Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

Pros

- Earns valuable Membership Rewards points

- A valuable card for food, including at U.S. supermarkets and restaurants worldwide

- An array of credits that help offset the card's annual fee

Cons

- Use it or lose it credits

- Perks are not for everyone

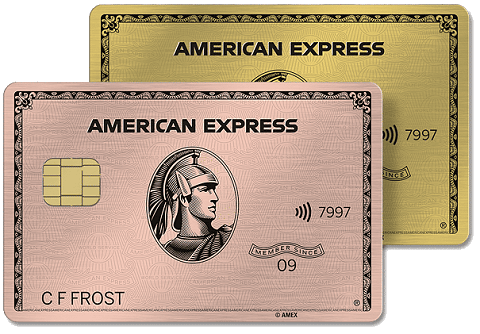

American Express® Gold Card

Those that spend a large portion of their budget on food, either at U.S. supermarkets or restaurants worldwide, will find a lot of value with this card. The ability to earn valuable Amex Membership Rewards® points is icing on the cake.

Slickdeals Compares See how the American Express® Gold Card stacks up to the...

Statement Credits

-

$120

Annual Dining Credit

The annual $120 dining credit is issued in $10 monthly installments when you pay with your card. This credit is valid at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, Milk Bar and select Shake Shack locations. Enrollment required.

-

$120

Annual Uber Cash

Up to $120 Uber Cash, issued in $10 monthly increments every calendar year. The credit is valid on both U.S. Uber rides and Uber Eats purchases. Gold Card needs to be added to the Uber app to receive the Uber Cash benefit.