Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

For Capital One products listed on this page, some of the benefits may be provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

In the days of the Wild West, a grizzled cowboy might have paid for his drinks at the saloon with a satisfyingly hefty sack of metal coins. Those days are long behind us, but metal credit cards are something like the modern equivalent.

Metal credit cards function the same as plastic ones, but the look and feel of a metal credit card has a certain aura to it. These cards can also sometimes offer better perks or rewards, but may come with a higher annual fee. If you want to hop on the metal credit card wagon, here are the best metal credit cards to pay in style.

- Best for Overall Value: Chase Sapphire Preferred®

- Best Affordable Travel Card: Capital One Venture Rewards Credit Card

- Best for Premium Travel Perks: Chase Sapphire Reserve®

- Best for Frequent United Flyers: United Club℠ Infinite Card

- Best for Amazon Power Shoppers: Prime Visa Credit Card

- Best for Foodies: American Express® Gold Card

Chase Sapphire Preferred®

- Our Rating 5/5 How our ratings work

- APR21.49% - 28.49% (Variable)

- Annual Fee$95

-

Sign Up Bonus

60,000Chase Ultimate Rewards Points

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠. Dollar Equivalent: $1,380 (60,000 Chase Ultimate Rewards Points * 0.023 base)

The Chase Sapphire Preferred Card is one of the gold standards for earning travel rewards. It has a generous sign-up bonus and you can earn points on travel and dining expenses. The card does have an annual fee, but you can continue earning points through bonus categories and an anniversary points boost.

Overview

The Chase Sapphire Preferred is pretty flexible as it lets you transfer rewards points into miles or points several airlines and hotel programs. You can take advantage of strong transfer partners such as United, Southwest, Singapore Airlines, Virgin Atlantic and Hyatt. Similarly, you can book any reservation you want through the Chase Travel℠ portal. Although the card might not be ideal for the most frequent travelers, it has a built-in upgrade path, so when it’s time to level up your travel rewards game, you won’t have to start from scratch.

Pros

- Points are easily transferable to airlines and hotel partners

- Accelerated earnings on dining, travel & household purchases

- Excellent travel and purchase protections

- No foreign transaction fees

Cons

- Not ideal for the highest spenders

- $95 annual fee

Why We Like It:

The Chase Sapphire Preferred® has a $95 annual fee, but this card offers many ways to earn and maximize the value of your Chase Ultimate Rewards points. The Sapphire Preferred is known for being one of the best cards for versatility thanks to Chase’s large number of transfer partners. In addition, Ultimate Rewards points are among the most valuable credit card points. With the Sapphire Preferred, your points are worth 25% more when redeemed for Chase Travel℠.

This card also comes with a generous welcome offer and annual credits, making this card well worth the annual fee.

Weight: 13 grams

Card Benefits:

- 5X points on Chase travel, 2X on all other travel

- 3X points on dining, select streaming services and online grocery purchases

- 25% point boost when you redeem for through Chase Travel℠

- Each anniversary year, earn a point bonus equal to 10% of your total purchases from the previous year

- Includes travel and purchase protections, such as trip cancellation and auto rental collision damage waiver

- $50 annual hotel credit

Best for overall value: The Sapphire Preferred offers incredible value overall with an affordable annual fee.

Related Article

Related Article

Why the Chase Sapphire Preferred and Chase Freedom Unlimited Make the Perfect Duo

Capital One Venture Rewards Credit Card

- Our Rating 4.5/5 How our ratings work

- APR19.99% - 29.99% (Variable)

- Annual Fee$95

-

Sign Up Bonus

75,000Capital One Rewards Miles

Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel Dollar Equivalent: $1,350 (75,000 Capital One Rewards Miles * 0.018 base)

The Capital One Venture Rewards Credit Card offers a lot of value to both beginner and expert travelers. The upfront bonus and high ongoing rewards rate aren’t easy to beat, making the card a solid option for a large audience. Where it really shines is with the flexibility of the redemption process, though. You can redeem miles to cover past travel expenses, book travel through Capital One or transfer miles to any of Capital One’s airline and hotel loyalty programs.

