Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

Whether money is tight or you’re financially comfortable, it’s always important to be smart with the cash you earn. Spending less in one area frees you up to use your earnings on the things that matter most to you, like setting up a high-yield savings account, eliminating debt or planning a fun family vacation. But let’s be honest. The actual process of cutting expenses can be time-consuming and complex. The good news is that the best money-saving apps make it easier to stretch your hard-earned dollars. Check out these smart bill negotiation apps that can help you lower your bills, cancel unwanted subscriptions and even automate your savings.

What Are Bill Negotiation Apps?

How They Work

Bill negotiation apps are services you can use to help lower your monthly bills, cancel recurring subscriptions and manage other financial needs, like budgeting or spending habits.

In most cases, users pay a subscription fee and provide some banking and other information. Then, the app’s team works to negotiate lower bills on your behalf, usually for things like phone and internet charges or streaming subscriptions, though some promise to work on other expenses as well.

Cost

Most bill negotiation apps offer a free version that only gives you access to a few services like budgeting tools, for example. For bill negotiation services, you’ll typically pay either a flat monthly fee or a percentage of any successful savings earned for you.

How Much You Can Save

How much you can save with bill negotiation apps varies depending on a lot of factors, but most of the apps claim they can save you several hundred dollars. This is definitely a “your mileage may vary” situation, however, and you’ll want to assess these apps’ value before you shell out any cash.

6 Best Bill Negotiations Apps

| Cost | Average Savings* | Services | Availability | |

|---|---|---|---|---|

|

15% of first-year savings |

$213/year |

|

Web browser |

|

|

30%-60% of first year savings; $3-$12 additional services |

Unknown |

|

iOS, Android |

|

|

40% of savings; $9 for each subscription cancellation |

$300 |

|

iOS, Android, web browser |

|

|

$99 lifetime subscription |

$900 |

|

iOS, Android, web browser |

|

|

$24.99/month |

$263.69 |

|

iOS, Android, web browser |

|

|

$9.99/month |

Unknown |

|

iOS, Android, web browser |

*Average savings data based on information publicly available on company websites without additional independent verification

