Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

Just like your GPA was a measure of how well you did in school, your credit score is a measure of how well you do with loans and borrowing. Credit scores traditionally focused only on borrowing activity, such as credit cards, student loans, auto loans and mortgages. However, your Netflix account can now help you improve your credit score.

The popular Experian Boost™ product can help to improve your credit score by factoring in utility bills and other monthly charges on your credit report. As of July 27, 2020, that can include your Netflix account. Keep reading to learn more about how Experian Boost works and how you can boost your credit score with Netflix.

Building Credit Score How to Use Your Netflix Payments to Build Credit

-

1

Set Up a Free Experian Boost Account

Start by creating an account with Experian Boost. You'll need to enter your personal information, including your full name, address, email address and Social Security number. The account is free to set up and no credit card is required for sign up.

-

2

Link Your Bank Accounts

You'll be asked to link a bank account or credit card you use to pay your bills. Select your bank and sign in with your bank's online login credentials. You can add more than one account if you choose to.

-

3

Add Your Netflix Account

You will have the option to add your Netflix payment history or other payments such as utility bills or subscription services to your Experian credit file.

-

4

See Your Updated Credit Score

Once your subscription accounts have been added to your Experian file, you will likely see an instant boost to your credit score.

How Credit Scores Work

Your credit score is a number from 300 to 850 that tells lenders and other companies how likely you are to default on a loan. A high credit score signals a low risk to lenders while a low score indicates you are likely to be late or miss payments.

The popular FICO® Score and VantageScore models use slightly different scales to measure your payment history, amounts owed, length of credit history, mix of credit accounts and recent credit applications to determine your credit score.

The two biggest factors in your credit score are on your on-time payment history and credit balances. Those make up more than half of your credit score. If you focus on these two areas and try to avoid tinkering elsewhere on your credit report, you should see your score rise in the long term.

The inputs to your credit score come from your credit report. You can get your credit report for free from Experian™ or Credit Karma to see where you stand today.

Recommended High-Yield Savings Accounts

| Bank Account | APY | Features | Learn More |

|---|---|---|---|

|

|

5.25%

UFB Direct breaks balances into five tiers, but, currently, there is only one interest rate. |

No minimum deposit |

Open Account |

|

|

0.50% - 4.60%

Customers earn 4.60% APY on savings balances when they set up recurring monthly direct deposit of their paycheck or benefits provider via ACH deposit. Alternatively, deposit at least $5,000 each month to earn 4.60% APY on your savings balance. Checking balances earn 0.50% APY |

No minimum deposit |

Open Account |

|

|

5.05%

Earn 5.05% APY on balances over $5,000. Balances of less than $5,000 earn 0.25% APY. Annual Percentage Yield is accurate as of July 27, 2023. Interest rates for the Platinum Savings account are variable and subject to change at any time without notice. |

$100 minimum deposit |

Open Account |

|

|

4.65%

Annual Percentage Yield is accurate as of July 27, 2023. Interest rates for the Savings Connect account are variable and subject to change at any time without notice. |

$100 minimum deposit |

Open Account |

What Is Experian Boost™

Until Experian Boost came around, most credit reports were limited to just borrowing account data. That means credit cards, student loans, personal loans, mortgages, auto loans, lines of credit and other accounts where you borrow money from someone else. Now, with Experian Boost, some other types of accounts can be included.

For example, you may be able to add your utility bill or telecom bill to your credit report with Experian Boost. That means you’ll get credit for an on-time payment for paying your power bill, gas bill, water bill, phone bill or cable bill.

In the past, you had to borrow to build a credit score. Now, with Experian Boost, you can build your credit score by making on-time payments with accounts you likely already have. That can help you get approved for a new account save money on future borrowing by qualifying for a better interest rate. As long as you always pay those bills on time, this free service could help to improve your credit score.

