Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

Unless you’ve been living under a rock or as a hermit in a little cave far away from civilization, you’ve probably heard of Bitcoin. The cryptocurrency that started it all emerged in 2008 and has the potential to revolutionize how we handle money. But before you put all of your money into the cryptocurrency markets, it’s essential to understand what you’re buying and the risks involved. Here’s a look at how Bitcoin works and the pros and cons of cryptocurrency investing.

What Is a Bitcoin?

A bitcoin is a form of digital currency. Just like the dollar bill you carry around in your wallet, you can acquire more or spend them on buying things – though your options to spend Bitcoin are fairly limited. However, you need a digital cryptocurrency wallet to hold those and other cryptocurrencies.

Bitcoin uses a blockchain technology that ensures every single coin ever created is unique and can’t be copied. That’s different from other computer files, like family photos, that you can make unlimited copies of. Each crypto coin exists only once with a single verified owner.

Every dollar bill in the United States has a unique serial number. Every Bitcoin also has a unique identifier, so it can’t be copied or replicated. Image via Wikipedia.

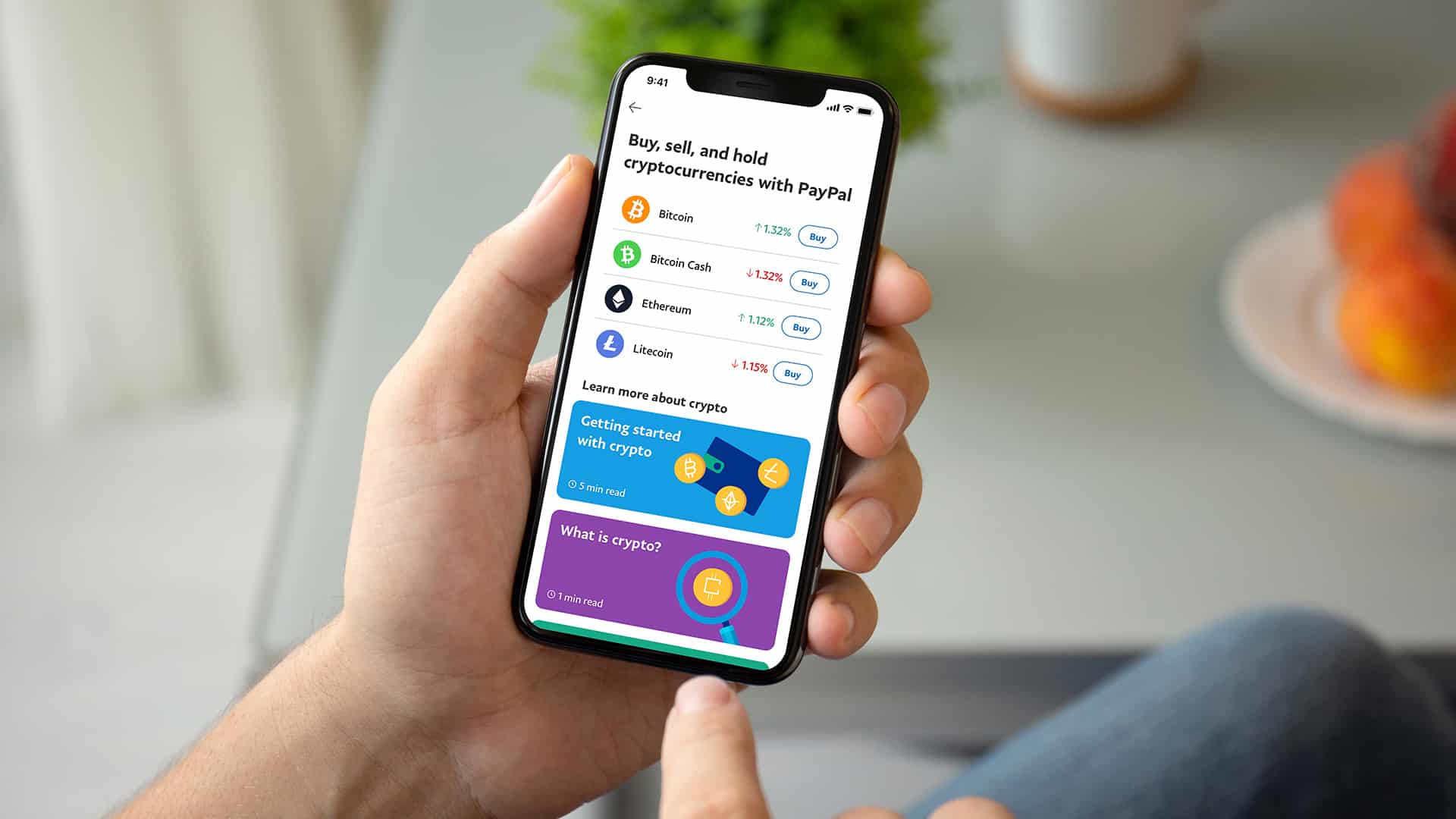

Bitcoin is the best-known cryptocurrency, but other noteworthy currencies exist as well. Ethereum is by far the second biggest currency. Other popular cryptocurrencies that also use blockchain technology include Stellar Lumens, Compound, Maker and of course, Elon Musk’s favorite, Dogecoin.

How Does Bitcoin Work?

