Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain. Non-Monetized. The information related to Chase credit cards was collected by Slickdeals and has not been reviewed or provided by the issuer of these products. Product details may vary. Please see issuer website for current information. Slickdeals does not receive commission for these products/cards.

With 2020 in the rearview mirror, most people don’t want to look back at what many consider the worst year of their lives. The COVID-19 pandemic changed the way we live forever, including how we manage our finances.

Our latest survey, conducted by OnePoll, gives us a revealing snapshot of how Americans’ spending and savings habits were flipped upside down due to the pandemic and how these new habits are trending a year later.

Changes in Spending Habits

OnePoll conducted the latest Slickdeals-commissioned survey, which polled 2,000 Americans. Of those surveyed, 60% of people reported that 2020 had affected their budget and spending habits forever.

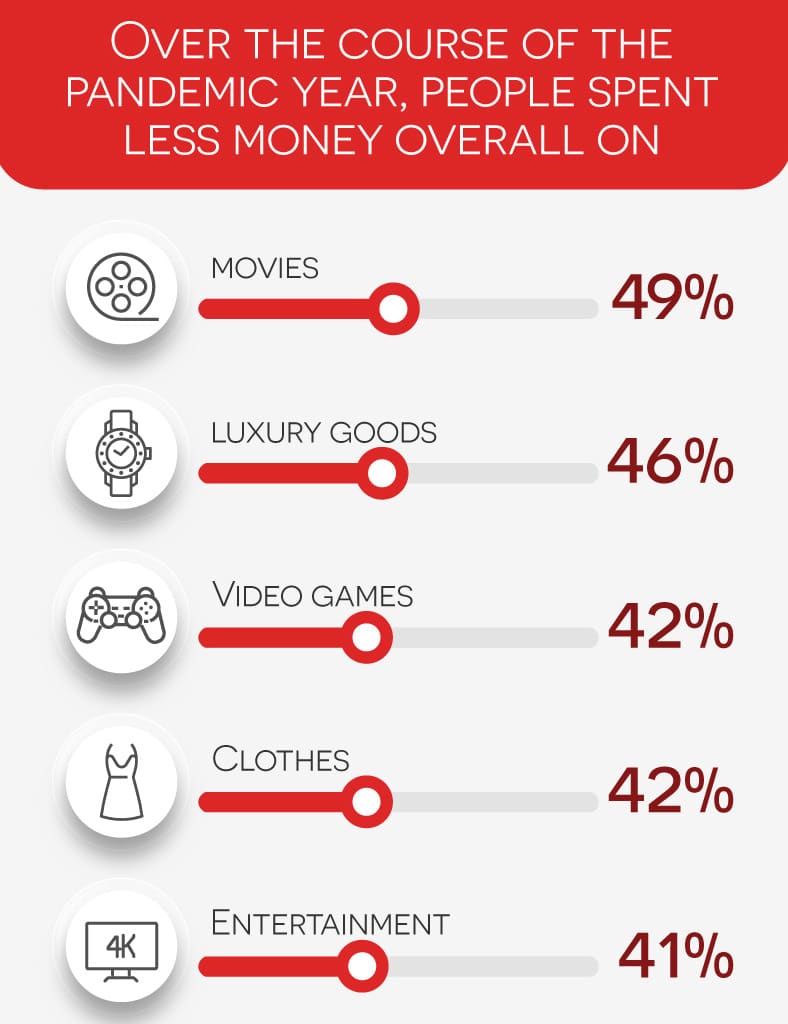

Many Americans struggled to make ends meet. Our daily lives changed this past year thanks to stay-at-home orders, business closures and general concerns about health and safety. Because of COVID-19’s disruption of the status quo, non-essential spending dropped considerably in 2020.

What Did Americans Spend Less On During 2020?

- Movies 49%

- Luxury goods 46%

- Video games 42%

- Clothes 42%

- Entertainment 41%

Instead, Americans increased spending on essential items and their physical, mental and emotional well being.

