Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

As of early October 2020, Credit Karma Savings offers a 0.40% APY, which is much higher than the average savings rate of 0.05%, according to the FDIC. Here's how Credit Karma Savings works and what to consider.

How Credit Karma Savings Works

Credit Karma started out as a credit monitoring service in 2007, and it's still one of the leaders in the credit monitoring industry. But over time, the company has added new features and tools, including a completely free tax preparation service, an unclaimed money database and a high-yield savings account.

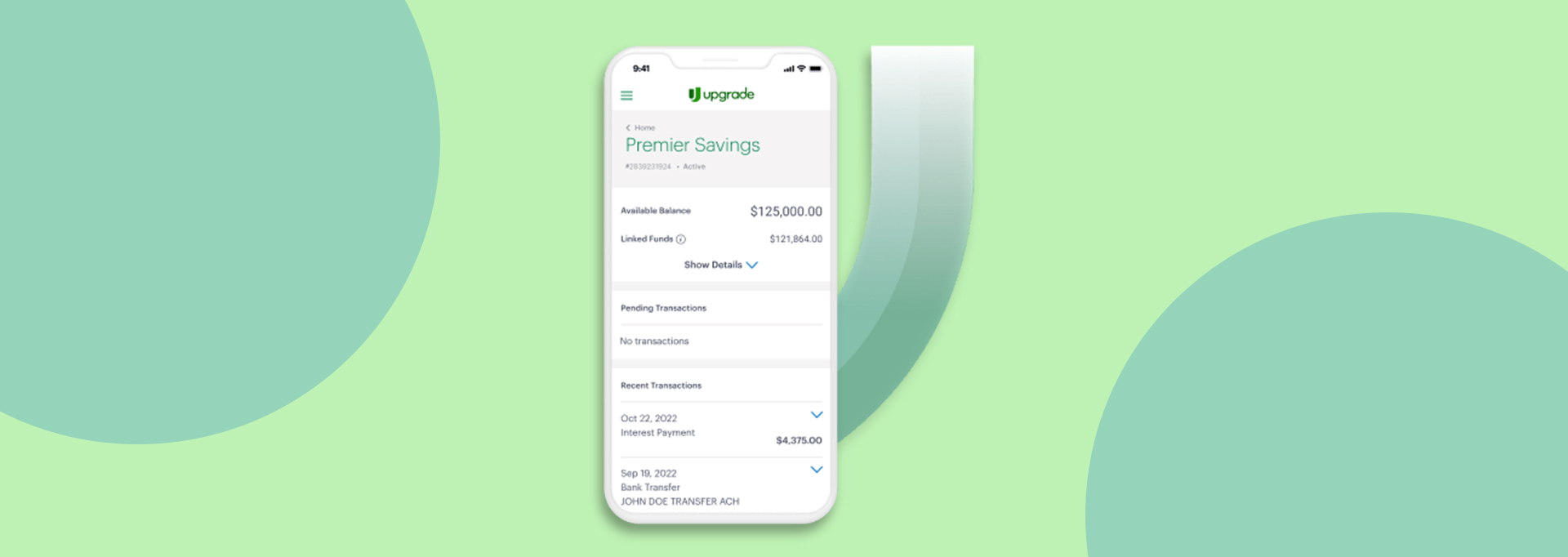

But Credit Karma Savings doesn't work the same as most other savings accounts. For starters, Credit Karma isn't a bank, so it doesn't hold your money. That's not necessarily unique on its own. But instead of keeping your deposits with a partner bank, it could maintain your deposits with one of more than 800 banks at any given time.

The idea is that interest rates are constantly changing, and there's no single bank that consistently offers the best return. So Credit Karma has partnered with more than 800 financial institutions, and it monitors their savings account rates regularly. Each month, it may automatically move your money to a different bank to ensure you're always getting the best rate in its network.

