Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

You’re probably familiar with Nationwide because of the company’s insurance products. Nationwide also offers full-service banking through a partnership with online bank Axos Bank (Member FDIC).

By partnering with Axos Bank, Nationwide Bank provides customers with a convenient way to bank digitally. The need for contactless banking continues to grow, and Nationwide offers a way to manage your money from anywhere in the world.

One of Nationwide’s most popular offerings is its Nationwide Direct Checking account. This online checking account comes with no minimum balance requirements, easy to waive fees and access to a host of helpful account features. Keep reading to learn more about Nationwide Direct Checking to see if it’s right for you.

Nationwide Direct Checking

The Nationwide Direct Checking account features no minimum deposit requirement and no ongoing minimum balance requirements. Additionally, there are no hoops to jump through. You bank however is best for your needs with Nationwide. Direct Checking also comes with small perks like a free debit card and check-writing capabilities.

Nationwide Direct Checking is non-interest-bearing. So it won’t earn any APY, but the account provides plenty of value because of its other features.

Nationwide Direct Checking Features

Nationwide Direct Checking is an online checking account offering the best of digital banking with minimal fees. Online banks don’t have the overhead costs of a traditional brick-and-mortar bank, so they often pass the savings on to their customers through higher interest rates and no-fee banking. It’s nice to know that you can bank each month without worrying about fees or having to meet specific requirements to have them waived. There are no monthly fees with Nationwide Direct Checking.

Early Direct Deposit

A recent Highland Solutions survey revealed that 63% of Americans live paycheck to paycheck since the pandemic first hit in the U.S. in 2020. Budgets are tight, and having access to your money as quickly as possible is more important than ever.

Imagine not having to wait until Friday to see your paycheck deposited into your bank account? With Nationwide Direct Checking's Direct Deposit Express, you can receive your paycheck up to two days early when you set up direct deposit to your account.

Early direct deposit availability is based on your employer’s payroll service and how they process payments.

ATM Fee Reimbursement

Online banking is great, but there are still times when it’s nice to have access to cash. Nationwide doesn’t have its own ATM network, but that doesn’t mean you can’t withdraw cash when you need it.

You’re eligible for up to $30 each month in ATM fee reimbursements through your Direct Checking account. The average ATM fee ranges from three to four dollars, which means you can use ATMs at least six times a month before you surpass the reimbursement limit. You can use ATMs anywhere — your local bank, gas stations, rest areas, airports and more. As long as you limit your ATM use somewhat, you’ll likely never pay any fees with Nationwide.

Mobile Check Deposits

Going to the bank to deposit a check is a time-waster. But services like Nationwide have made use of the latest mobile technology that allows customers to deposit checks without needing an in-branch location, as long as they have their smartphone handy.

Customers can deposit checks quickly and easily through Nationwide’s mobile banking app. There’s no delay when you deposit checks through your phone, either. Deposits made before 3 p.m PT Monday through Friday post on the same day. Deposits made after that time will post the following business day.

Online Bill Pay

Another great feature is the ability to pay bills directly through your Nationwide Bank online account. You can add from hundreds of vendors in Nationwide’s database or create your own. Then, you can set up one-time and recurring payments for all of your regular monthly and annual bills. Better yet, Nationwide’s online bill pay feature is accessible digitally through online access or the mobile app. You can pay bills from almost anywhere in the world.

