Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

If you want to improve your credit scores instantly, you should know about Experian Boost®*.

Experian Boost is a free feature that allows you to add positive payment history to you Experian® credit file, which can help your credit scores. It’s a free service that anyone should consider to improve their credit.

Here’s a closer look at Experian Boost, how it works and whether or not it makes sense for your credit report and credit score. Keep reading to learn more in this Experian Boost Review.

What is Experian Boost®?

Experian Boost is a credit-building feature from Experian. With this unique credit improvement feature, you can easily add non-credit accounts to your Experian credit report from a list of supported billers. Adding these payments to your credit gives you many of the same benefits as adding a new credit card or other credit-related accounts.

It usually takes existing credit-related accounts with a six-month history to establish a credit score. Using Experian Boost, you can use monthly bills that you already have to improve your credit. Bills that may show up on your credit report include Netflix, AT&T, Verizon and others.

When you sign up for Experian Boost, the utility, telecom, security system or streaming account is instantly added to your Experian credit report, which should also immediately improve your credit score.

How Experian Boost Helps Your Credit Scores

Typically, your credit scores are based on the following five primary factors:

- Payment history: 35% of your credit score comes from your payment history. A 100% on-time history is the most important step in building and maintaining good to excellent credit. Late payments and missed payments stay on your credit report for up to seven years. From this date forward, commit to always paying at least the minimum required payment by the due date for credit cards and other loans to build the best possible credit.

- Amounts owed: 30% of your credit score comes from your credit account balances. If you carry any credit card balances, the fastest way to improve your credit score is likely to pay off your credit cards to zero. While it’s easier said than done, paying off credit cards with high interest rates also saves you a lot of money on interest charges.

- Credit history length: A longer credit history shows lenders that you’re a responsible borrower. This contributes to 15% of your credit score. Keeping credit accounts open as long as possible helps here. Only close credit accounts like credit cards if they charge an annual fee or you have a negative history that you’re trying to close and move on from.

- Credit mix: Having multiple types of credit can help your score, but that’s usually not enough reason to apply for a new credit account alone. This makes up 10% of your credit score. Student loans, mortgage loans, auto loans, credit cards, lines of credit and other credit categories with an overall larger number of accounts help here.

- New credit: New accounts and inquiries from lenders when applying for credit temporarily lower your credit score. This makes up 10% of your score.

How Multiple Credit Card Payments a Month Can Boost Your Credit Score

The two most significant factors in your credit score are your payment history and account balances. These alone make up about two-thirds of your credit score, so it’s most important to focus on making on-time payments and keeping your credit card and line of credit balances low. Keeping accounts open for a long time and avoiding opening new ones unless you really need them is the best way to handle the remaining one-third of your credit.

Experian Boost allows you to add non-credit accounts to your credit report. Experian can add an account to your credit with similar benefits to a credit card or other loan using your bank account, debit card or credit card data.

As long as you pay that bill on time every month, it’s treated as an on-time payment for your credit report and credit score. That helps build a positive payment history, the most important factor in your credit score. Keeping up with that bill helps keep your credit utilization (amounts owed) low.

Over time, the benefits to your on-time payment history, credit history length and credit mix can help you establish, improve or turn around your credit. Assuming you consistently pay your bills on time, there is a lot to gain here and little to lose, particularly if you don’t already have good to excellent credit.

Bills That Work With Experian Boost®

When signing up for Experian Boost, you are given a list of bills you can add to your credit report. Here are some popular bills and categories Experian looks for when adding accounts to your credit report:

- Major electric utilities

- Major water utilities

- Phone, cable and internet providers

- Cell phone plans

- Streaming services

- Online rent payments

- Insurance payments

Related Article

Related Article

Here’s How Netflix Can Now Improve Your Credit Score

Experian doesn’t provide a complete list of bills that work, but popular providers known to work with Experian Boost® include Netflix, Disney+, Hulu, HBO, AT&T, Spectrum and Verizon. If you pay these bills using automatic payments, they should only help your credit scores overall.