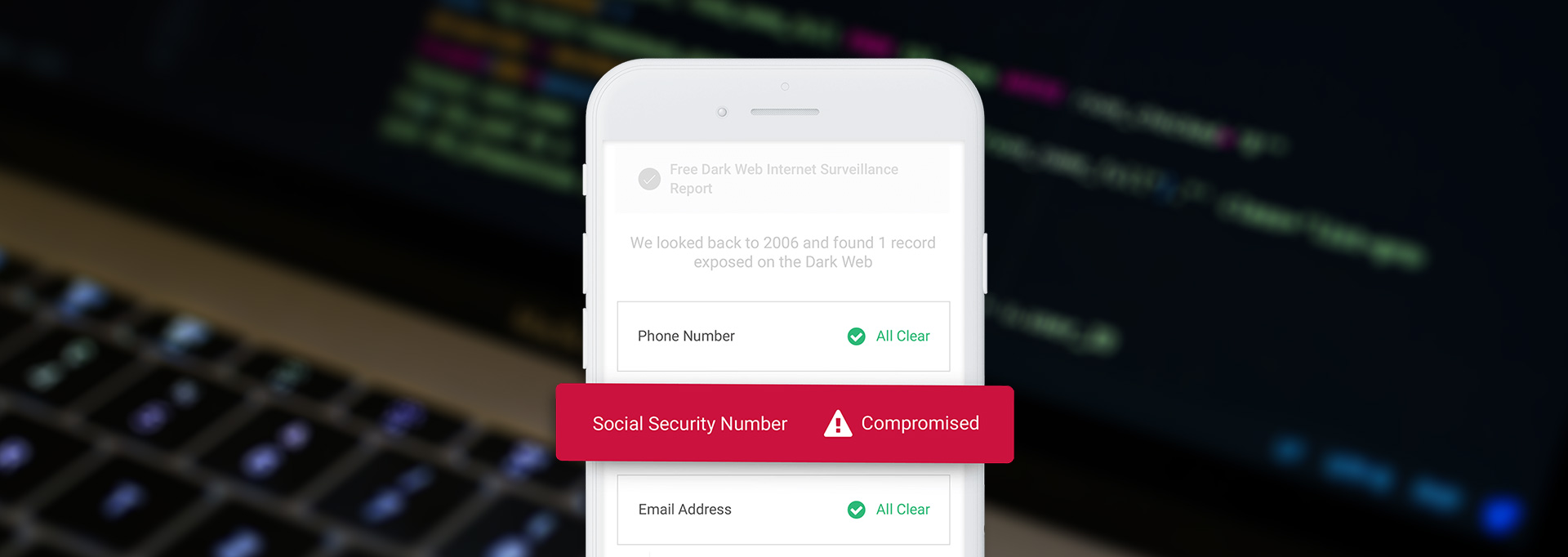

In addition to credit building features, Experian Boost offers more tools and goodies including the ability to scan the dark web for your personal information, an important protection against identity theft.

How Multiple Credit Card Payments a Month Can Boost Your Credit Score

Experian Boost™ Adds Netflix to Your Credit Report

Netflix accounts can be included with Experian Boost. If you’re a long-time Netflix user, paying your Netflix account balance every month can count as an on-time payment on your credit report.

I signed up for Netflix in August 2008. In nearly 12 years, I could have built up a chain of 143 on-time payments had Experian Boost been around since the beginning. That would almost certainly have benefited my credit score.

But now, that’s exactly how it works. Sign up for Experian Boost to add Netflix to your Experian credit report. According to Experian, more than four million people have connected utility and telecom accounts so far with an average 13-point increase to their credit score. It is completely free to use.