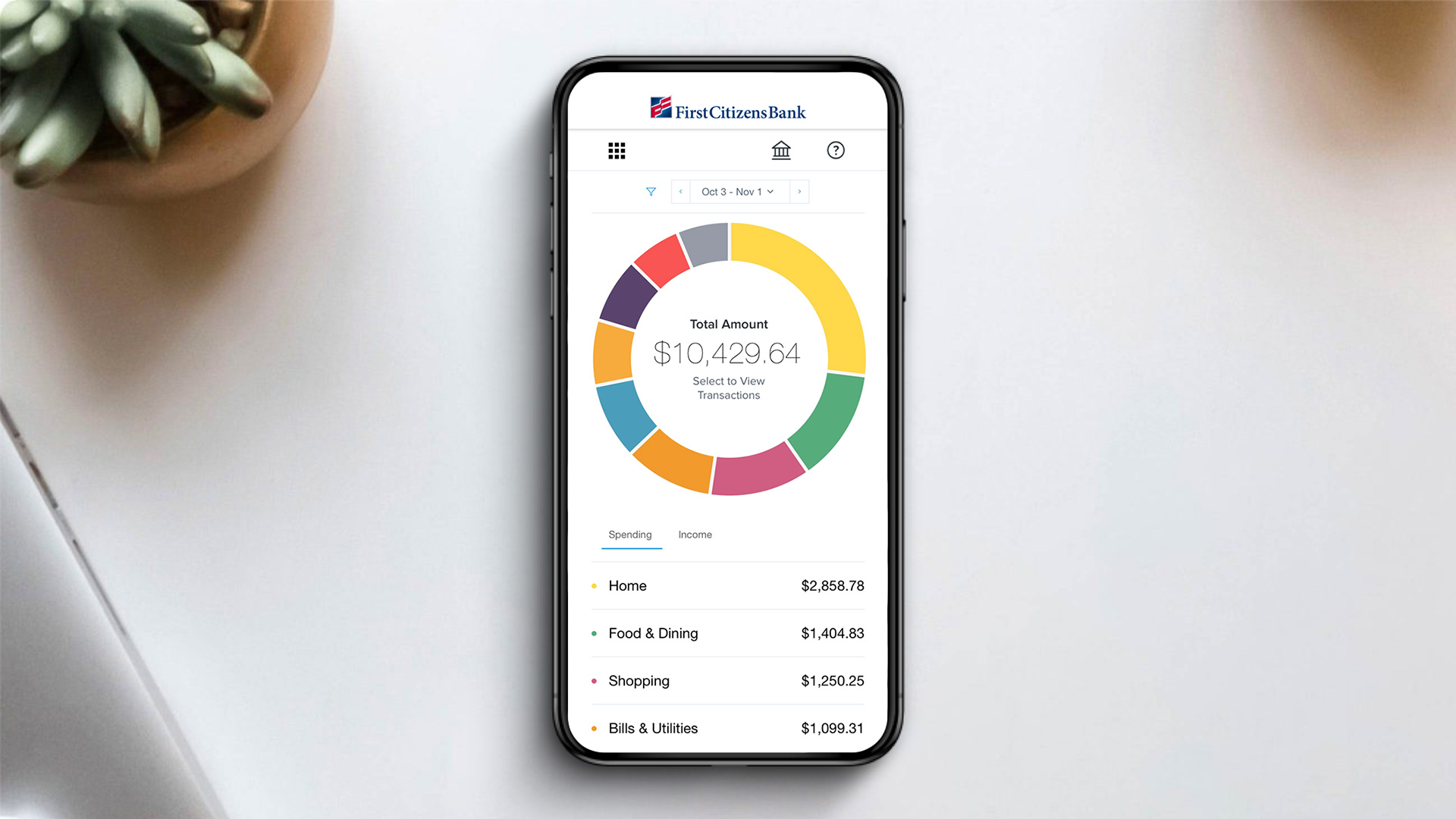

Online and Mobile Account Access

Digital banking gives customers a way to access and manage their money wherever they are home, at work, on vacation or anywhere in the world. There’s no need for local banking services when you can manage your Nationwide accounts from your mobile phone or computer.

Security

Wondering if it’s safe to bank with Nationwide online or from your phone? Nationwide has you covered. The bank employs the latest security technology to keep your money (and personal information) safe. Nationwide uses SSL-Encryption technology, antivirus and malware software and two-step authentication to ensure your information is safe at all times. Plus, all Nationwide accounts are regularly monitored to check for potential fraud.

