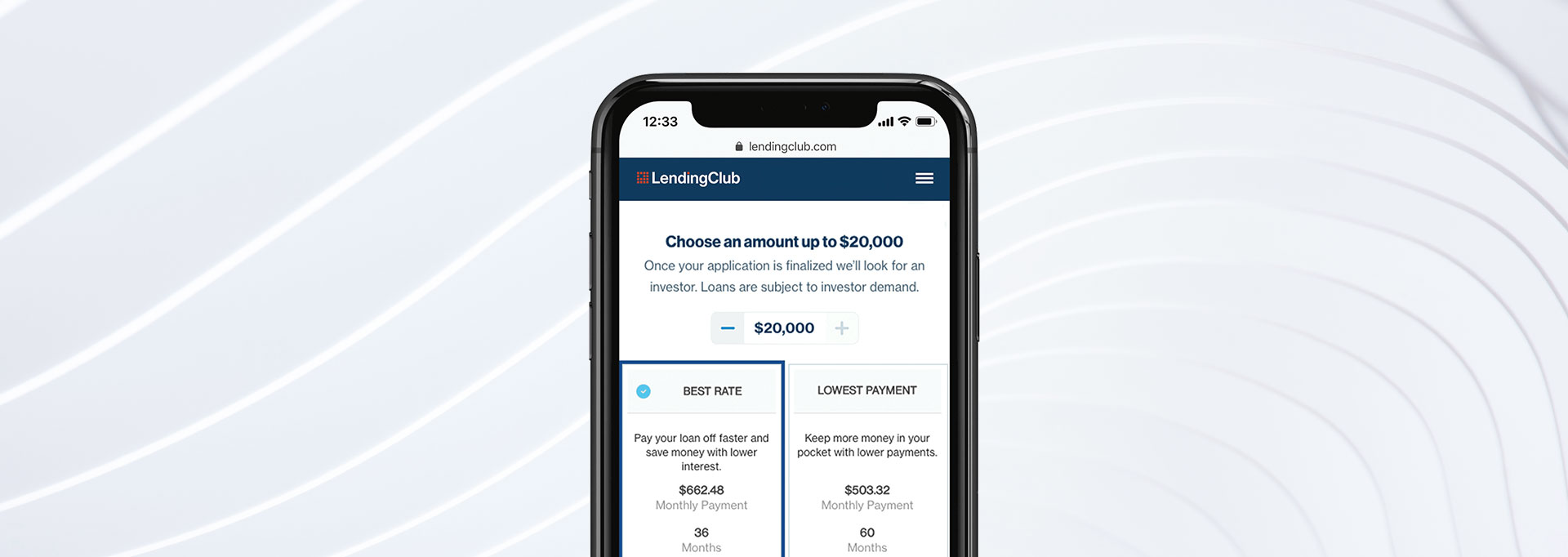

Best for Fast Funding: LendingClub

LendingClub

- Loan Amounts$1,000 – $40,000

- Loan Terms24 – 60 months

- APR Range9.57% – 35.99%

- Minimum

Credit Score600 or aboveA credit score is used to indicate the creditworthiness of an applicant, but it is only one of several factors considered for approval. These credit scores alone are not guarantees for approval and should only be used as guidelines.

Borrowers in the fair credit range who need a small loan can appreciate LendingClub's quick funding and option for direct payments to creditors with debt consolidation loans.

Overview

LendingClub can be a good fit for those looking to consolidate high-interest debt, as they offer the ability to pay your creditors directly from your loan. You can also use LendingClub loans for almost any purpose, from home improvements to medical bills. Eligible borrowers who need some assistance qualifying can apply for a joint loan, and borrowers can expect to receive funding as soon as 24 hours after approval. However, APRs do start at relatively higher rates than some competitors.

Pros

- Low minimum loan amount

- Fast funding for personal loans (receive funds as little as 24 hours after approval)

- Joint loans allowed

- Direct payment to creditors

- Check rates without a hard credit inquiry

Cons

- Has origination fees

- No physical branches

- Lower maximum loan amount than some lenders

Best for Secured Loans: Best Egg

Best Egg

- Loan Amounts$2,000 – $50,000

- Loan Terms36 – 60 months

- APR Range8.99% – 35.99%

- Minimum

Credit Score700 or aboveA credit score is used to indicate the creditworthiness of an applicant, but it is only one of several factors considered for approval. These credit scores alone are not guarantees for approval and should only be used as guidelines.

Best Egg provides fast personal loans, including unsecured and secured options.

Overview

You can use Best Egg loans for various purposes, including paying for moving expenses, home improvements, debt consolidation, weddings, adoption and more. Borrowers will pay origination fees and need a minimum annual income of $100,000 to qualify for their lowest rates. Best Egg products are not available for residents in Iowa, Vermont, West Virginia, the District of Columbia or U.S. Territories.

Pros

- Loans are funded as soon as the next day

- Loans up to $50,000

- Option for secured loans for homeowners

Cons

- No physical locations

- Has origination fees

- Steep income and credit requirements

- Doesn’t allow co-signers or joint applicants

- Not available in all states

Best for Limited Credit: Upstart

Upstart

- Loan Amounts$1,000 – $50,000

- Loan Terms36 or 60 months

- APR Range7.8% - 35.99%

- Minimum

Credit Score300 or aboveA credit score is used to indicate the creditworthiness of an applicant, but it is only one of several factors considered for approval. These credit scores alone are not guarantees for approval and should only be used as guidelines.