Overview

The Capital One Venture Rewards Credit Card offers a lot of value to beginner and expert travelers alike. The card’s big upfront bonus and high ongoing rewards rate aren’t easy to beat, making it a solid option for a large audience. Where it really shines, though, is with the redemption process. When it comes to travel credit cards, it can be really challenging to find a way to use your rewards in the way you want.

With hotel and airline credit cards, for instance, you’re basically stuck redeeming your points or miles with the co-branded hotel or airline partner. And with some general rewards programs, you might get less value if you use your points or miles to book a flight versus a rental car or hotel.

With the Capital One Venture Rewards Credit Card, though, you’ll get a lot of flexibility. Here are some of the top redemption options that are available: redeem miles to cover past travel expenses, book travel through Capital One or transfer miles to any of Capital One’s multiple airline and hotel loyalty programs.

Perks

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- No foreign transaction fees

- Access to premier culinary events, must-see music events and major sporting events

Pros

- Simple rewards and earning structure

- Ability to earn transferable points to use with travel partners

- Relatively modest $95 annual fee

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

Cons

- Other travel cards offer higher rewards rates on certain spending categories

Why We Like It:

The Capital One Venture Rewards Credit Card is a foray into the world of premium credit cards. While other cards might have more bells and whistles, they generally have annual fees that reflect that. This card does have an annual fee, but at just $95 (Rates & Fees), it’s an affordable way to gain access to some premium perks.

Cardholders can earn unlimited 2X miles on every purchase—there are no rotating categories or special bonus categories to track or activate. The Capital One Venture Rewards Credit Card also excels as a travel card because you'll earn unlimited 5X miles on hotels and rental cars booked through Capital One Travel.

Weight: 16.6 grams

Card Benefits:

- Unlimited 2X miles on every purchase, plus 5X miles on hotels and rental cars booked through Capital One Travel

- Up to a $100 application fee credit for Global Entry or TSA PreCheck® when you pay the fee with your card (Rates & Fees)

- Transfer miles to 15-plus travel loyalty programs

Best for an affordable travel card: With its high rewards rate on every purchase and nice travel perks, this card is great for the average traveler.

Related Article

Related Article

Who Should (and Shouldn’t) Get the Capital One Venture Rewards Credit Card

Chase Sapphire Reserve®

- Our Rating 4.5/5 How our ratings work

- APR22.49% - 29.49% (Variable)

- Annual Fee$550

-

Sign-Up Bonus

60,000Chase Ultimate Rewards Points

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠. Dollar Equivalent: $1,380 (60,000 Chase Ultimate Rewards Points * 0.023 base)

This card features an annual credit for travel purchases, which can offset the annual fee, plus bonus points when you sign up. You'll also get free access to tons of Priority Pass lounges and restaurant options around the world, along with access to the Chase Sapphire Lounge network.

Overview

If you’re looking to elevate your travel experience, look no further than the Chase Sapphire Reserve. When you first get approved, you’ll earn a generous sign-up bonus that can be used for travel-related spending booked through Chase Travel℠. Transfer the points to one of Chase’s airline or hotel partners and they’re potentially worth even more.

Pros

- An array of premium travel perks including access to Priority Pass lounges

- Easy-to-use $300 travel credit that helps offset card's annual fee

- Generous rewards rates for spending

Cons

- High annual fee may be a deterrent for some

- Perks are starting to get stale relative to newer competition

Why We Like It:

The Chase Sapphire Reserve® is undoubtedly one of Chase’s best cards, offering a plethora of credits, perks, and bonuses for frequent travelers. While its welcome offer doesn’t provide as much bang for your buck as the Sapphire Preferred, it offers so much more in terms of ongoing benefits. Those who like to travel in style won’t find many options better than this card.

One of the Chase Sapphire Reserve’s best benefits is its $300 annual travel credit, which takes a big chunk out of its $550 annual fee. But that hardly compares to the $1,200 in value you can get from this card in the form of various credits and complimentary memberships to popular partners like DoorDash, Lyft and Instacart. You also get complimentary airport lounge access to over 1,300 airport lounges through Priority Pass Select, ensuring you can travel in comfort.