Recommended Credit Cards

| Credit Card | Rewards Rate | Annual Fee | Bonus Offer | Learn More |

|---|---|---|---|---|

|

|

1x- 5xPoints

The card offers 5x points per dollar on Chase Travel℠, 3x points on dining (including eligible takeout and delivery services), as well as 3x points on select streaming services and online grocery purchases (excluding Target, Walmart and wholesale clubs). This card earns 2x points on all other travel spending and 1x point per dollar everywhere else. Chase broadly defines travel to include not just airfare, hotels and rental cars, but expenses like parking, tolls and public transit too. |

$95 |

60,000Chase Ultimate Rewards Points

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. Dollar Equivalent: $1,380 (60,000 Chase Ultimate Rewards Points * 0.023 base) |

Apply Now |

Southwest Rapid Rewards® Premier Credit Card |

1x - 3xPoints

Earn 3 points for every $1 on Southwest Airlines® purchases, 2 points for every $1 on Rapid Rewards hotel and car rental partners, 2 points per $1 on local transit and commuting (including rideshare), 2 points per $1 on internet, cable, and phone services; select streaming, and 1 point for every $1 on all other purchases. |

$99 |

50,000Southwest Rapid Rewards Points

Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening. Dollar Equivalent: $700 (50,000 Southwest Rapid Rewards Points * 0.014 base) |

This product is currently not available via Slickdeals. All information about this product was collected by Slickdeals and has not been reviewed by the issuer. |

|

|

2%Cashback

Earn unlimited 2% cash rewards on purchases. |

$0 |

$200Cash Bonus

Earn a $200 cash rewards bonus after spending $500 in purchases in the first 3 months. |

Apply Now Rates & Fees |

|

|

1% - 5%Cashback

Earn 5% cash back on purchases in your top eligible spend category each billing cycle, up to the first $500 spent, 1% cash back thereafter. Also, earn unlimited 1% cash back on all other purchases. Special Travel Offer: Earn an additional 4% cash back on hotels, car rentals, and attractions booked on Citi Travel℠ portal through 6/30/2025. |

$0 |

$200Cash Bonus

Earn $200 in cash back after you spend $1500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® points, which can be redeemed for $200 cash back. |

Apply Now Rates & Fees |

Take Control of Your Credit Score to Join the 800+ Club

A higher credit score can help you get approved for the best travel and cash back rewards cards. When applying for a big loan like a mortgage, the lower interest rate you could get with a good credit score can save you tens of thousands of dollars or more over a 30-year loan.

An excellent credit score can be incredibly valuable. That’s why it’s important for you to take charge of your credit report and actively work to improve your credit score. Paying your bills on time every month and keeping revolving balances (credit cards and lines of credit) low are important steps in building your credit score. Now, you can get a positive note from non-credit accounts too.

If you have Netflix and always pay on time, considering signing up for Experian Boost today. It won’t cost anything and could lead to a better credit score instantly. That’s a win for your money and your credit report. Don’t wait—sign up today to see how much your credit score can improve with Netflix and Experian Boost.

FAQs

-

Experian Boost connects your utility and telecom service accounts to your Experian credit report, which has the potential to raise your FICO score. It does this by monitoring your bank account activity to track payments to streaming services, cellphone carriers and utility accounts. Because it only reports on positive transactions, it can be a good, safe way to build your credit.

-

Yes, it is safe to link your bank account to Experian Boost because it's limited to read-only access to the data. It does not store any bank credentials either, so your account is not at risk for malicious intrusions. It is also safe for your credit score because it only records positive, on-time transactions, which can work to improve your credit.

-

Around 60% of people who’ve used Experian Boost have seen their credit score go up, with the average boost being 12 points. Those who started with what is considered a “poor” score did even better, with an average increase of 22 points.

Not all users will experience the same effect. People with an already good credit score may see little to no improvement, so the benefits are felt the most by thin-file consumers or those with poorer scores.

-

It only takes a few minutes to sign up and link your bank account, and if you have a history of making payments to utility and telecom providers on time, the boost will be instant. Then, Experian Boost will provide updates to your score every 30 days.

However, if the account is new and you don’t have a FICO score yet, you’ll likely need at least six months of history before you can generate a score. On the other hand, if you already have a good score you may not see a change at all in your credit score after signing up for Experian Boost.