Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

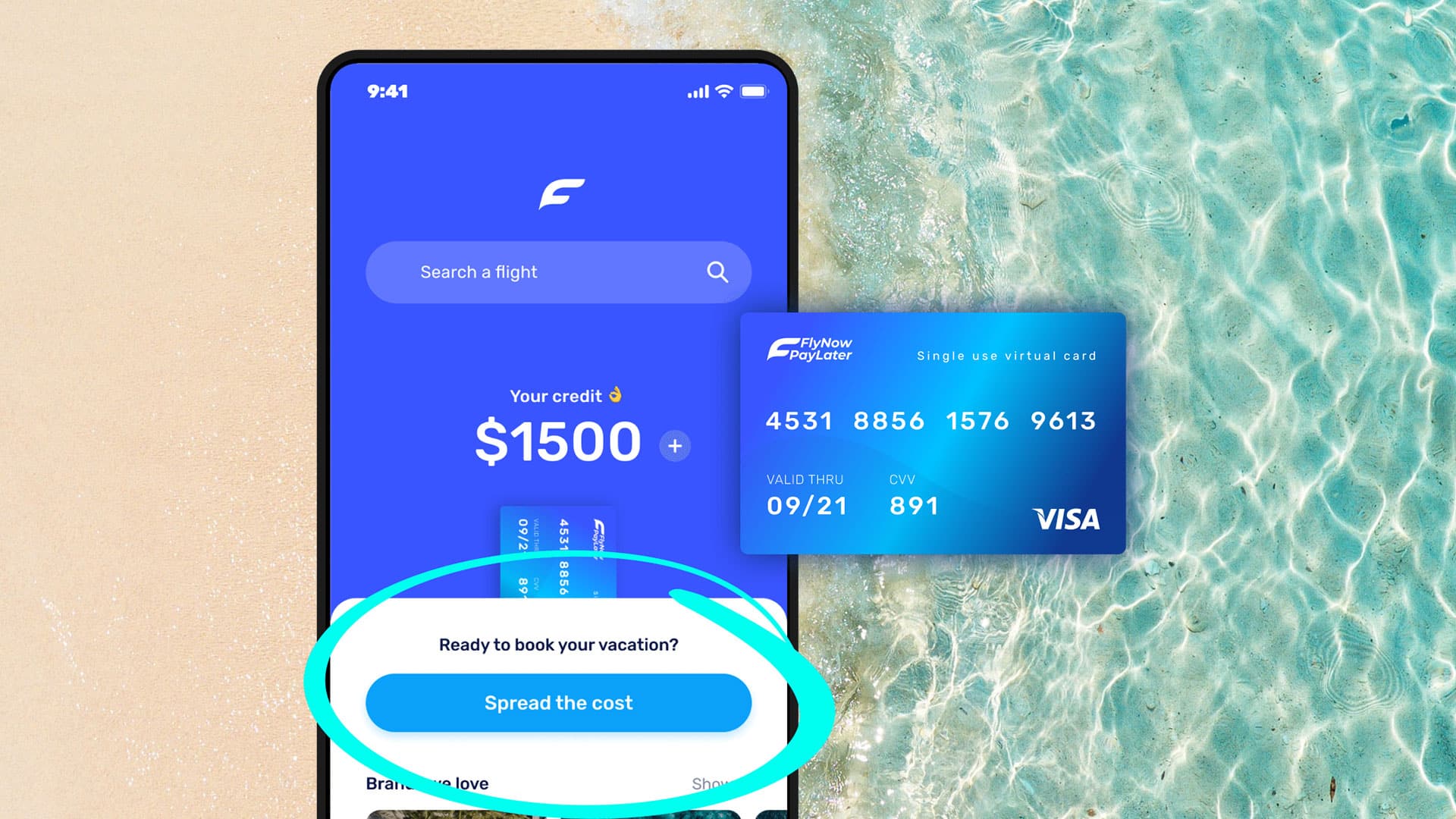

When online shopping, it’s easy to get a little trigger happy adding items to your cart. As sticker shock sets in, you might debate deleting items from your list—until you see a payment plan option advertised. “Break up your payments into four easy installments,” it says. What a relief! But don’t click the offer just yet.