Weight: 13 grams

Card Benefits:

- $300 annual travel credit

- Up to $100 every four years as reimbursement for the application fee for Global Entry or TSA PreCheck® or NEXUS

- 50% points boost when you book travel through Chase Travel℠

- Priority Pass Select Membership, which offers access to 1,300+ airport lounges

Best for premium travel perks and rewards: This card is packed with luxury perks and travel credits, making it a great choice for those who like to travel comfortably.

United Club℠ Infinite Card

- Our Rating 4.0/5 How our ratings work

- APR21.99% - 28.99% (Variable)

- Annual Fee$525

-

Sign Up Bonus

90,000United MileagePlus Miles

Limited-time offer: Earn 90,000 bonus miles after you spend $5,000 on purchases in the first 3 months from account opening. Dollar Equivalent: $1,260 (90,000 United MileagePlus Miles * 0.014 base)

United’s premier card comes with a sizable annual fee, but if you’re a serious United flyer, want lounge access and can use other perks like free checked bags or the TSA PreCheck credit, you could eke a lot of value out of this card. Those who can’t use enough of the perks to offset the high annual fee may be better off with a different card.

Overview

If you love United Airlines, can fly with the airline often and enjoy benefits like airport lounge access free checked bags and quick trips through airport security on busy travel days, then the United Club Infinite Card is made for you. It’s loaded with travel perks such as statement credits and valuable insurance benefits.

Pros

- You and your eligible travel companions can enjoy complimentary access to United Club locations

- Up to $100 statement credit for your Global Entry, TSA PreCheck or NEXUS application

- Check up to two bags for free

Cons

- $525 annual fee will only be worth it for United loyalists

Why We Like It:

If you fly United often, the United Club℠ Infinite Card may just be the right choice for you. This card includes an exhaustive number of premium benefits for United passengers, and it makes it easy to earn cash back. There is also a lucrative welcome offer that makes the card well worth the hefty annual fee.

The United Cub Infinite Card has a sky-high rewards rate on United purchases, application fee credits for Global Entry, TSA PreCheck® or NEXUS, and a $75 statement credit for IHG bookings. And if you are checking bags, you and a companion can get your first and second bags checked free. But best of all, the card comes with a United Club membership which gets you access to more than 45 United Club lounges worldwide (valued at $650).

Weight: 12 grams

Card Benefits:

- Complimentary United Club membership—up to $650 value per year

- Up to $100 as a statement credit for Global Entry, TSA PreCheck® or NEXUS every 4 years as reimbursement for the application fee when charged to your card

- Premier Access® travel services, which give you preferential treatment at the airport

- 25% discount on in-flight purchases of food, beverages, and Wi-Fi

- Free first and second checked bags

- $75 IHG Statement Credit

Best for frequent United customers: If you have flown United more times than you can count this year, the United Club Infinite Card might be well worth it.

Prime Visa Credit Card

- Our Rating 3.5/5 How our ratings work

- APR20.49% - 29.24% (Variable)

- Annual Fee$0

$0 with Prime membership

-

Sign-Up Bonus

$200Gift Card

Get a $200 Amazon Gift Card instantly upon approval exclusively for Prime members

This card is a good fit for consumers who do a lot of shopping at Amazon and Whole Foods because they can earn an unlimited 5% cash back on purchases there. Cardholders also earn some cash back on other purchases, with decent rates for restaurants and gas stations. If you already have or plan to get a Prime membership, using this card could quickly earn you sizable cash back.

Overview

With high rewards rates, this card could make up for the required Prime membership fee if you shop a lot at Amazon and Whole Foods. Non-Prime members can qualify for the Prime Visa Credit Card, which is pretty similar but with lower rewards rates.

Pros

- No annual fee

- High rewards rates

- Sign-up bonus offer

- Can redeem rewards as soon as the next day

- No foreign transaction fees

Cons

- Must have a Prime membership for highest rewards rates

- No intro APR offer

Why We Like It:

You can buy just about anything on Amazon, and many of us do. If you’re going to buy everything on Amazon, why not get rewarded for it? The Prime Visa Credit Card offers generous rewards to Amazon Prime members, not just on Amazon purchases but also on many of your everyday purchases.

