Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

When you prequalify for a personal loan, you can find out what loan rates and terms you are eligible for from a variety of different lenders without having to commit — and without any effect on your credit score. The pre-qualification process is a great way to shop around and compare lenders to find the best personal loan deal for you.

Personal Loans How to Prequalify for a Personal Loan

Prequalifying for a personal loan is simple and can be done entirely online for many lenders. Here is how to get started.

-

1

Shop for Lenders

Knowing your options and finding the right lender for your financial needs is essential. Start by researching lenders that cater to borrowers with credit profiles like yours. Some lenders specialize in borrowers with average or bad credit, while others work with borrowers with good to excellent credit. Bad credit lenders usually offer loans with high APR and short lending periods. On the other hand, lenders focusing on good to excellent credit borrowers tend to provide lower APRs and longer terms. Regardless of your credit status, you should prequalify with several lenders to compare loan packages.

-

2

Complete the Pre-qualification Forms

After narrowing down your lender options, you can start filling out pre-qualification forms for each lender. Most lenders have pre-qualification forms online, even if you apply with a traditional bank or credit union. The pre-qualification form may ask for a variety of information, including personal information, employment, annual income, assets, monthly debts, mortgage or rent payments, requested loan amount, loan purpose, etc.

-

3

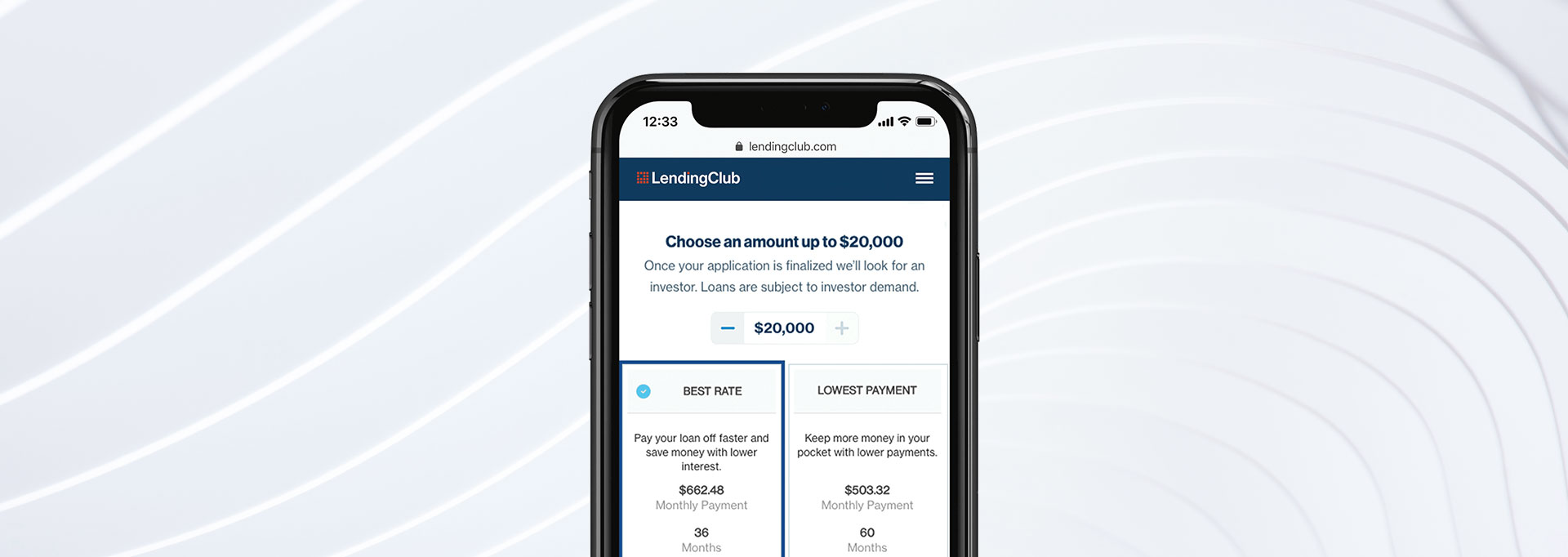

Review Pre-qualification Results

When you get your pre-qualification results, review the loan options to determine the best deal for you. Compare APRs, origination fees, loan terms, funding timeline, and other perks that may be offered to borrowers. For example, some lenders offer rate discounts for autopay or unemployment protection in the event of a job loss. If you have a less-than-ideal credit score and want to improve your credit so you'll receive better terms, request a free copy of your credit reports and take steps to improve your credit before prequalifying again.

-

4

Choose a Lender and Submit a Formal Application

Your loan term should appear within minutes after submitting your pre-qualification form. If you find the terms satisfactory, you can officially apply for the personal loan. You'll need to provide financial documents to verify the information provided during the pre-qualification stage. The lender will also perform a hard credit inquiry to verify your full creditworthiness. Upon approval, the lender usually electronically transfers the money to your checking account within a few business days. Some lenders can complete the process the same day upon approval.

