Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

Not all available financial products and offers from all financial institutions have been reviewed by this website.

Perhaps it’s finally time to expand your tiny kitchen, replace your carpet with hardwood or add a second bathroom to your home. But costs add up quickly, especially when it comes to unforeseen extras and upgrades. Using the right credit card can offer far more than just cash back or travel rewards. You may also be able to take advantage of interest-free purchasing periods, extended warranties, return or purchase protection benefits and even free cellphone insurance. Here are some of the best credit cards to consider for home improvement projects, as well as some tips to get the most out of your purchases.

Whether you are embarking on a DIY home remodel or upgrading your appliances, here are a few cards to consider for your home improvement purchases.

Recommended Credit Cards for Home Improvement

| Card | Welcome Offer | Rewards Rate | Best for | Learn More |

|---|---|---|---|---|

|

|

1.5%Extra Cash Back

Earn an extra 1.5% on everything you buy (on up to $20,000 spent in the first year) — worth up to $300 cash back. That’s 6.5% on travel purchased through Chase TravelSM, 4.5% on dining and drugstores, and 3% on all other purchases. |

1.5% - 5%Cashback

Enjoy 5% cash back on travel purchased through Chase TravelSM, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 1.5% on all other purchases |

Earning Chase rewards |

Apply Now |

|

|

N/A |

Strong intro APR offer |

Apply Now Rates & Fees |

|

|

|

$200Cash Bonus

Earn a $200 cash rewards bonus after spending $500 in purchases in the first 3 months. |

2%Cashback

Earn unlimited 2% cash rewards on purchases. |

Simple cash-back rewards |

Apply Now Rates & Fees |

|

|

$0 | N/A |

Home Depot shoppers |

Apply Now |

|

|

$750Cash Bonus

Earn $750 bonus cash back after you spend $6,000 on purchases in the first 3 months from account opening. |

1.5%Cashback

Earn unlimited 1.5% cash back on every purchase made for your business. The advertised rewards type is cash back, but it’s important to note that you’re technically earning Chase Ultimate Rewards points (which can then be converted to cash back). |

Businesses |

Apply Now |

Tips to Maximize Your Benefits on Home Improvement Purchases

- Look for sign-up bonuses: Earn a sign-up bonus to offset large expenses. If you’re going to spend a lot of money, you might as well sign up for a new card that requires a high amount of spend within a short amount of time.

- Use gift cards: If your credit card offers rewards on grocery store or drugstore purchases, buy a gift card for Lowe's or Home Depot to use instead. This is one way you can earn rewards on your home improvement purchase.

- Use a shopping portal: Order products through a shopping portal to stack rewards. Some sites, like Slickdeals, offer cash back from participating stores.

- Consider a store credit card: Some store credit cards can come with incentives, such as a discount on your purchase, deferred interest financing or other extended return benefits. If you shop at a store regularly, it might be worth opening a store card.

- Set a deal alert: Set up product alerts for expensive, important or regular purchases. You can set up a custom Deal Alert at Slickdeals for the item you need, and you'll get notified when there is a sale on that item.

Don't Miss These Home Depot Deals

-

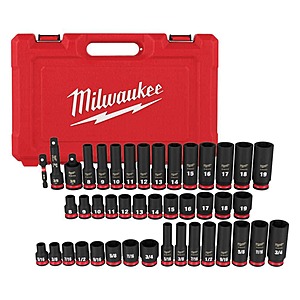

Milwaukee SHOCKWAVE 3/8 in. Drive SAE and Metric 6 Point Impact Socket Set (43-Piece) $84.97

See Deal -

Home Depot Christmas lights sale

See Deal -

6 ft. Animated Star Wars Stormtrooper™ $149 (Home Depot)

See Deal

How to Choose the Right Home Improvement Credit Card

When you're choosing a credit card for your home improvement purchases, make sure your cards come with most or all of these benefits:

- Purchase protection: Purchase protection can save you money, time and stress if you end up buying a faulty product. In some cases, you may even be compensated if an item is stolen from your home or damaged while in your possession.

- Extended warranty benefits: Extended warranty benefits can repair, replace or reimburse you for expenses associated with a purchase that is no longer covered under warranty.

- 0% introductory APR periods: Leverage a new card's 0% APR introductory benefits to your advantage. Some cards offer intro APR periods between 12-15 months, allowing you to pay off a balance without interest during this time frame. But be sure to pay off the final balance before your offer ends or you'll be on the hook for hefty interest charges.

- Cash back or travel rewards: Cards that reward you for spending money can soften the sting of a big expense by offering a silver lining for something to look forward to: a future vacation, a trip home to see family, or even a staycation if you need to leave your home for a few days.

Quick Tip

Add your 0% introductory APR expiration date to your calendar, with reminders two weeks and two months in advance. That way, you won’t be caught off guard with a big bill to pay on short notice.

Frequently Asked Questions

-

A good credit card for home improvement expenses should reward you for your spending, provide a 0% introductory APR period for large purchases and offer purchase protection or extended warranty benefits.

-

Some contractors and vendors allow you to pay for home repair or remodel expenses via credit card. You can also purchase your own supplies in some cases, which means more opportunities to earn credit card rewards on big purchases.

-

Some credit cards offer introductory periods where you don’t pay interest on new purchases, which allows you to pay off your bill over time at no additional cost.

-

In some cases, a store-branded home improvement credit card can provide homeowners with special benefits that regular credit cards do not have. For example, the Home Depot consumer credit card offers extended return times and financing options on larger purchases. Lowe's also offers discounts on your store purchases and special financing deals.