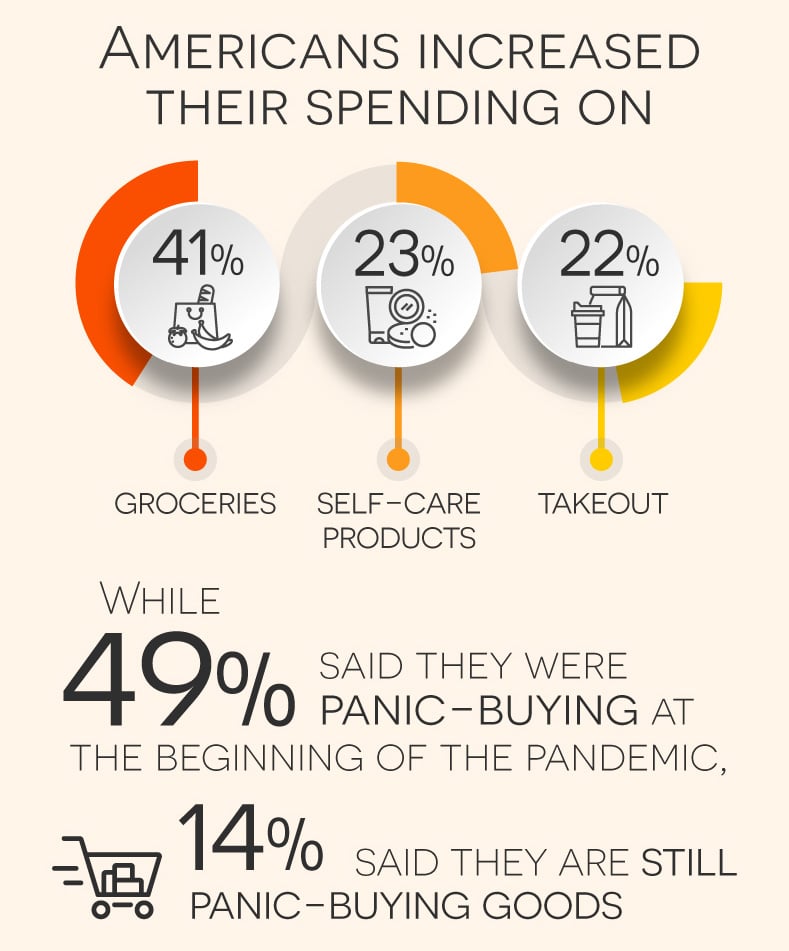

What Did Americans Spend More On in 2020?

- Groceries 41%

- Self-care products 23%

- Bills 22%

- Takeout/Restaurant Dining 22%

- Healthcare 20%

Changes in Panic Shopping for Americans

Panic shopping has changed considerably since the start of the pandemic. Our May 2020 spending survey showed Americans were spending 18% more during lockdowns. Our latest study revealed that nearly half of Americans were panic-buying essential goods, like toilet paper, water, hand sanitizer and cleaning products at the beginning of the pandemic.

One year later, essential items are still a hot commodity, but not at the same level as before.

Spending Increase at the Beginning of the COVID-19 Pandemic

- Toilet paper 50%

- Cleaning supplies 42%

- Hand sanitizer 41%

- Water 41%

- Paper towels 40%

Spending Increases a Year Later

- Toilet paper 35%

- Cleaning supplies 31%

- Hand sanitizer 29%

- Water 31%

- Paper towels 28%

The Cost of Staying Home

The pandemic changed where Americans spent most of their time, which also affected their budgets. More than half (58%) of people surveyed said they reallocated their “going out” budget for staying in, with 41% of people spending more money on nesting by comfortably redecorating their home.

Renewed focus on living spaces also changed how people felt about their homes. Nearly three-quarters (73%) of these nesters feel more pride in their home since they began investing more money and time into household repairs. Seventy-six percent of these proud nesters believe they’ll spend more time post-pandemic at home because they’ve fallen in love with their homes.

Related Article

Related Article

9 Money Moves to Set Your Finances on the Right Path: An End of Year Financial Checklist

More than a third (37%) describe their redecorated homes as sanctuaries for themselves and their families. A quarter even said their homes felt cozier and more put-together than ever before.

“Our internal data supports what consumers are reporting in this survey when it comes to their spending over the course of the pandemic year,” said Ryan Tronier, senior personal finance editor for Slickdeals. “We’ve found search volume continues to remain high in the categories of home improvement and home office; and while there’s been a decline since the height of pandemic for searches related to essential items, terms like toilet paper continue to be popular with our users.”

Financial Struggles Through the Pandemic

As with many things in 2020, not all spending changes were voluntary for Americans. Two out of five Americans said they had a “significant” financial setback or loss in 2020. For 75% of respondents, money problems made them reevaluate their long-term budgets. In addition to budget cuts, 43% of people had to deal with unexpected expenses within the past year.

Unexpected Expenses During the COVID-19 Pandemic

- New bills 31%

- New savings costs 22%

- Clothes 22%

- Groceries 19%

Americans also experienced increases in other unexpected expenses this past year, like funerals, medicine and health expenses. Sixty-seven percent of respondents said they received a stimulus check within the past year, which, for most of them, was spent on necessities like bills, groceries and savings.

Spending, Saving and Shopper Guilt

While habits changed considerably this past year, Americans still experienced guilt about how they spent their money. Twenty-nine percent of respondents felt guilty for buying something unnecessary with their stimulus money. Respondents felt guilty for buying items like designer bags and shoes, new appliances, weekend getaways, skincare products and even home decor.

When the paycheck comes in, 69% of Americans will first tackle their bills. After that, however, they will go shopping.

- Groceries 54%

- Transportation 31%

- Clothes 25%

- Medications 21%

- Pets 21%

American spending habits also point towards hunting for the perfect deal. Over half (54%) would be willing to spend more than their budget would allow if the item they want is on sale. Nearly as many (52%) are willing to buy things in bulk if they’re on sale.

All the same, eight in 10 Americans are more likely to buy essential items on sale than non-essential items and luxuries.

The good news is that by using Slickdeals, Americans can find the best deals, saving more of their money for other necessities.

Tronier added, “The study showed that the past year has significantly impacted how a majority of Americans spend their money. However, while budget priorities have changed, our Slickdeals community of savvy shoppers has consistently helped one another discover the best products at the best prices, from toilet paper to technology.