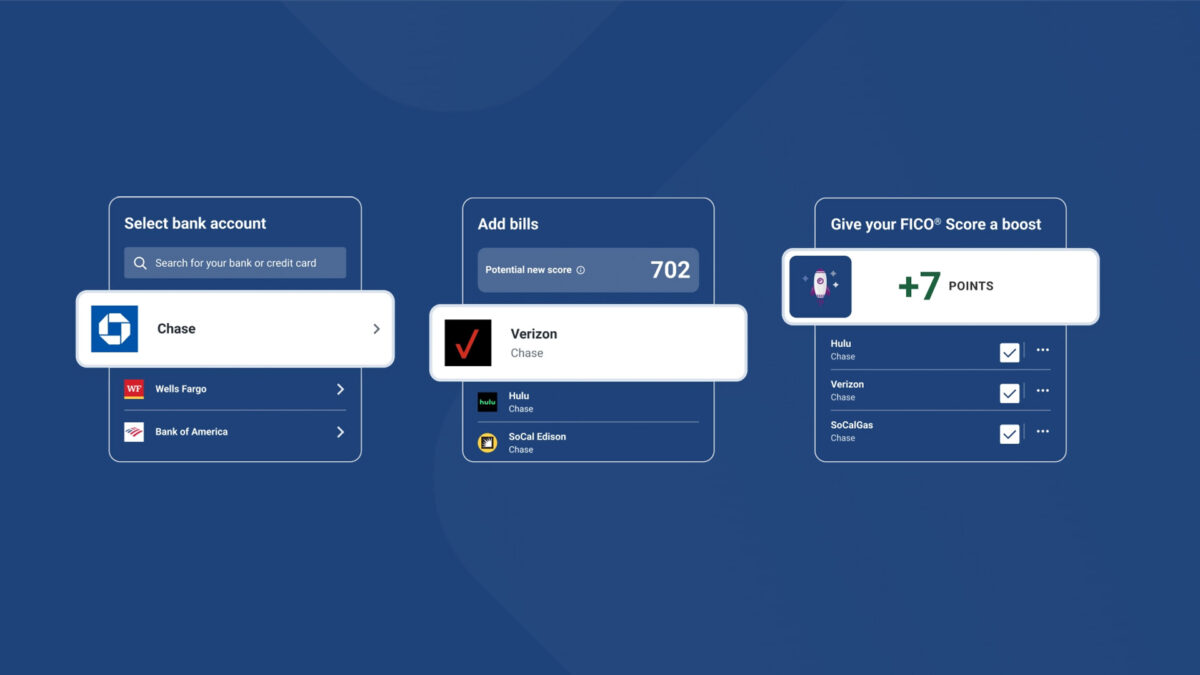

Getting Started with Experian How to Set Up Experian Boost®

To give an in-depth Experian Boost® review, I signed up for the service myself. The tool is free to use and requires an Experian account. Most adults in the United States should have an Experian account anyway, as it’s a free way to see your credit report** and credit score from one of the three major credit bureaus.

-

1

Create an account

If you don’t already have an Experian account, you can sign up for one here. Signing up requires entering and verifying your personal information, an email address, password and SSN. Experian tries to upsell to paid products. Be sure to only click on the buttons to sign up for those services you want.

-

2

Add Experian Boost®

Next, you’ll add Experian Boost® to your Experian account. If you sign up through an Experian Boost® signup link, you may see options to enable both at once to save time.

-

3

Connect your bank and credit card accounts

On the next step, you will need to connect Experian to your bank or credit card accounts used for payments. Experian uses this data to verify that you’ve paid on time. Experian also uses this connection for its free personal finance analysis tools. The website takes a couple of minutes to analyze your bank and credit accounts for eligible bills. You give Experian read-only access to your account data in the signup process. This also adds to the Experian data used for other business and consumer products.

-

4

Choose bills to add to your Experian credit report

Experian doesn’t add your bills to your credit report automatically. After scanning your payment histories, you can choose which bills to add. After connecting my Chase credit card and American Express credit card accounts, I could add my Spectrum internet service, Google Fi cell phone plan and Netflix account. Everyone’s bills are unique, so you will have to add every bank and credit card you use for bill payments to see which accounts are eligible.

-

5

Check your results

According to Experian, the average person has seen their FICO® score by 13 points. Some users may see no improvement, while others may see a much more dramatic benefit. Your results depend on your existing credit history and the bills you add.

If you have no credit accounts or only a few, you have a thin credit file. This is an industry term meaning you don’t necessarily have good or bad credit. You have so little that it’s hard to tell. For example, adding utility payments can help you build a longer Experian credit file.

It’s important to note that your TransUnion and Equifax credit reports and credit scores are not affected by Experian Boost. Every bank, credit union, credit card company and other lender uses one or more of these credit reports and scores to evaluate your application. It’s wise to spend time looking at all three credit reports, so you know you’re on the right track.

Is Experian Boost® Worth It?

Assuming there’s room to improve your score, you will probably benefit from using Experian Boost. After all, it’s free to use and is likely to improve your credit with just a few taps on your phone screen or clicks on your computer.

Anyone who already has a credit score over 800 may want to leave their credit alone, as they don’t have much to gain by improving their credit score. However, if you have a score in the 700s or lower, there’s little harm in trying Experian Boost, as long as you pay all your bills on time. Remember, autopay is hugely helpful here.

I already have an 830 credit score, so I decided not to add the three eligible accounts. However, if I were newer with credit or had a lower score, I wouldn’t have hesitated to add them. I would suggest Boost without any hesitation to friends or family who come to me with questions about improving their credit scores.

Reasons Why Credit Scores Can Drop

Experian Boost® Alternatives

This isn't your only option if you want to improve your credit or take other steps to build credit. Consider these alternatives and additional methods to improve your credit:

- Handle your credit well: If you want to have excellent credit, Experian Boost® won’t do it alone. It’s important to take reasonable steps to maintain your credit over time.

- Become an authorized user: If you have a parent, spouse or other family members with a credit card with a perfect history, they may be willing to add you as an authorized user. Authorized users have the credit card account show up on their credit report but are not liable for payments.

- UltraFICO: UltraFICO is a new credit score improvement product from the company that created the FICO score. UltraFICO allows you to connect checking, savings and money market bank accounts to show lenders that you’re responsible with money and maintain positive account balances. UltraFICO is free and was developed in partnership with Experian.

In most cases, there are no instant methods to fix your credit. Paying off credit card balances, if you’re able and adding products like Experian Boost are two of the quickest ways to raise your credit score. However, you should never lose track of on-time payments and maintain low credit card balances if you want to join the 800+ credit club.

Related Article

Related Article

How to Monitor All Three of Your Credit Scores for Free

Experian Boost®: The Bottom Line

Experian Boost® is an excellent consumer credit product that can help you improve your credit scores instantly. The opportunity to do that for free in just a few minutes could be extremely valuable to some households.

You have access to the best rewards credit cards, the lowest interest rates and other opportunities to improve your financial outlook with better credit. There’s a lot to gain and little to lose for most people, making Experian Boost® a good decision for the average person’s finances. If you want to improve your credit, Experian Boost® may be an essential part of your long-term credit improvement strategy.

Disclosures

* Credit score calculated based on FICO® Score 8 model. Your lender or insurer may use a different FICO® Score than FICO® Score 8, or another type of credit score altogether. Learn More

** Results will vary. Not all payments are boost-eligible. Some users may not receive an improved score or approval odds. Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost®.