These types of payment plans are called buy now, pay later (BNPL) loans. Many retailers are using BNPL loans to help customers get their goods without paying the full price immediately.

But buy now, pay later services are still very new and come with their own risks. Here are the potential dangers to watch out for, how to use BNPL responsibly, and alternatives to the financing option.

What Is Buy Now, Pay Later?

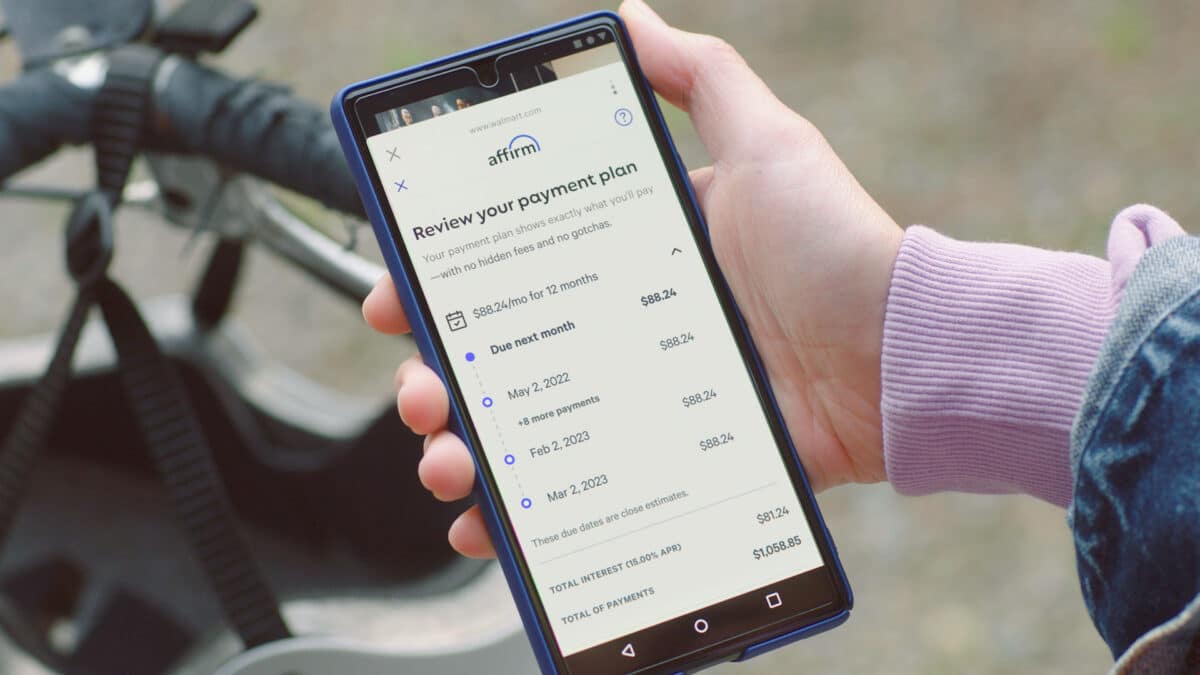

Buy now, pay later, or BNPL, is an installment loan that lets consumers get their goods and pay for them over time, usually broken up into four installments. There’s no credit check to use the service; in most cases, you don’t owe any interest as long as you make the four installment payments on time.

Thousands of retailers use buy now, pay later financing, and there are a few different ones available. You might see names like Affirm, Afterpay, Klarna, Sezzle, and more. BNPL financing operates outside of retail environments, too. For example, Sunbit focuses on BNPL for services rather than goods, like the dentist or auto repair.

Personal Loan Pros & Cons: When Are They a Good Idea?

How Does Buy Now, Pay Later Work?

BNPL is like a reverse layaway program, except you get your goods right away and pay for them over time instead of waiting to get your items until you’ve paid in full. When you check out, you’ll go through the retailer’s partner, like Affirm or Afterpay.