Using artificial intelligence to help evaluate borrowers, Upstart is a unique lending platform that looks beyond your credit score for personal loan approval.

Overview

Upstart is a first-of-its-kind online lending platform that uses artificial intelligence to help make smarter lending decisions. This means the company considers factors beyond a borrower’s credit score to help determine creditworthiness. Upstart indicates its model has resulted in 43% lower rates for borrowers than traditional credit score models.

Beyond your credit score, Upstart will also look at your employment history, income and level of education when deciding whether to approve you for a loan. The company states that borrowers with credit scores as low as 300 might be able to get approved for a personal loan, though that loan may come with a relatively high APR.

Upstart’s rates are fairly competitive and loan funds are disbursed as soon as one business day after approval. This lender charges origination fees, so it’s important to read the fine print before applying.

Pros

- Considers factors beyond your credit score in lending decisions

- Loans up to $50,000

- Fast funding time

- Check rate without affecting credit score

- Low minimum credit score requirement

Cons

- No physical locations

- Limited repayment terms

- Has origination fees

- High maximum APR

- Not available in Iowa or West Virginia

What Visas Are Required to Get a Personal Loan?

Lenders will typically require that you have a green card or visa with at least two years remaining, but some may accept it if you had six months left. Those with visas that are about to expire may have trouble finding a lender that will approve your personal loan.

Depending on the lender, here are a few examples of visas that may qualify for a personal loan.

- DACA recipients

- Asylum seeker

- E -1, E-2. E-3

- F-1-OPT, OPT STEM

- H-1B, H-2A, H-2B

- J-1

- L-1

- G

- O-1

- TN

Lenders will need to see proof of the borrower's visa status along with employment authorization forms.

How to Improve Your Chances of Approval

Lenders take on a lot of risk when giving out personal loans to non-U.S. citizens, which is why they have stricter eligibility requirements. But here are some things you can do to increase your chances of approval:

- Build up your credit with a credit card. Some issuers have credit cards specifically for non-residents, including international students or new immigrants. You can apply for a credit card, make purchases, and repay the balances on time to build up your credit score.

- Get a co-signer. If you get a co-signer with a good credit history, you can improve your chances of getting approved for a loan. It's important to keep in mind, however, that if your payments are delayed, it can impact both your credit rating and that of your co-signer.

- Offer collateral. Getting a secured personal loan backed by collateral reduces the lender's risk. But if you don't repay the loan according to your agreement, the lender can seize the asset.

- Become an authorized user on a credit card. If a trusted friend or family member adds you as an authorized user on their credit card, you can benefit from the credit boost when they make monthly on-time payments.

How to Get a Personal Loan as a Non-U.S. Citizen

The steps to getting a personal loan can vary by lender, but here is what you can generally expect and how to get started:

- Research and compare your options: Find a lender that is willing to work with non-U.S. citizens. You can check out traditional banks, credit unions, or online lending institutions. Get prequalified with multiple lenders so you can compare their loan offers, including rates and terms.

- Gather your documents: Verify with the lender what type of documents they'll need from you. You'll typically need to provide forms of identification, proof of income, employment authorization forms, and a copy of your visa status. Some lenders may require additional information.

- Apply for the loan: Once you've decided on a lender, formally apply for the loan. Submit the application and any necessary documentation. If the lender asks for more documentation, provide it as soon as possible to avoid delays.

- Receive approval and funding: If your loan is approved, you'll receive your funding within several business days. The funds are disbursed straight into your bank account.

- Repay the loan: Once you receive the funds, you should make every effort to keep up with the payments. Set up autopay and notifications to remind you of every payment.

If your loan application was denied, ask the lender what you could do to improve your chances the next time you apply for a loan. In many cases, they may tell you exactly why the loan wasn't approved in their denial notice.

Related Article

Related Article

How to Prequalify for a Personal Loan, and Why It Can Be a Good Idea

What Documents Do I Need?

Even though each lender has their own documentation requirements depending on your residency status, here’s a list of common information they may request.

|

Personal Identification |

|

|

Proof of Residency |

|

|

Employment |

|

|

Income |

|

|

Education |

|

|

Proof of Address |

|

If you are a non-permanent resident, you may only have a few of these documents on hand. Don't let that stop you from searching for a lender. Some institutions are willing to lend to non-permanent residents with limited documentation.

The Bottom Line

Despite a more in-depth application process, getting personal loan approval as a non-U.S. citizen is possible. As long as your documentation proves you’re in the country legally and are financially able to repay the loan, there are lenders that are willing to work with you. It just takes a bit more research to find the right one.

FAQs

-

No, you can still apply for a personal loan or open a bank account without a Social Security number (SSN). If you do not have a SSN, you can use an Individual Taxpayer Identification Number (ITIN). Many lending institutions accept ITINs when a Social Security number is unavailable.

-

Personal loans generally range from $600 to up to $100,000. If you are not a U.S. citizen, you'll likely be limited in how much you can borrow, as lenders may be hesitant to lend you a large sum. You may also face higher rates than someone with good credit who is a citizen.

-

Yes. Banks and lending instituations do provide personal loans to non-permanent resident borrowers as long as they meet the bank’s requirements. However, lending instituations may have stricter requirements for non-U.S. citizens, such as requiring a co-signer.