It's hard to beat an unlimited 5% back on Amazon, Amazon Fresh and Whole Foods purchases. But these aren't the only ways to earn extra rewards with this card. You can also earn an unlimited 2% back on purchases at gas stations, restaurants and commuting. New cardholders can also receive a $200 Amazon gift card included upon approval with an eligible Prime membership—no minimum purchase is required for this bonus.

Weight: 12.4 grams

Card Benefits:

- Eligible Prime cardmembers earn unlimited 5% back at Amazon and Whole Foods Market—plus 10% or more on a rotating selection of items and categories on Amazon.com

- Includes auto rental collision damage waiver, baggage delay insurance, extended warranty, and other insurances and protections

- Redeem daily rewards at Amazon.com as soon as the next day

Best for Amazon Prime members: While this card includes a few benefits that anyone will appreciate, Amazon Prime members and Whole Foods shoppers will get the most value from it.

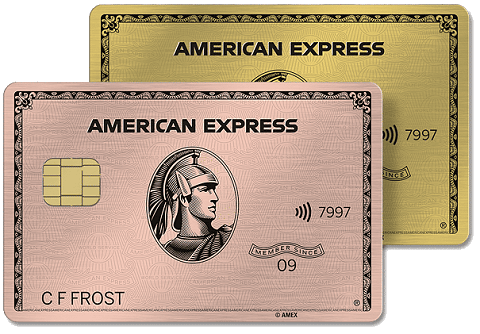

American Express® Gold Card

- Our Rating 4.5/5 How our ratings work

- APRSee Pay Over Time APR

- Annual Fee$250

-

Welcome Bonus

60,000Membership Rewards Points

Earn 60,000 Membership Rewards® points after you spend $6,000 within the first six months of card membership. Terms Apply. Dollar Equivalent: $1,140 (60,000 Membership Rewards Points * .019 base)

This card is a foodie’s dream—you'll earn outsized rewards at U.S. supermarkets and restaurants worldwide and get dining credits with select merchants. No foreign transaction fees and others credits make this card ideal for travelers, too. Plus, people who can take advantage of the annual statement credits may easily offset the annual fee. Enrollment is required for select benefits and terms apply.

Overview

Thanks to its generous rewards and attractive benefits, the American Express® Gold Card is a very popular rewards card. While most credit cards these days target frequent travelers, this card offers practical benefits that come in handy in your everyday life as well as your travels.

Pros

- Earns valuable Membership Rewards points

- A valuable card for food, including at U.S. supermarkets and restaurants worldwide

- An array of credits that help offset the card's annual fee

Cons

- Use it or lose it credits

- Perks are not for everyone

Why We Like It:

American Express offers a couple of premium travel cards, and the American Express® Gold Card is the smaller cousin of the The Platinum Card® from American Express. While the Gold card has trimmed-down benefits, its annual fee is a much easier pill to swallow (Terms Apply; see rates and fees). Besides, it still offers plenty of value in exchange for a middle-of-the-road annual fee.

The American Express Gold Credit Card earns 4X Membership Rewards® points at restaurants worldwide, plus takeout and delivery in the U.S. Additionally, earn 4X points at U.S. supermarkets on up to $25,000 in purchases per year (then 1X). You also earn 3X points on flights booked directly with airlines or on AmexTravel.com. This card includes a couple of credits that can nearly pay for the annual fee on their own.

Weight: 15 grams

Card Benefits:

- Up to a $120 dining credit ($10 statement credits per month) when you dine at GrubHub, The Cheesecake Factory, Goldbelly, Wine.com, Milk Bar and select Shake Shack locations

- Up to $120 in Uber Cash per year, issued in $10 monthly credits (only applicable for U.S. Eats orders and Rides; Gold Card needs to be added to the Uber app to receive the benefit)

- $100 experience credit on bookings through Amex's The Hotel Collection. The Hotel Collection requires a minimum two-night stay

- 4X Membership Rewards Points at restaurants and supermarkets

Best for foodies: If you dine out often and spend considerably on groceries, this card includes great rewards rates on restaurants and U.S. supermarkets, in addition to a $120 dining credit each year. Enrollment is required for select benefits.

