Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

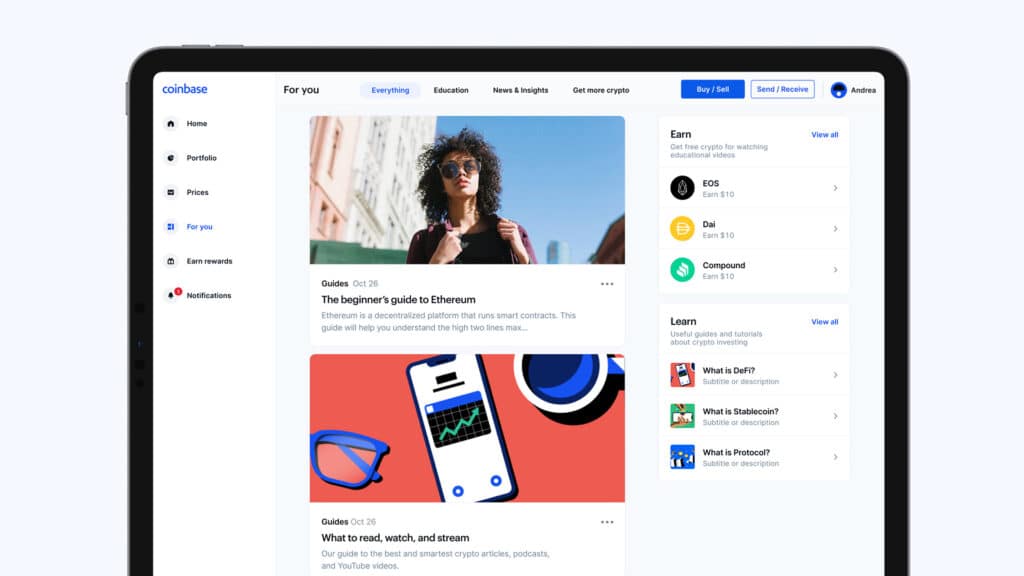

Interested in turning your IRS tax refund into cryptocurrency this year? Thanks to a new partnership between TurboTax and Coinbase, you can do just that. Instead of receiving a refund check by mail or direct deposit to a bank account, you can have your refund deposited directly into your Coinbase account to invest as crypto. Once the refund is in your account, you can convert it from US dollars to one of over 100 cryptocurrencies available through the online cryptocurrency exchange.

How To Receive Your Tax Refund in Cryptocurrency

You must have a Coinbase account to receive your tax refund through the online cryptocurrency platform.

To get started on getting your tax refund into your Coinbase account:

- Use this link to access the special Coinbase offer.

- Choose your TurboTax filing option (Free, Deluxe, Premier or Self-Employed).

- Pick "Direct Deposit" when given options on how you want to receive your refund.

- Choose "Coinbase" and confirm it as your preferred direct deposit method.

- Enter your Coinbase account details the same way you would enter a bank account and routing number for direct deposit.

When your tax refund is ready, the IRS deposits your refund into your Coinbase account.

What Else Coinbase Customers Should Know

If you're thinking about choosing Coinbase for this year's tax refund, here are some other details you need to know.

- Automatic Direct Deposits: If you have direct deposit set up already, Coinbase will automatically convert your tax refund into the preferred asset you've already set up. If you want to keep your refund check in US dollars or choose another cryptocurrency, you'll need to update your account preferences accordingly before receiving your refund.

- Fees: There are no extra fees to receive your refund through Coinbase. The only fees you will pay are for filing through TurboTax if you choose one of the paid options.

- Risks: Cryptocurrency values can fluctuate wildly, so it can be a risky option to store your funds if you need it for emergencies.

The IRS issued warnings that refunds could take longer this year due to the ongoing pandemic and staffing shortages. Keep that in mind when filing your taxes.