Requirements

Typically, you must meet these qualifications to apply for buy now, pay later financing:

- Be 18 years or order

- Have a mobile phone number

- Have a debit card, credit card, or bank account to make payments

Application

To sign up, you’ll complete a short application with some personal details, like your name, phone number, address, date of birth, and Social Security number. Then, you’ll add payment details—usually a debit card, credit card, or bank account number. The BNPL partner will run a soft credit check to make sure you are who you say you are and your details line up. This is not a full credit check with a hard inquiry, which means you shouldn’t see any impact on your credit score.

Approval (or denial) happens immediately.

Making Payments

If you’re approved, you’ll set up payment for four equal installments. The first payment is due at checkout, and each one after is due every other week. So, if you owe $100 for an item, your first payment will be $25. Every installment after that will also be $25 until you’ve paid in full.

Who Is Buy Now, Pay Later Good For?

People choose buy now, pay later financing for different reasons. For some shoppers, it helps you buy things you need without paying the full price upfront; it’s more manageable for some people to pay $25 every other week than to pay $100 right away.

Buy now, pay later might be good for:

- Young shoppers. If you don’t have a credit card or a strong credit history, you might struggle to get approved for one and start building a record of responsible repayments. You can use BNPL apps in lieu of credit cards while shopping.

- Credit-adverse buyers. Some shoppers might prefer to avoid credit cards entirely or need to limit their use while they recover from major credit debt. A BNPL service can help you make necessary purchases without using a credit card.

- Shoppers denied other loan options. If you’ve been denied other loans due to a low credit score, it’s possible to get approved for BNPL financing.

Since BNPL financing isn’t a credit card, some consumers might see this as a smarter financial choice. For young adults without much credit use, BNPL might be a more sensible spending plan.

Hidden Dangers of Buy Now, Pay Later

Since BNPL loans are still relatively new, there are concerns about how they operate—especially considering the lack of government regulation. Make sure you’re aware of the risks involved with BNPL before your commit to using the service.

Some of the things to be aware of with BNPL services include:

- Lack of protection from fraud. If you use a credit card to make a purchase that turns out to be fraudulent or faulty, you can report it to your credit card company and, in most cases, get your money back. But if you make the same purchase using buy now, pay later, it’s much harder to dispute a purchase and report a scam.

- More hurdles for disputes. BNPL policies vary by retailer and provider, making refunds and returns tricky. Some services might require you to continue to make payments (and pay in full) until the dispute is resolved between you and the merchant. Even if it gets resolved, there’s often no telling when you can expect a refund.

- Fees still exist. In most cases, you won’t face any interest or fees using a BNPL service. You might incur a late fee for missed payments, but those charges vary widely by provider. Also, some services offer payments over a longer period of time, like six or twelve months. In that case, you might pay interest and face a hard credit check. There’s no guarantee you’ll be approved for this type of loan, either.

BNPL Alternatives

While buy now, pay later services might work for some, you should consider the option carefully. If you decide to go another route, there are several alternatives to buy now, pay later loans.

Credit Cards

If you’re comfortable managing credit card purchases, cards make a great alternative to BNPL. You won’t face interest charges if you have the funds to make your payment in full at the end of the pay period. But if you carry a balance, you could face high interest charges.

Credit cards also have higher protections for customers if you end up with faulty goods or get scammed.

Credit Card “Plan It” Services

Many credit cards offer “plan it” options to make large purchases, which allow you to make payments over time without facing major interest charges. However, you might pay a small monthly fee depending on the card issuer. This option allows you to use your card like normal while also building a responsible credit history. Many of the major banks offer BNPL services for customers.

Debit or Cash

If you don’t want to owe anyone money, you can use your bank account, debit card, or cash to make transactions. Debit cards get swiped the same way as credit cards (and card information gets entered online in the same way).

However, debit cards don’t offer as much protection against fraud as credit cards. And paying in cash means you’ll need to keep your receipt as proof of the transaction in case you need to dispute it. Still, these methods eliminate the need for borrowing money through a buy now, pay later loan or credit card.

Bottom Line

While buy now, pay later services are a great option for credit-adverse and young shoppers, the concept is still relatively new. Make sure you know the risks involved in using a BNPL service.