Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

Bank failures, high APYs and bonus incentives. If there was ever a time to consider switching to an online bank it’s right now.

For years, traditional banks have struggled to keep pace with online neo banks but after the Silicon Valley Bank took a nosedive, consumers are on the hunt for a new place to stash their cash. And right on cue – enter the competition. Here are the details.

The Current State of Banking

Interest Rates have been skyrocketing in the banking world, and online banks have seen some of the biggest jumps, with some accounts exceeding 5.00% APY. On the other end of that spectrum, some traditional institutions are still only offering a minuscule 0.01% on their standard savings accounts.

Online banks with their unique structure are set up perfectly to take advantage of their competitors' oversight, and likely recruit some of their clientele along the way. Here’s how they can get a leg up.

- Low Overhead Costs: Online banks have lower overhead costs than traditional banks since they don't have to maintain physical branches and employ as large a staff. This allows them to offer higher APYs to their customers.

- Convenience: Online banks offer a wide range of digital banking services that can be accessed from anywhere with an internet connection, making banking more convenient for customers.

- Customer Service: Online banks often provide more comprehensive remote customer service than traditional banks since they have fewer physical branches and can focus on providing quality service online or over the phone.

- Lower Fees: Online banks often have lower fees for account maintenance, overdrafts and ATM transactions, which can help you save money over time.

The Competition is Heating Up

Online banks now have a triple threat on their hands and it looks like this:

- Trust in the traditional banking system is wavering. With a major player in the banking world collapsing (Silicon Valley Bank), this stands to be the largest bank crash our generation has seen since 2008.

- Traditional banks aren’t keeping up. The standard .01% interest isn’t cutting it anymore. With inflation bringing up the cost of just about everything, there needs to be an incentive for keeping your money in a savings account. And given the current climate, the chance to earn more money on your savings balance is unarguably enticing.

- Online banks are hot with ultra-high incentives. Some banks offer rates hundreds of times better than what you can find at traditional, brick-and-mortar banks. Plus, some accounts even come with a nice sign-up bonus for new accounts.

Related Article

Related Article

4 Warning Signs You Need to Get a New Bank Account

Banking Offers to Watch

While there is plenty of incentives available, here are our top picks:

Recommended Bank Bonuses

| Bank Account | Intro Bonus | Minimum Deposit | Learn More |

|---|---|---|---|

|

|

Up to $700Expires June 27, 2024

Earn up to $700 when you open a new U.S. Bank Smartly® Checking account and a Standard Savings account and complete qualifying activities. Subject to certain terms and limitations. Offer valid through June 27, 2024. Member FDIC. Offer may not be available if you live outside of the U.S. Bank footprint or are not an existing client of U.S. Bank or State Farm. |

$25 | Open Account |

|

|

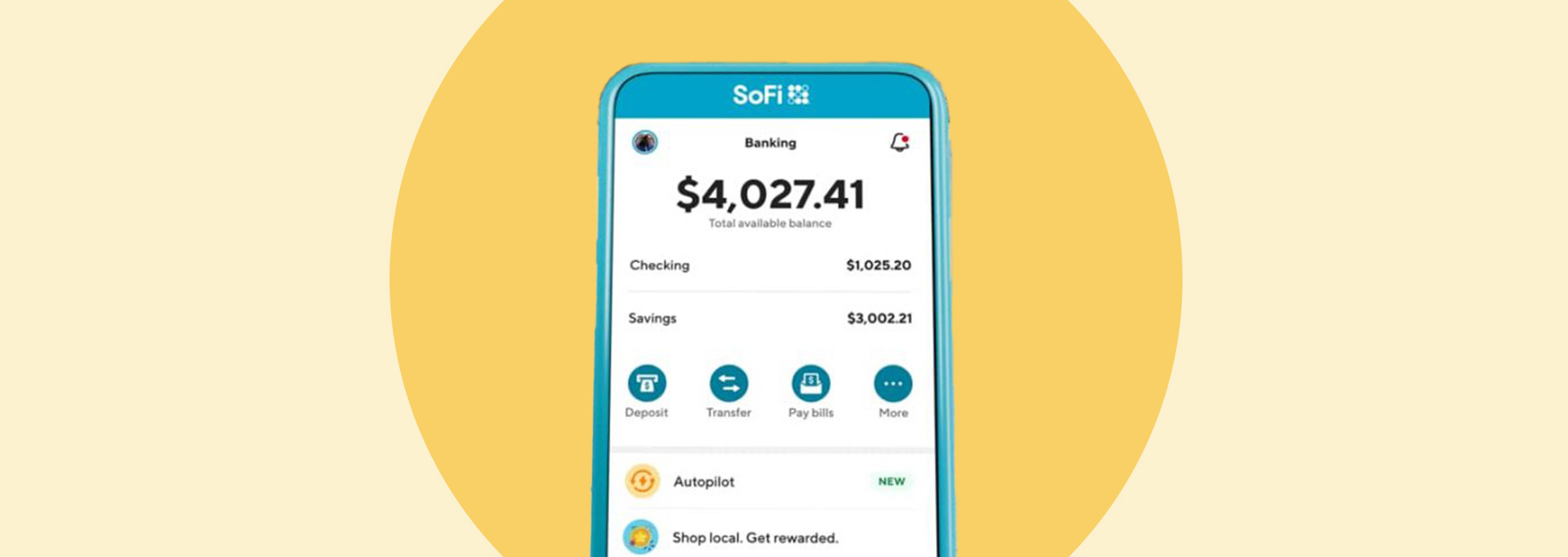

$50-$300Expires June 30, 2024

New customers can earn a $300 bonus for opening a new SoFi Checking and Savings account and receiving a total of $5,000+ in qualifying direct deposits within the specified evaluation period; receive $1,000 - $4,999 in qualifying direct deposits to earn a $50 bonus. |

N/A | Open Account |

|

|

$300Expires July 24, 2024

New Chase checking customers enjoy a $300 bonus when you open a Chase Total Checking® account with qualifying activities |

N/A | Open Account |

|

|

$300Expires July 22, 2024

Earn $300 when you open a new Chase Business Complete Checking® account. For new Chase business checking customers with qualifying activities. |

N/A | Open Account |

Making The Switch

The banking landscape is still uncertain but if you're not totally happy about where you've been banking, now is the best time to consider making a switch. With high intro bonuses, outstanding APY and low fees (many banks having none at all), there's every reason to contemplate moving your money.

Hassle-free savings solutionsExplore the Best Savings Accounts

Visit the Marketplace