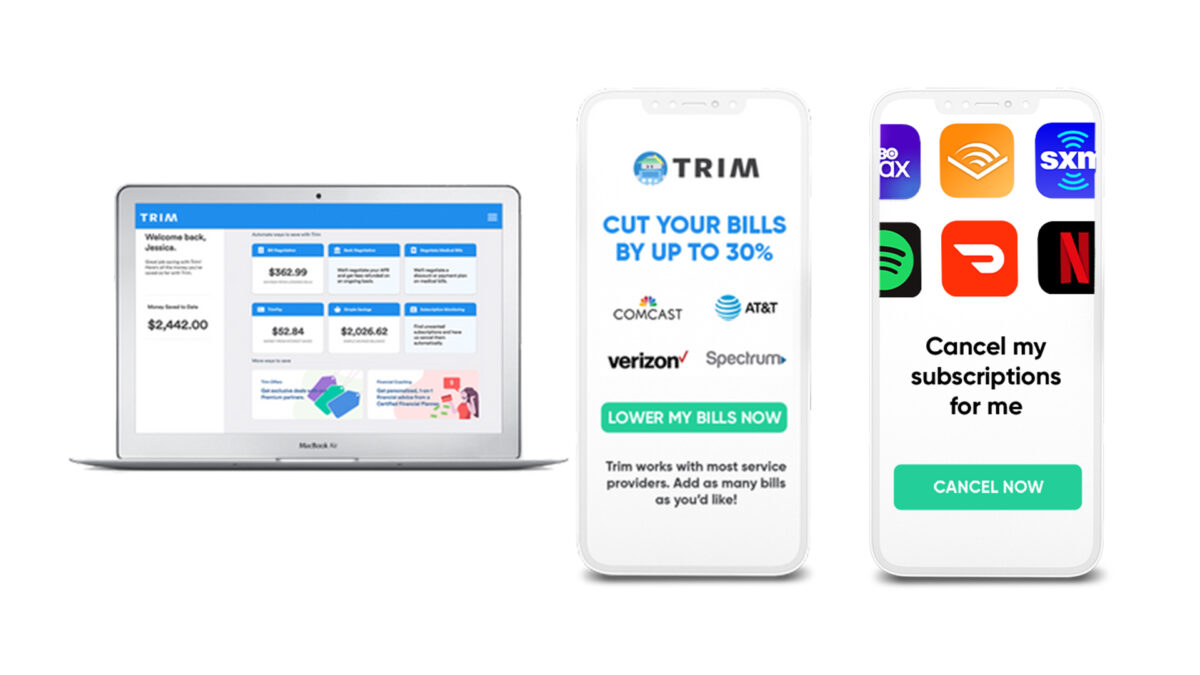

Trim

Trim is a useful financial tool that can help you save money in multiple ways. With Trim you may be able to lower your phone, cable or internet bills up to 30%. If you discover subscriptions you no longer need, Trim can even cancel them on your behalf.

Trim Cost

If you want to get started with the free version, you can create an account and don’t have to worry about a free trial or paying up front.

If you sign up for the bill negotiation service, however, you’ll be charged 15% of the first year of savings Trim gets for you. If they aren’t successful in lowering your bills, you won’t have to pay anything, which is nice.

Here’s how the pricing works: Say Trim manages to reduce your phone bill by $25 per month. That’s a one-year savings of $300. In that case, you’d be charged 15% of that, which is $45.

Trim Features

Trim’s main features are bill negotiation and subscription cancellations. The gist is you send Trim your bills and their team works on negotiating lower rates for you. Trim can also analyze your expenses to alert you to recurring subscriptions you may want to cancel or reduce.

Want more information about this app and how it could potentially save you money? Check out our full Trim review.