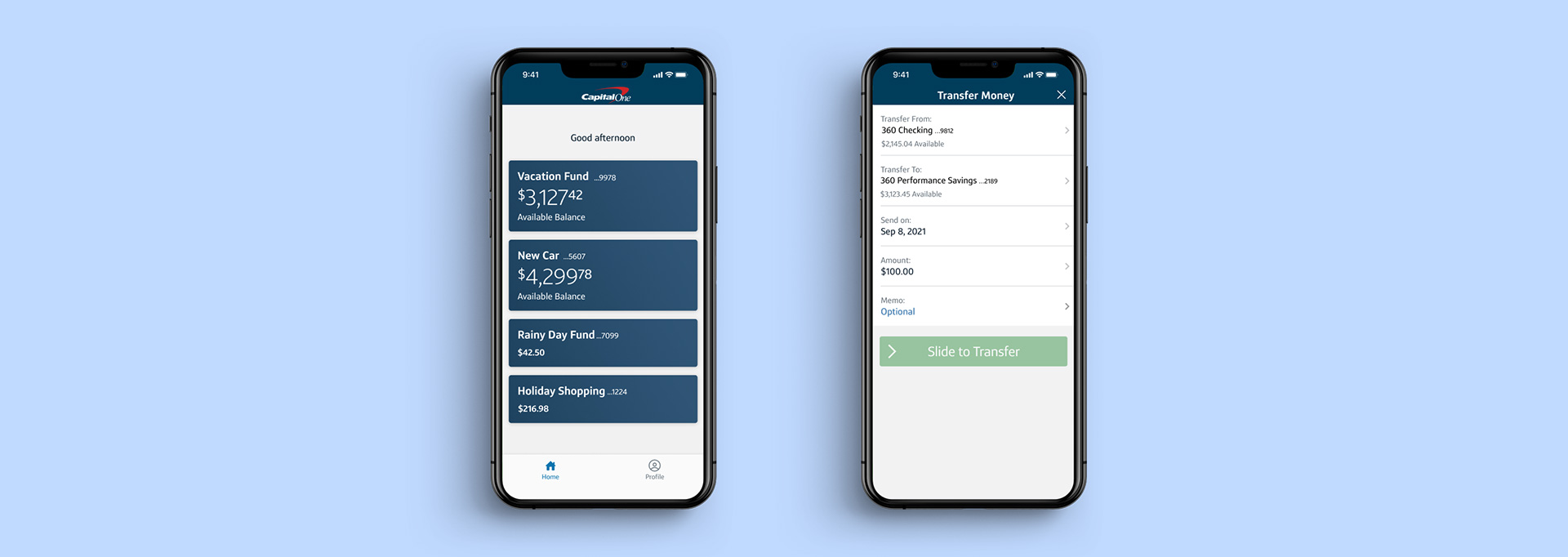

While that sounds complicated, it's all happening in the background. When you log into your Credit Karma Savings account, you'll be able to view your balance, make deposits and withdrawals and do just about anything else you'd be able to do with a regular savings account.

Minimum Deposit

This savings account does not require a minimum deposit when initially opening an account. However, you cannot earn the high-yield savings account interest rate until you have a positive balance.

Minimum Balance

There is no minimum balance for this high-yield savings account. Similarly, there is no minimum opening deposit either.

Fees

There are no fees. Credit Karma provides one of our favorite savings options because, unlike a traditional bank account or savings account, there are no balance requirements or fees when balance requirements are not met.

ATM Access

Unfortunately, since this Credit Karma account isn't a traditional savings account, there is no ATM access or debit cards. Instead, money is transferred between accounts using the mobile app.

Fine Print

Banking services for Credit Karma are provided by MVB Bank, Inc., Member FDIC. Maximum balance and transfer limits apply. The balance in your savings account may be moved to one or more network banks where it is eligible for FDIC insurance up to $5,000,000 once the funds arrive at a network bank. Actual insured amounts may be lower or adversely affected based on any balances you hold at a network bank. Learn more about FDIC insurance and FDIC-insured financial institutions here.

Money Market vs. Savings Accounts: Which Is Best for Your Savings?

How Does Credit Karma Savings Stack Up Against Other High-Yield Savings Accounts?

The idea behind Credit Karma Savings is a solid one. Being able to maximize the interest rate on your savings account without opening multiple accounts is revolutionary.

But, unfortunately, the banks in Credit Karma's network don't compete very well against the top high-yield savings accounts on the market — at least not right now. As an example, PNC Bank offers a competitive APY on its high-yield savings account, and Axos Bank offers among the highest average percentage yields.

Of course, while these rates are more than double what Credit Karma Savings offers, it may not matter too much for most consumers. According to the Federal Reserve's Survey of Consumer Finances, Americans with savings accounts have a median balance of $4,500.

Over a year, that amount would net you $45 in interest with a 1.00% APY, or $19.80 with a 0.44% APY. That's a difference of $25.20 over 12 months or $2.10 per month.

Also, it's important to keep in mind that banks with higher yields right now may not necessarily provide higher yields in the future, and they don't have the flexibility of moving your money to a different institution if you can get a better rate there.

So while Credit Karma Savings doesn't offer the best interest rate right now, its flexibility may provide better options in the future, so it may be worth having an account just in case that happens.

Other Credit Karma Benefits

With or without a high-yield savings account, Credit Karma has a lot of perks to offer. Credit Karma Savings has a lot of potential, but it's not even the most valuable service the company provides.

Free Credit Score Monitoring

Monitoring your credit is one of the best ways to improve your credit score because it helps you understand which areas you need to address and gives you the chance to track your progress. With Credit Karma, you'll get your VantageScore credit score and credit report access from Equifax and TransUnion, two of the three major credit reporting agencies. You'll be able to see which factors are influencing your score and even get some tips on how to build your credit, qualify for credit cards and learn more about what major credit card issuers are looking for in a new cardholder.

