Best Credit Cards for Buying Groceries

If you want to master the art of earning credit card rewards, there’s one essential rule you need to follow: Never spend extra money on your quest for points or cash back.

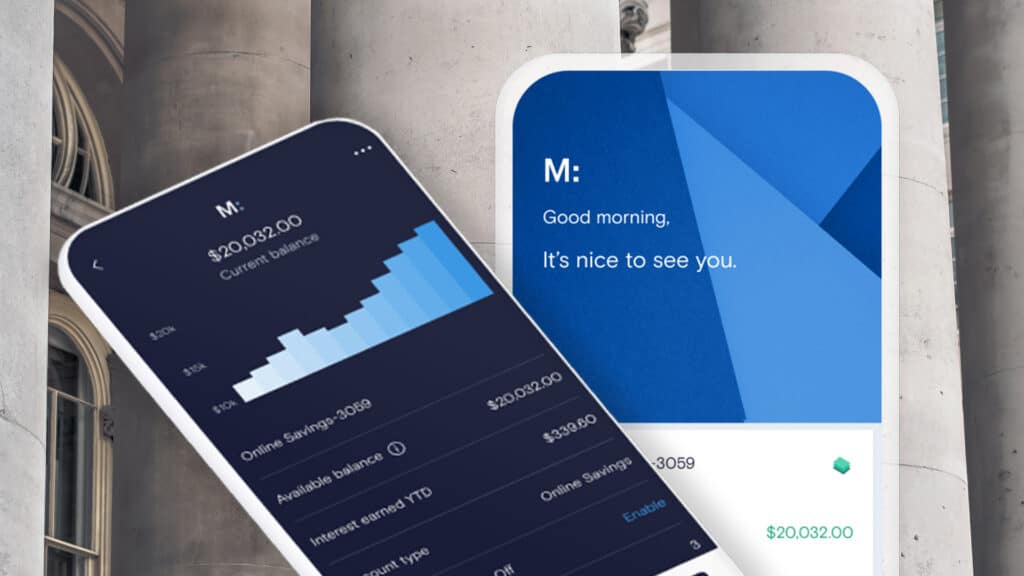

Instead, successful credit card reward hacking consists of earning points, miles or cash back from purchases you’d need to make anyway. There are credit cards that offer higher rewards for another common expense: grocery shopping.

According to the USDA, the cost of feeding a family of four a nutritious diet can run between $565 to $1,286 per month. If you use the right grocery store rewards credit card to pay for those purchases (and pay off your full balance each month), you could enjoy some valuable perks.

We’ve rounded up the best rewards credit cards for groceries from our partners to help you earn rewards every time you swipe at the supermarket.

Methodology

We chose our best rewards credit cards based on the total value they offer to cardholders through ongoing rewards, sign-up bonuses, 0% APR promotions and other perks. We also broke the cards down into clear categories that highlight features that credit card users are typically interested in — for example, premium travel vs. general travel, flat rewards vs. tiered rewards, and so on.

While some cards charge annual fees, we only picked ones that make it easy to make up for them with the value they provide. Before you apply, though, take some time to compare these cards with other top credit card offers to make sure you get the best fit for you.

Best Credit Cards for Groceries and Supermarkets FAQ

-

Most grocery rewards credit cards provide cash back, points or miles on purchases made at grocery stores, supermarkets and even online grocery spending. In general credit cards that offer accelerated rewards earning for groceries will award cardholders additional rewards every time they make purchases at a retailer that codes as a grocery store.

-

It depends on the credit card issuer. American Express typically only provides bonus rewards for purchases made at U.S. supermarkets. However, Chase and Capital One will generally award accelerated earnings to purchases at worldwide grocery stores. Check with your credit card issuer for specific details.

-

Each credit card will have its own qualifying credit score requirement. In many cases, you’ll need a credit score of 670 or higher to qualify for a rewards credit card. Applicants with bad credit will most likely have a difficult time getting approved, but people with fair credit (FICO 580 to 669) or poor credit (300 to 579) may qualify for a secured credit card that offers points or cash back on all purchases, including groceries.

-

Some travel and cash-back credit cards offer higher-than average rewards when you make purchases at supermarkets and grocery stores. Earning rewards for buying groceries is as easy as shopping at your local supermarket and paying with your credit card.

-

A grocery rewards credit card is the same as a rewards credit card that offers accelerated rewards earning for spending at grocery stores and supermarkets. Rewards vary by card issuer and a card user’s spending habits.