Related Article

Related Article

7 Personal Finance Apps for Saving, Budgeting & Investing on your Phone

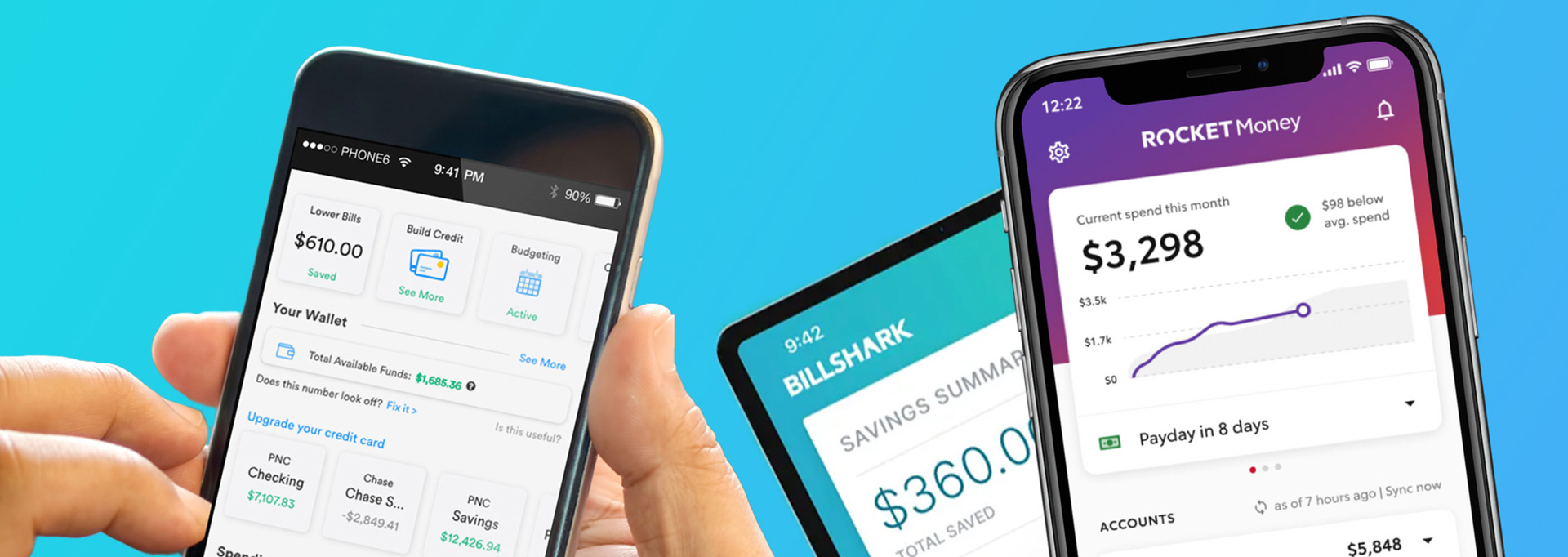

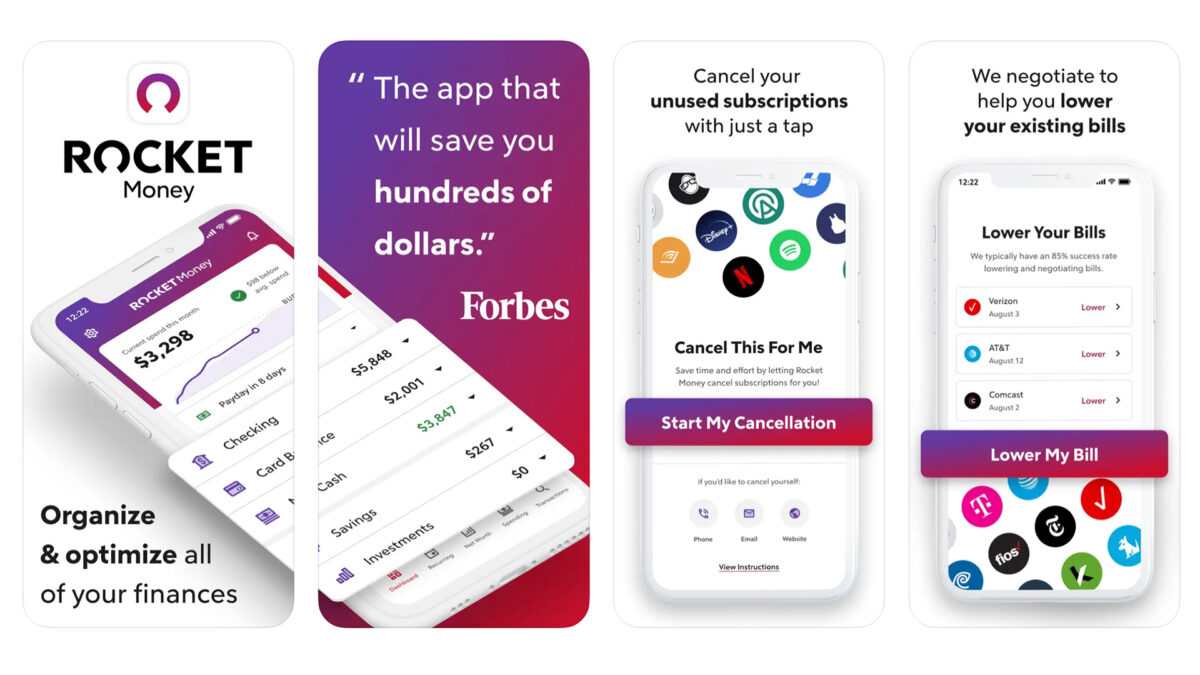

Rocket Money

Formerly known as Truebill, Rocket Money is another popular bill negotiation and budgeting app. It offers a wide range of financial tools including:

- Bill negotiations

- Spending insights

- Savings automation

- Bills and subscriptions tracking and cancellations

- Budgeting tools

- Credit score monitoring

Rocket Money Cost

Here’s a look at the costs associated with using Rocket Money:

- The app: $0 but has limited functionality

- Premium services: $3-$12 per month, sliding scale (can be canceled anytime)

- Bill negotiation services: 30%-60% of first-year savings if negotiation is successful (you set the percentage)

At the moment, Rocket Money doesn’t offer a free trial and the free app has limited uses, but the Premium version can be canceled anytime through the app.