Nationwide Direct Checking Fees

Unfortunately, Nationwide Direct Checking does require a monthly maintenance fee. The good news is that this monthly fee is easily waived.

The monthly service fee is $5, which is waived with recurring direct deposits are sent to your account each month. Considering how many employers rely on direct deposit these days, most customers should have no trouble getting the monthly fee waived.

Many banks that charge monthly fees require customers to meet minimum balance or specific transaction requirements to waive monthly fees.

Like most checking accounts, your Direct Checking account may be subject to other fees like non-sufficient funds or overdraft fees, stop payment fees and fees for ordering checks. It’s a good idea to check an account’s schedule of fees for details on what fees you could face before applying.

Other Nationwide Banking Products

Nationwide offers full-service online banking beyond its Direct Checking account. With a handful of other account options, Nationwide Bank has something to meet almost every banking need imaginable. Check out the bank’s other offerings below.

Checking

Nationwide Direct Checking is just one of the checking accounts you can open through Nationwide. There are several other checking accounts to choose from if you’re thinking of opening a new checking account.

Check out the chart below to see a comparison of all of Nationwide’s checking accounts.

| Opening Minimum Deposit | Monthly Maintenance Fee | ATM Fee Reimbursement | Interest Rate | Direct Deposit Express (get paid up to 2 days early) | Special Features | |

|---|---|---|---|---|---|---|

|

My Checking |

$100 |

$0 |

Unlimited |

N/A |

Yes |

Unlimited ATM fee reimbursements |

|

Advantage Checking |

$50 |

$0 |

N/A |

Earns APY |

No |

No overdraft fees |

|

Interest Checking |

$0 |

$0 |

Up to $30 per month |

Earns APY |

Yes |

Complimentary starter checks |

|

Direct Checking |

$0 |

$5 (waived with direct deposit) |

Up to $30 per month |

N/A |

Yes |

N/A |

Savings

Nationwide banking services also offers four different savings options that might supplement your checking account nicely. Below is a list of the accounts and some of their key features and benefits.

- Regular Savings: This savings account earns 0.50% APY on all balances. The account does have a $3 monthly maintenance fee which is waivable by meeting the $300 minimum daily balance requirement. You can also receive a free debit card with a Regular Savings account upon request.

- My Savings: A My Savings Account earns up to 0.70% APY and requires a $100 minimum initial deposit. The account has no monthly maintenance fees and no ongoing minimum balance requirements.

- Money Market Plus: Tiered-interest earning account with competitive APY potential (compared to other money market account offerings), up to $10 in ATM fee reimbursements (domestic) per month, check writing privileges, free starter checks (upon request at account opening), $8 monthly maintenance fee waived with a minimum daily balance of $1,000

- Certificates of Deposit (CDs): 3-5 year term, $500 minimum deposit required, lower CD rates compared with numerous other financial institutions

Certificates of Deposit (CDs)

If you want to maximize your savings and have funds that you don’t need access to for a while, Nationwide also offers CDs with terms ranging from three months to five years. All CDs currently earn a modest APY. A $500 minimum deposit is required to open a CD through Nationwide.

CDs automatically renew upon maturity. Once a CD reaches maturity, there’s a 10-day grace period where you can change terms, add additional deposits or withdraw funds without penalty. Like most banks, Nationwide CDs are subject to early withdrawal penalties (up to 24 months of interest) if you decide to withdraw funds before the maturity date.

Nationwide also offers IRA CDs, which also earn a modest APY. Both Traditional and Roth IRA CDs are available and require a $500 minimum deposit to open. IRA CDs are available in terms ranging from six months to five years.

Money Market Plus

Money Market accounts are hybrid bank accounts offering the best features of savings and checking accounts. Nationwide Money Market Plus earns a mid-range, tiered APY and comes with a free set of starter checks upon request. A $1,000 minimum deposit is required to open a money market account. There’s also an $8 monthly maintenance fee, but it’s waived as long as you maintain a $1,000 minimum daily balance.