Best Personal Loans for Co-Signers & Co-Borrowers

What Does It Mean to Prequalify for a Personal Loan?

Prequalifying is a prescreening process that allows you and the lender to see whether you are a good candidate for a loan. You'll be able to see estimates on APRs, monthly payments, loan amounts, and repayment time based on your finances and credit background. Getting prequalified allows you to compare one lender’s offer with as many other lenders’ offers so you can find the best deal for you.

Benefits of prequalifying for a personal loan:

- See rates, loan terms, and loan sizes from multiple lenders

- Check your eligibility for personal loans without hurting credit score

- Compare and shop around for the best loan deal

- Most prequalification can be done online within minutes

During the prequalification process, lenders only use a soft credit inquiry, so your credit score will not be affected until you formally apply for the loan.

Does Prequalification Guarantee Approval?

Going through the prequalification process does not mean you will be approved for the loan you were offered. You will still need to go through the formal application process where the lender will request more detailed financial information and conduct a hard credit inquiry. Once the lender reviews your full loan application and determines you are a good fit, you will then receive approval for the loan.

Does Prequalifying for a Personal Loan Hurt Your Credit Score?

If you use a lender that performs soft credit inquiries to check your creditworthiness, prequalifying will not harm your credit score. Most lenders do use soft credit inquiries — or soft pulls — to quickly assess your eligibility for a personal loan and provide you with estimated loan offers.

Even though a soft pull does not provide as much information as a hard credit inquiry, lenders can get your credit score and enough of your credit history to judge your creditworthiness during prequalification.

Related Article

Related Article

How Your Credit Score Could Rise or Fall from a Personal Loan

What Do You Need to Prequalify for a Personal Loan?

Prequalifying information varies from lender to lender. But most lenders will request some common information, such as:

- Identification and contact information: Lenders usually ask for your home address, phone number, date of birth, and the last four digits of your social security number.

- Income and Assets: You'll need to provide your total annual income, including salary, dividend payments, social security benefits, etc. Some lenders may ask about savings or asset accounts.

- Outstanding debt and monthly payments: Include any debts and monthly payments from credit cards, car loans, payments due to adverse legal judgments, rent or mortgage payments, etc.

- Loan amount: Specify the loan amount you need. Some lenders have a maximum loan limit, so check whether the loan you need will exceed this maximum.

- Desired loan term: The typical loan repayment can range from two to five years.

- Loan purpose: Personal loans can be used for a variety of purposes, but some lenders may have different offers depending on what your loan will be used for.

Do's and Don'ts of Prequalifying

Here are some basic do's and don'ts to help you get the best offers possible.

Prequalifying Do’s

- Shop around: Don't go for the first offer you receive, even if you like the terms. Be sure to check out credit unions, brick-and-mortar banks, and online lenders to compare as many offers as possible. There is no limit to how many prequalifications you can request, and the more options you have, the better your chances of finding the best deal out there.

- Review the fine print: As with any document, always check the fine print for any stipulations or other personal loan fees. Be on the lookout for origination fees that may be deducted from your full loan amount, or prepayment penalties that charge you for paying off your loan early.

- Check your credit report: Before you fill out a prequalification form, review your credit report to see where you stand and if there are ways to improve your current score. Don't forget to check for any credit report errors and have them fixed as soon as possible. Removing any inaccuracies can help to increase your credit score.

Prequalifying Don’ts

- Don't apply for more money than necessary: It can be tempting to take out the maximum amount from a lender. However, the higher the loan amount, the greater the responsibility. Taking out far more money than you need can put you in serious debt without any benefit in return.

- Don't allow the pre-approval to expire: If you've qualified for a pre-approval, the lender will send you an offer with all the details. Since a borrower's financial situation can change at any moment, pre-approvals are usually time-sensitive. Lenders may give you a few weeks or up to a month to decide before you need to go through the process again.

Using Prequalifying to Your Advantage

Prequalifying can be a valuable tool for borrowers because the process can provide insight into the types of loan terms and rates available while allowing you to comparison-shop across many different lenders. If you're being offered unfavorable loan terms, you also have the opportunity to improve your creditworthiness to qualify for better deals next time.

FAQs

-

If you have a good to excellent credit score, a steady source of income, and low debts, it increases your likelihood of getting preapproved. Even if you have bad credit, there are some lenders that specialize in bad credit loans, but beware that the offer may come with high interest rates and short payback periods.

-

Prequalifying for a personal loan is optional. Along with serving as an applicant pre-screener, prequalifying lets you know whether you are eligible for a personal loan at certain rates without submitting a formal application and without affecting your credit score.

Formally applying for a personal loan without prequalifying may open you up to the increased risk of getting rejected or receiving less favorable offers than if you prequalified and shopped around for better rates.

-

There is no official rule or limit on how many lenders you can prequalify with. Since prequalifying does not harm your credit and only provides an estimate of your loan terms, you can prequalify with as many lenders as you want.

-

No, prequalifying does not guarantee approval on a personal loan because the lender may find information from the hard credit inquiry that could disqualify you.