Possible perk: If you have used Rocket Mortgage, you can get access to Rocket Money Premium services for free (Rocket Money and Rocket Mortgage are separate subsidiaries under Rocket Companies.)

Rocket Money Features

Most of the Rocket Money services customers may want to use are the Premium features, which cost a few dollars per month. These services include:

- Bill negotiations for things like phone services and insurance premiums

- Cancellations concierge to cancel subscriptions

- Ability to create unlimited budgets

- Option to automate savings

- Real-time balances syncing

- Access to premium chat services

Related Article

Related Article

6 Best Apps to Maximize Your Credit Card Rewards

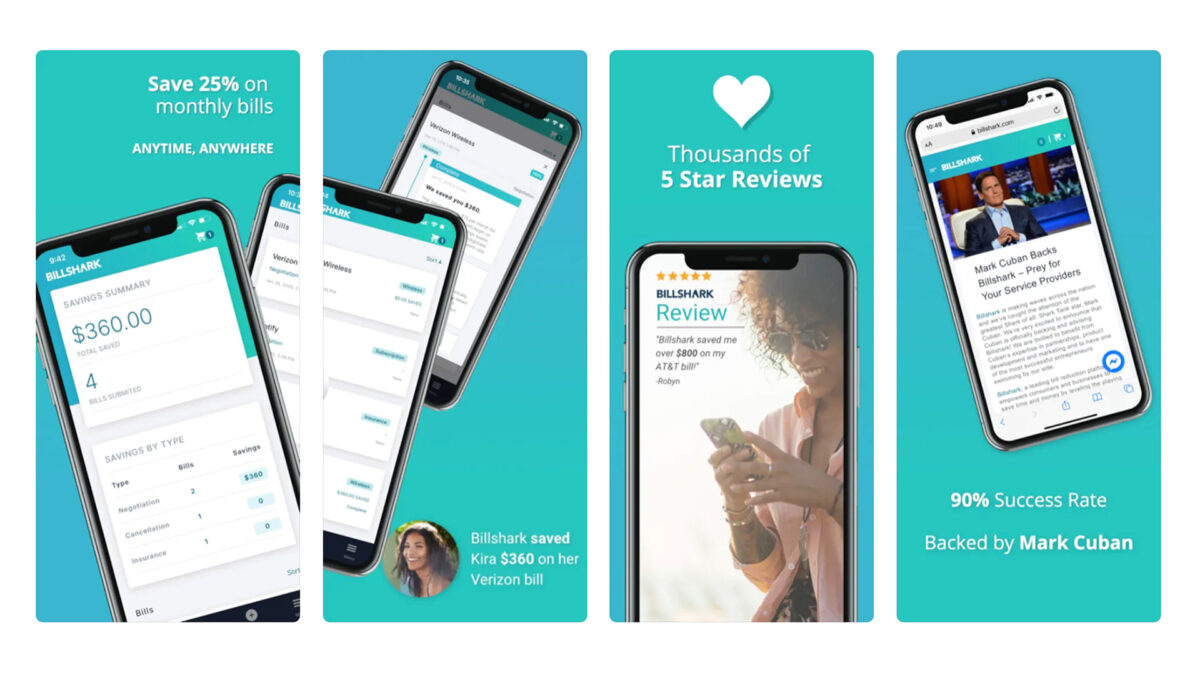

Billshark

Billshark and its performance-based pricing model may appeal to you if you like the idea of a bill negotiation service without a set monthly fee. With this app, you pay nothing unless the service successfully reduces your bill or cancels a subscription on your behalf.

Billshark Cost

Billshark doesn’t offer a specific free trial, but you also won’t have to pay for bill negotiation unless the company successfully negotiates lower bills for you. When Billshark is successful, it will charge you a one-time fee of 40% of the savings, capped at 24 months even if the savings apply to a longer time frame.

Here’s an example of how the bill negotiation pricing works:

Say Billshark manages to reduce your bills by $20 a month. That means you’ll save $240 per year. In that case, Billshark will charge you 40% of your savings, which is $96 for one year of savings.

According to the company, it’s successful 90% of the time it negotiates on a customer’s behalf.