Loans

Nationwide is also home to several loan products. The bank currently offers the following home mortgages options:

- Conforming Loans

- FHA Loans

- Home Equity Line of Credit (HELOC)

- Home Equity Loan

- Interest-Only Mortgages

- Jumbo and Super Jumbo Loans

- Non-conforming Loans

- Portfolio Loans

- VA Loans

- Home refinance loans

In addition to home loans, Nationwide also offers personal loans and auto refinance loans.

Nationwide Premier

Nationwide Premier is an invitation-only banking service for high net worth customers. Premier clients get access to a dedicated account manager and a host of other benefits. Interested customers can contact Nationwide for more information on this exclusive banking program.

Nationwide Account Access

Nationwide exists entirely online, except for one branch in its headquarters of Columbus, Ohio. Nationwide bank accounts are accessible online 24 hours a day, seven days a week.

Customers can also access their bank accounts by downloading the Axos Bank for Nationwide mobile app. The app is available for iOS and Android. Through the app, customers can:

- Manage their accounts

- View account balances and transaction history

- Transfer funds

- Pay bills

- Deposit checks

The Axos Bank for Nationwide mobile app incorporates Fingerprint ID technology for individuals looking for added security.

Nationwide Bank Customer Service

You can call 855-232-2967 Monday through Friday, 8 a.m. to 8 p.m. ET, for personal banking phone support. Customers can also receive support via email by emailing [email protected]. You can also use the chat feature on the Axos Bank website for additional support.

Nationwide and Axos Bank

As mentioned, Nationwide’s banking services are provided through a partnership with Axos Bank (Member FDIC). By partnering with one of the top online banks, Nationwide can offer its existing customers and the general public access to the very best online and mobile banking services. All Nationwide deposit accounts are FDIC insured up to the legal limits through its partnership with Axos Bank.

New Account Requirements

Credit Review

Axos Bank may review your credit history (TransUnion) and your past banking relationships when you fill out a new account application. This is standard procedure for many financial institutions.

If you have a security freeze on your TransUnion credit report, you’ll need to temporarily lift it before you apply for a new account. You can unfreeze your report online, via the TransUnion website, or by calling the credit bureau at 888-909-8872.

The bank recommends that you wait a minimum of 30 minutes after you lift your security freeze before you submit a new account application.

Minimum Deposit

You will need to provide a minimum deposit of at least $100 to open a Nationwide Interest Checking account. You must agree to fund your account within 30 days of account opening or the bank may close your account. Once customers fund their accounts, however, no ongoing minimum balances are required.

Personal Information

In order to comply with the USA Patriot Act, Axos bank will ask you for the following personal details when you apply for a Nationwide Interest Checking account.

- Legal Name

- Residential Address

- Date of Birth

- Social Security Number

Additionally, you’ll need to provide at least one form of unexpired photo identification. If the bank cannot verify your identity, it will deny your application or may close your previously funded account.

How to Apply for a Nationwide Interest Checking Account

Once you’ve completed your research and decided to open a Nationwide Interest Checking account, the online application is an easy process.

If you’re an existing customer, you can login to your account. The online application will pre-populate much of your personal information to save you time.

As a new customer, however, you will need to provide the following details when you apply:

- Social Security Number

- Valid U.S. Address (P.O. boxes will not be accepted)

You’ll also need to upload a copy of a valid U.S. ID, such as a driver license or State ID.

The bank requires you to be 18 years of age or older to apply for an account. And you must be either a U.S. citizen or a resident alien.

Apply for a Nationwide Direct Checking Account

Nationwide Direct Checking is a viable option if you’re in the market for a new checking account. The account offers convenient banking with low, easily waived fees, early direct deposit and access to other helpful digital features. It’s also an excellent account for individuals who want to make the jump from local banking to an online bank.