If you prefer a credit monitoring service that offers free FICO® score access, check out Experian's credit score and report. I've used both services for years and like how they complement each other.

Free Tax Preparation

Credit Karma also offers a truly free tax preparation service, which is an excellent alternative to similar services that make it sound like it's free then charge you to process certain deductions and credits.

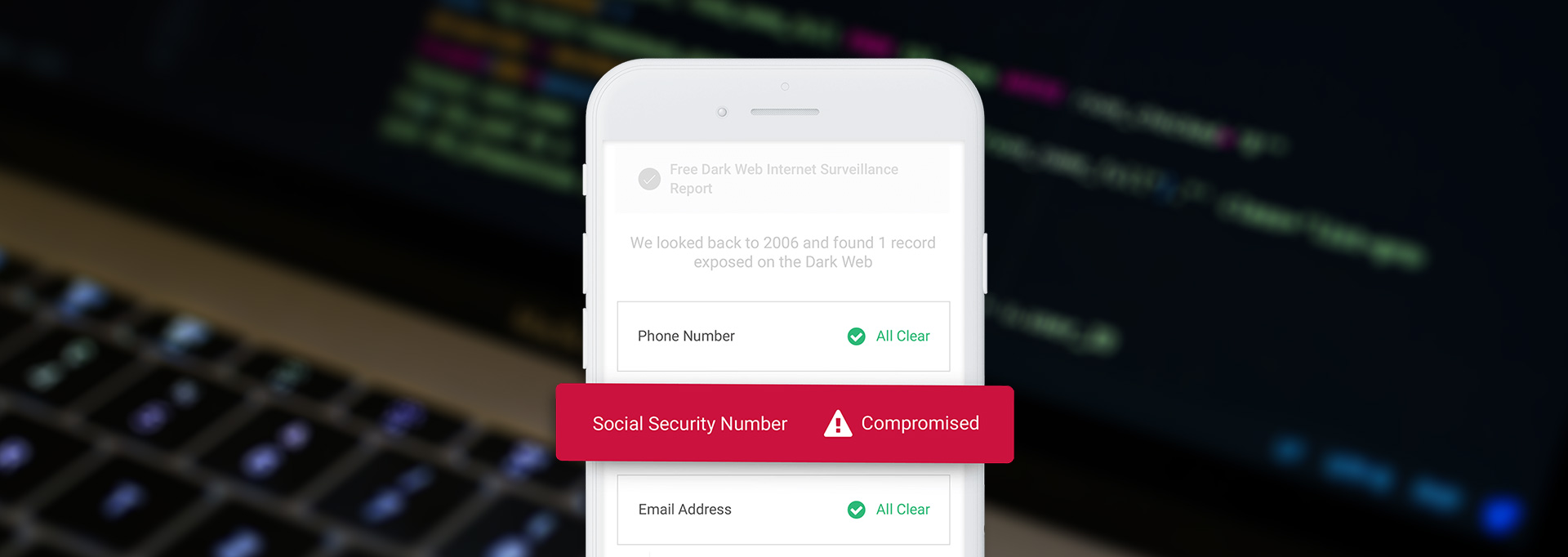

Free Identity Monitoring

With data breeches at major retailers and social media sites in the news cycle, many people are looking for affordable ways to protect and monitor online data for themselves and their families. The good news is that one the best identity theft protection services is completely free. So if you’re not sure that you’re ready to pay for identity theft monitoring, then Credit Karma has you covered with its completely free service.

Credit Karma’s coverage is minimal compared to paid plans through other providers and financial products. So if you’re interested in more robust protection and monitoring, see our guide to affordable and effective identity theft protection. However, Credit Karma’s free identity monitoring service is sufficient for both people who are at minimal risk and people are on a tight budget.

Free Unclaimed Money Search

Finally, Credit Karma's unclaimed money database is a great way to find out if you're owed money. For example, maybe you paid a deposit for your cable hookup and never got it back. Or maybe a bank closed one of your accounts and you still had a balance. I've found unclaimed money for myself and some of my family members a few times over the last few years.

In other words, if you're not familiar with Credit Karma, there's a lot of value you could be missing.

Related Article

Related Article

5 Great Uses for a High-Yield Savings Account

Should You Sign Up for a Credit Karma Savings Account?

Credit Karma Savings offers a unique approach to high-yield savings. While it may not provide the best rates all the time, compared with the top options, its flexibility may offer a better chance to maximize the return on your savings in the future.

Even if you don't plan to use Credit Karma Savings as your main savings account, take some time to learn about the company's other services and how they can help improve your financial situation.