The two prices to know with Billshark are:

- Bill negotiation: 40% of your savings if Billshark is successful

- Canceling services for you: $9 per cancellation

Billshark Features

Billshark is pretty straightforward in offering a simple bill negotiation service. It doesn’t offer the bells and whistles of some other apps, like credit monitoring or budgeting, for example, so you may want to factor that into the expense of the service as you compare your options.

It does, however, offer a separate service to cancel services on your behalf. To take advantage of this feature, you will pay a flat rate of $9 per cancellation request.

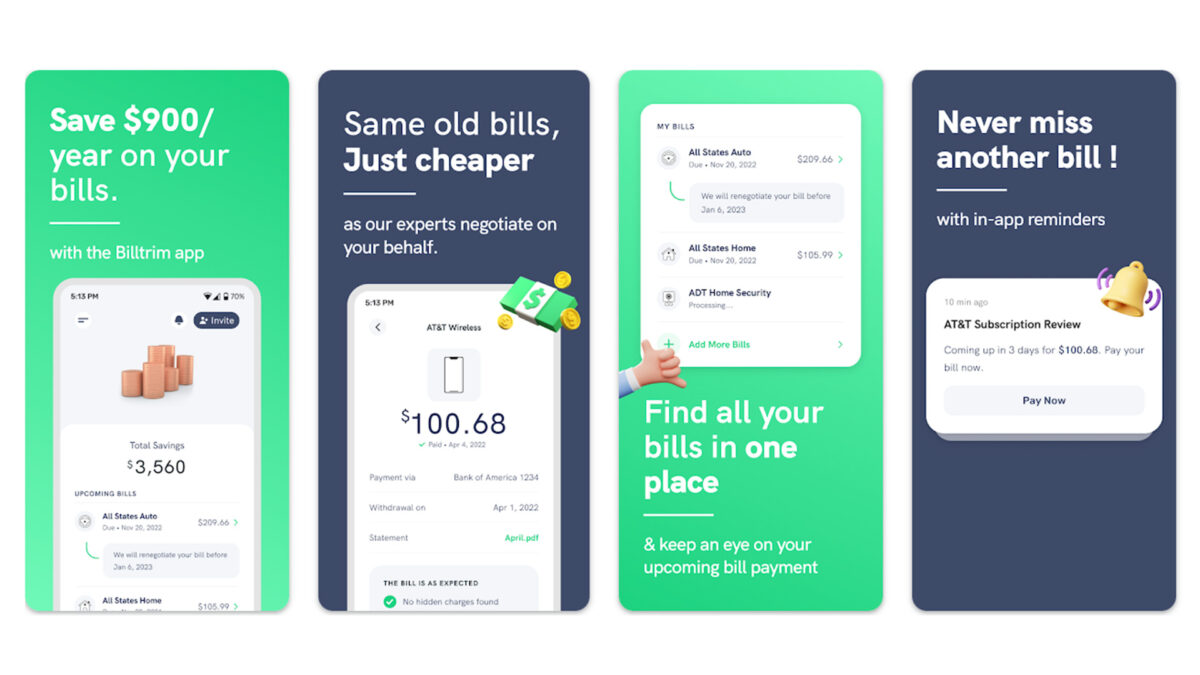

BillTrim

BillTrim is another negotiation and money-saving service offering to help lower recurring bill costs, monitor payments and help you manage autopay. It also offers some other features like a prepaid card to help you pay your bills and track your spending via the app.

BillTrim Cost

BillTrim has an interesting pricing structure: You pay $99 for a lifetime subscription. You can join for free and the app is free to download, but the majority of BillTrim’s features require a subscription. The company mentions you can apply promo offers, but at the time of this writing, they weren’t offering a free trial or other discounts on the company site.

BillTrim Features

With the one-time fee comes a host of BillTrim services, including:

- Bill negotiations

- Payment monitoring to keep you aware of increases and other changes

- Autopay services

- Bill tracking and insights

- 24/7 customer service

BillTrim also boasts a promise to save you at least $300 on your bills or you can get a full refund on the subscription price. The company doesn’t specify the timeline for this $300 threshold though.