Why Do People Want Metal Credit Cards?

There are many reasons people may want metal credit cards. Some are directly related to their perks, while others may be tied to the aesthetic experience. Here are some possible reasons:

- Metal credit cards can be a status symbol. Fancy watches, handbags, and shoes are some of the items people might adopt as status symbols. For some, metal credit cards could be in that category as well, suggesting the cardholder has a certain level of wealth.

- They have great rewards and benefits. While this isn’t always the case, metal credit cards are often premium cards reserved for those with the best credit scores. In exchange, they often have high rewards rates, provide numerous statement credits, and have premium perks that can more than pay for their annual fees.

- They have aesthetic appeal. Plastic credit cards might be the norm, but they aren’t very appealing to see or touch. Metal credit cards often look nicer with glossy finishes, intricate designs and simple appearances that make them appear luxurious.

- They can be more durable. Plastic cards are durable enough, but they may not have the durability of metal credit cards. The latter is less likely to bend, crack, or wear out over time, which means they can last longer than plastic cards.

- They have a strong social perception. Something about using a metal credit card just “feels” better than using a plastic card. Whether founded or unfounded, using these cards can convey a sense of financial success and stability.

These are just a few of the reasons people might want a metal credit card. While these cards can seem better than their plastic counterparts, it’s important to review their full list of benefits and perks and consider their annual fees. This will give you a better sense of how the card fits within your budget.

What Qualifies You for a Metal Credit Card?

This may vary by credit card, as not all metal credit cards are the same. In general, metal credit cards tend to be premium cards meant for big spenders. As a result, you may need to meet certain criteria to qualify:

- Have a good to excellent credit score. Generally, a credit score in this range will give you the best chance of qualifying for any credit card. With metal credit cards, you may need a score closer to the excellent range.

- Have adequate income. Card issuers like to see you have enough income to keep up with the card’s spending requirements and annual fee, which can be high for metal credit cards.

- Have the right spending behavior. Issuers of metal credit cards may consider spending behavior. For instance, they may want to see if you can meet certain spending thresholds and if you will make use of the card’s premium benefits.

- Have a strong credit history. Credit card issuers prefer consumers with a strong credit history because it shows an individual is more likely to make payments and exercise responsible credit card usage.

- Have an existing relationship with the issuer. While this isn’t a must, it may help if you are already a customer of the card issuer and have a good relationship with the company.

This list isn’t exhaustive, but meeting these requirements can increase your odds of getting a metal credit card.

Are Metal Credit Cards Worth It?

It's never a good idea to get a credit card solely for its aesthetic appeal. It’s important to consider the card's rewards structure, your spending habits, the perks, and whether all of these factors justify paying the annual fee.

Metal credit cards can be worth it for those who can take advantage of the card’s premium benefits and perks. For example, a travel credit card with a high annual fee is worth it if you fly often because the money you save on flights and the travel credits offered can offset the annual fee. However, the same card may not be worth it if you rarely travel.

Frequently Asked Questions

-

Metal credit cards are not as rare as they once were, but they are still less common than plastic credit cards. These cards were once seen as a status symbol and were reserved for high-net-worth individuals, especially in their early days. Now, there are dozens of metal credit cards that are accessible to the average consumer.

-

Some of the biggest downsides include high annual fees, limited eligibility, and difficulty destroying when your card has expired. It’s best to weigh the annual fee against the perks of the card and whether you will use them to their full benefit before signing up.

-

Metal credit cards have the same security features as plastic credit cards, including EMV chips and tap-to-pay.

Disclosures

For rates and fees of the American Express® Gold Card, please visit https://www.americanexpress.com/us/credit-cards/card-application/apply/prospect/terms/gold-card/26129-10-0/?print#terms-details