As mentioned above, Bitcoin and other cryptocurrencies rely on a technology called blockchain. Blockchain is a distributed method of tracking transactions of many kinds, most notably cryptocurrency transactions, smart contracts and any other digital or physical good that requires a history of ownership verification.

Any time you or anyone else buys, sells or transfers bitcoin and other cryptocurrencies, the transaction is both public and private. It’s public in that a large network of computers verifies the transaction and records the new owner of the currency. But it’s private in that your digital wallet address is only known to you. Nobody else, other than potentially wallet administrators, knows who owns what in the cryptocurrency world.

Blockchain transactions are public and verified by a large network of computers called miners—screenshot from Blockchain Explorer.

A public address and private key secure every wallet. The public address allows others to send funds to your wallet. The private key allows you to access your funds and send funds to others. Never, ever, ever, ever give your private key to anyone else or store it unencrypted on your computer. If someone else gets your keys, they have full access to your crypto wallet.

Because the computers that mine bitcoin (verify and track transactions) are expensive and power-hungry, anyone who transacts in bitcoin must pay a modest fee to the miners. Depending on the currency you choose, the mining fees and transaction processing times can vary greatly.

Pros of Cryptocurrency Investing

If you understand the basics and want to invest in cryptocurrency, you may earn a small fortune. However, crypto is very volatile, and profits are far from guaranteed. Here’s a look at several significant benefits of cryptocurrency investing.

Decentralized Financial Abilities

The main benefit of crypto is that it works through a decentralized system. There is no single central bank, government or business that controls bitcoin and most other digital currencies. You don’t need a bank account or a centralized financial network to move your funds. It all happens through the Defi (decentralized finance) networks and blockchains.

For example, if you want to send $100 to a friend or relative in USD, your options are giving them money or using your bank account to transfer the funds. With cryptocurrency, you can send currency directly from your wallet to their wallet with no intermediary. You just have to pay a fee to the crypto miners that verified the transaction.

While giving your brother or paying back your parents $100 is pretty easy, things get more complicated with international transactions. Again, the decentralized power of cryptocurrency allows you to skip Western Union and MoneyGram. Someone can send funds to their family abroad with a few taps on their phone, and the funds will transfer to anyone in the world with an internet connection.

Financial Freedom and Anonymity

When you create a crypto wallet (which can be done for free), no one else knows who owns that wallet. You can store and send funds in a way that others can’t easily trace. Anyone could find all past transactions and link every crypto coin to a specific wallet, but they probably won’t be able to figure out who owns that wallet unless the owner tells them.

This financial freedom and anonymity is a massive benefit in the eyes of privacy advocates. However, these features also make cryptocurrencies attractive to criminals looking to skirt government-controlled financial systems. Only a tiny fraction of cryptocurrency activity is illegal. But good, upstanding citizens like you always pay their taxes and don’t need to worry about money laundering, right?

You Can Run Your Own Bank

When you have a cryptocurrency wallet, you are effectively running your own bank. You can bring in funds and send them off without connecting to the ACH network or a similar government-backed clearinghouse. You can store as much currency as you want without relying on anyone else.

If you use a hardware wallet, your digital bank is likely highly secure. As long as you keep copies of your backup codes and never share your private keys, the bank of you is a safe place to store funds.

Cons of Cryptocurrency Investing

Of course, cryptocurrency investing may not be all unicorns and rainbows. There’s a good chance you have noticed the volatility in cryptocurrency markets. Like other investments, you can lose money with cryptocurrency. If you make bad investment decisions or the entire market becomes illegal or implodes, you could lose everything. Here are some significant cons of cryptocurrency investing.

No Intrinsic Value

When you buy a share of stock, it is backed by the value of the company. When you hold a dollar, it’s supported by the “full faith and credit of the United States government.” Cryptocurrencies, on the other hand, don’t have a business or government behind the scenes.

There’s a strong argument that cryptocurrencies are not worth anything aside from what active traders are willing to pay.

No Recourse if Hacked or Stolen

If your bank goes out of business, the FDIC will ensure you get all of your funds. If your credit card is stolen, you are not liable for any fraud. If you lose your bitcoin wallet keys and your coins are hacked or stolen, you have pretty much zero chance of getting them back.

The nature of decentralized finance means that once a transaction hits the blockchain, it can’t be reversed. That also goes for criminals, hackers and their unfortunate victims.

You Have to Run Your Own Bank

While the ability to run your own bank is a pro, it’s also a con. There are plenty of stories about people who lost their digital wallets or threw away a computer or paper holding their keys or unlock codes. People have lost the equivalent of millions of dollars through lost access to their wallets.

Those who lost access to their funds may say you’re better off trusting the banking system to keep your money safe. If they had used a regular old bank, they would still have all of those funds.

Cryptocurrencies Are Likely Here to Stay

The cryptocurrency marketplace is only about a decade old, but it’s likely not going anywhere. The powerful features of decentralized finance and the ability to track ownership without any dispute using blockchain means the system of decentralized finance and cryptocurrencies is probably here to stay.

That said, every coin is different. You may find some cryptocurrencies skyrocket in value while others plunge into worthlessness. When it comes to crypto, invest cautiously and avoid putting in more than you can afford to lose. If you do, you’ll likely have an enjoyable foray into the world of bitcoin and cryptocurrency.