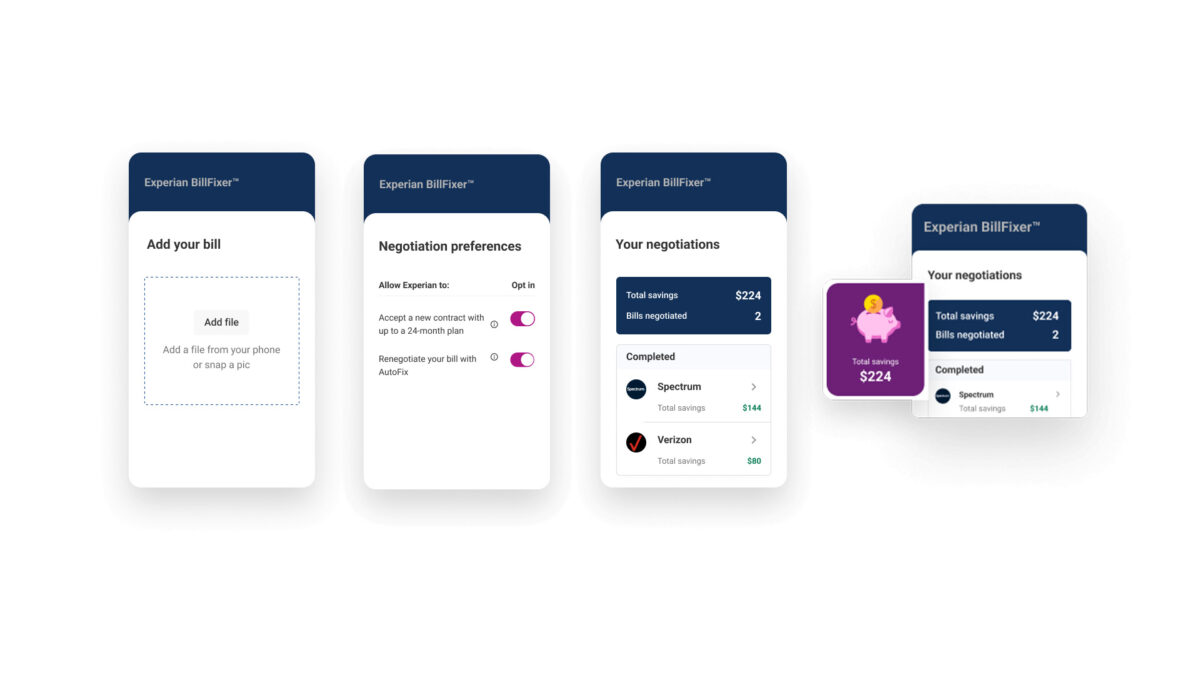

Experian BillFixer

Experian acquired BillFixers in 2023, and the service is now known as Experian BillFixer. It requires a premium membership but offers a free one-week trial to test it out, which not all bill negotiation services provide. For some, being part of Experian is an added benefit because the credit monitoring brand has a reputation for security and privacy.

BillFixer Cost

As mentioned, BillFixer offers a free one-week trial, though you do need to provide your credit card information up front and will be charged if you don’t cancel within that period.

Here’s how much BillFixer costs:

- Seven-day trial: $0

- Premium services: $24.99 per month

The price is steeper than with some other bill negotiation services, but BillFixer says you’ll get to keep 100% of the savings, which is a different model than some apps, which take a percent of what they save you.

BillFixer Features

Being part of Experian means BillFixer can offer a wider range of features related to credit monitoring.

Services you’ll have access to through BillFixer include:

- Bill negotiation services

- Monthly FICO® Scores from the three credit bureaus

- Other FICO tracking tools and score information

- Identity protection and monitoring

- Up to $1 million in identity theft insurance

- Fraud support

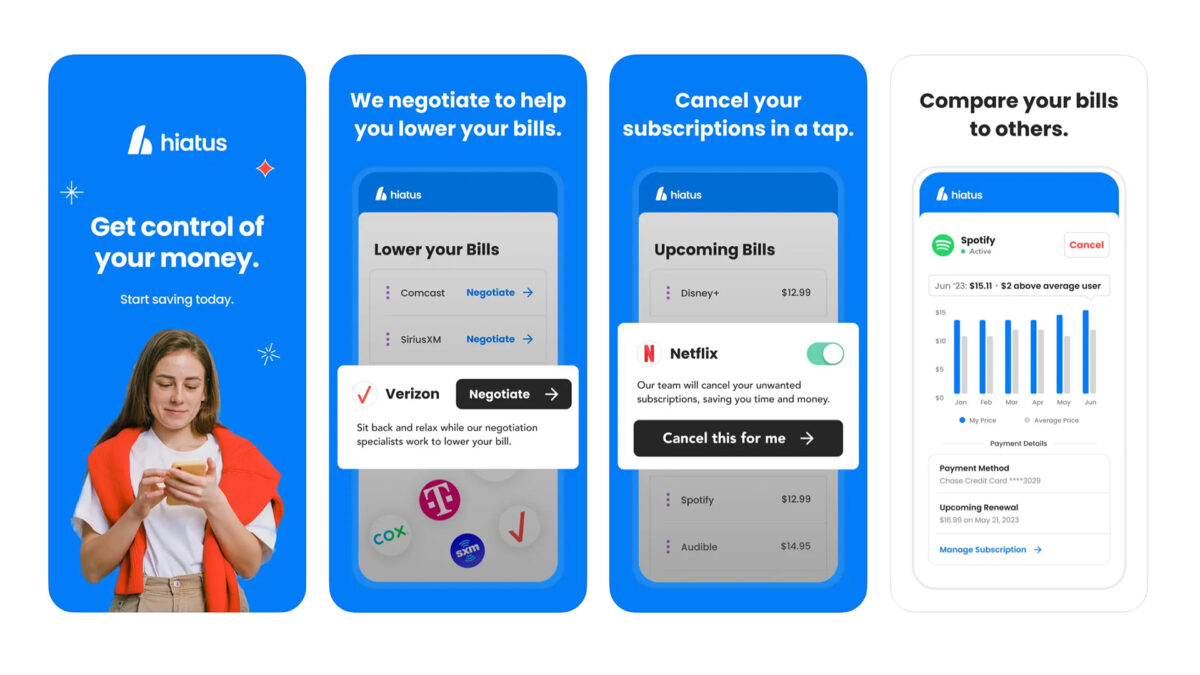

Hiatus

Hiatus is a bill negotiation and subscription cancellation mobile app that has a few other features to help you manage your budget and track your expenses. The app partners with LendingTree to offer personal loans and compare insurance premiums, which may or may not be a feature people want when trying to lower expenses.

Hiatus Cost

Hiatus doesn’t publish its pricing on its site or in the mobile app unless you go through all the steps to create an account, but it reportedly charges $9.99 per month for the premium option. The app itself is free to download but Hiatus isn’t offering a free trial for the paid services at this time. Without paying, you’ll only have access to a few simple features, like budgeting tools.

Hiatus Features

Most of Hiatus’ features require the premium subscription, but the app offers a wealth of financial features including:

- Bill negotiation service

- Subscriptions tracking and cancellation

- Budgeting tools

- Spending comparison and tracking

- Real-time net worth tracking

- Personal loan offers

- Insurance rate comparison tool

Are Bill Negotiation Apps Worth It?

The usefulness of bill negotiation apps depends a lot on your personal financial circumstances. In some cases, bill negotiation apps are worth it to wrangle all your bills or find random subscriptions you’ve forgotten to cancel. And if you don’t have the time or interest to call and haggle with service providers for lower rates, you might find a lot of use in a bill negotiation app. Many of these products also offer budgeting and spending tools that some people will find helpful to have all in one place.

Bill negotiation apps may not be worth it for those with a strong ability to track and manage financial transactions on their own as you might be able to save more if you negotiate with your creditors and service providers on your own. If you feel like you could handle these steps yourself and don’t mind making calls to lower your own bills, you probably won’t find these apps worthwhile.